Anti Jew Propaganda

See other Anti Jew Propaganda Articles

Title: Tucker Investigates: What is destroying rural America?

Source:

[None]

URL Source: [None]

Published: Dec 4, 2019

Author: Tucker Carlson

Post Date: 2019-12-04 13:22:21 by Anthem

Keywords: None

Views: 71391

Comments: 184

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: All (#0)

en.wikipedia.org/wiki/Paul_Singer_(businessman)

Lack of employment opportunities... Jorge Arbusto's fault... He's the one who downsized & outsourced our industrial infrastructury that is now produced more "efficiently" in Third World shitholes... Trump is 20 years too late, we should've elected Ross Perot when we had the chance... But I don't give a shit anymore.... I'm probably gonna croak sometime within the next 3~4 years anyway... Fuck all them idiots that did this... They fuckin' ruined this whole goddam planet for everybody... Too many goddam people, too much goddam garbage & trash... plastics, pesticides, fertilizer runnoff, flushed pharmaceuticals... Gonna all disrupt the global foodchain, drug-resistant diseases running rampant worldwide.... There's no avoiding it... I just hope I croak from old age before it hits

I take it that you're not a family man.(?) BTW, did you watch the video?

Nope I see no reason to focus on Paul Singer, even though he may be the worst of his ilk... But that's how they did it during Arbusto's reign.... Mitt Romney & Bain Capital were no different... Fuck 'em all... And Fuck Tump too.... he can't bring any of that stuff back no matter what he does... He's just a fucking conartist & grifter who's taking advantage of poor gullible fools who think there's still hope.....

Nope Ok, that explains a little. Thanks. I'm doing what I can for my progeny. Not sure what or if. I have this feeling for my country, but I'm not sure if it is any different than family, in both cases there's some dumbasses that I'd like to choke. Mitt Romney & Bain Capital were no different. Yep, same moral arrogance. I'm not sure about Trump. We'll see. My understanding is that it's a nationalist (Trump, Netanyahoo) vs. globalist. The next 6 months will reveal a lot. And yeah, there's no bringing the past back in terms or economic functions, but there may be a decent uprising (again) of the common man. Tulsi Gabbard is the only person on stage that I see with a glimmer of understanding.

Sanders and Warren, with their wealth taxes, also understand.

Tulsi is a mass murderer. She supports killing American children. She wants to end oil production. She doesn't want us to fight back against terrorists. She is a piece of shit.

At 5:00 minutes in you hear Tucker say that Singer has a lower tax rate than your local fireman. Singer is Jewish. So is Bernie. Do you honestly think for nanosecond that Bernie will tax Singer anymore than he is being taxed right now? Warren the simpleton merely wants to confiscate the wealth of every white American, and take away our right to defend ourselves. No, the only people Bernie and Lieawatha want to tax are those who have worked hard to put together some wealth relative to their labor.

You're a covetous little bastard. You are a thief at heart. You support abortionists like Bloomburg. That is why he is your favorite. You are with the human garbage on this one weirdo.

Vic is s thief at heart. He is very covetous.

Vic said that he wanted to raise our taxes here so we can have a global welfare system. The guy is a communist. Little Vic is a dick commie.

Vic will not escape the judgment that will befall him when the globalist finally succeed in uniting the world (against God). Global welfare, global governance, global this, global that. God didn't divide the peoples of the world (through language) just for fun. When everyone had a common language they rose up as one against God. Now, world leaders like the Pope are openly calling for global welfare et al. When they succeed, and they will, God will answer once again...and it will hurt. Mass starvation, disease, death...and that's only the beginning of sorrows. I am deeply concerned for souls like Vic.

Yeah, social upheaval is a given, especially with rising expectations in the overpopulated 'developing' Third World... Everybody (can't blame them) wants developed Western World standard or living, but it's an unsustainable goal... too much stress on the planet's natural resources, even totalitarian states like China & Indonesia won't be able to suppress the peasants..... But the same will be true in Africa & South America.... The Syrian conflict is just a mild precursor to global unrest....

[grunt] [scratch] [grunt][grunt][grunt] [scratch]

Warren might have been worth consideration, but she is just pathetically weak. Sanders is a corrupt joke. He's in it for the money. If he actually got into office he flail around worse than Yeltsin.

[grunt][grunt][grunt] [scratch] On Tulsi Gabbard the Hindu Abortion should remain legal and accessible. (Jan 2019) I consider myself pro-choice. (Sep 2012) Ban anti-abortion limitations on abortion services. (Feb 2014) Funding abortion avoids discrimination against poor women. (Jan 2015) Ban fracking. (Jul 2019) 2017: Short-sighted to withdraw from Paris Climate Accord. (Apr 2019) OFF Fossil Fuels: retrofit homes & fund new technology. (Apr 2019) Mixed score on "350 Action's 2020 Climate Test". (Mar 2019) Address climate change; US must lead worldwide effort. (Mar 2019) Silent on Green New Deal; supports push for renewables. (Mar 2019) No more fossil fuels for electricity by 2050. (Jan 2019) Tax incentives for wind, solar, biomass and wave energy. (Nov 2012) Supports regulating greenhouse gas emissions. (Sep 2012) Voted YES on banning offshore oil drilling in Gulf of Mexico. (Jul 2016) Constitutional right to terminate pregnancy for health. (May 2015) Endorsed Endorsed by EMILY's list for pro-choice Democratic women. (Aug 2012)

Noted that another "catholic" considers voting for murderers. Are you luke warm?

Well, Pokemecuntas did at least pretend that she was going after the leeches on Wall Street. They didn't like it, you can tell by those "poll" numbers.

Yep, she's a politician running for office on the Democrat slate from an overwhelmingly Democrat part of the country. Like it or not, abortion is the Establishment's policy and it was put in place by Republicans. It will be there until the population declines precipitously. Most young women support it because they don't want as many children as modern medicine allows to survive. Although I understand the concerns of the pro-abort crowd, I continue to oppose abortion on a moral basis, as it is a crude and vicious form of birth control that corrodes the emotional well being of the people. When I watch her I see a good hearted woman who is also intelligent and seeks the truth of matters. She may not always be right (re: agree with me), but she is not deliberately corrupt. That alone is worth support. Finally, her adoption of the mono-theistic (and Christian-like) branch of the Hindu religion is far more acceptable than the anti-Christian Jewish swamp we live with now.

Be very, very careful when dealing out the language of judgment and damnation.

I also hate that Catholics are liars like you just did. Catholics hold the majority in the Supreme Court they can end it today. But you dumb Catholics are like Lucy and the football with Charlie Brown. Lukewarm is what you are. An excuse maker for satan's democrats.

A good hearted woman doesn't support murdering children. That is a strange comment you made.

Vic, the judgment I refer to will affect us all. (I'm not referring to the final judgment that will come to those who reject God...that will come later). In fact, my family knows that we will certainly perish in the immediate judgments that signal the beginning of the Great Tribulation. The Trib judgments will begin when a New World Order/One World Government is solidified...it's on its way.

Kindly specify my error.

Put in place by Republicans. Sorry for calling you a liar but that isn't really true.

Yes, it's true.

You are with the human garbage on this one weirdo. (1)

(2)

(3)

Summary: 'I disagree with Person X, therefore he's a bastard, a piece of garbage and a Communist.' - A K A Stone

"Waa! Waa! Waa! Why can't we get any young supporters to uphold our beliefs anymore?" - Old Republicans. Gee, I wonder.

Roe v. Wade, 410 U.S. 113 (1973) Opinion of the Court 7-2; 5D, 2R Blackmun (R) delivered the Opinion of the court joined by 6 more. Dissenting justices: 1D, 1R White (D) filed a dissenting opinion, in which Rehnquist joined. The Court contained 6 nominees by Republican presidents Eisenhower, Nixon and Reagan. It contained 3 nominees by Democrat presidents FDR, JFK, and LBJ. Justice Powell was a Democrat nominated by Republican Nixon. Justice Brennan was a Democrat nominated by Republican Eisenhower. The Court contained 5 Democrat justices and 4 Republican justices. http://en.wikipedia.org/wiki/Harry_Blackmun http://en.wikipedia.org/wiki/Warren_E._Burger http://en.wikipedia.org/wiki/Thurgood_Marshall http://en.wikipedia.org/wiki/Lewis_F._Powell,_Jr. http://en.wikipedia.org/wiki/William_O._Douglas http://en.wikipedia.org/wiki/William_J._Brennan,_Jr. http://en.wikipedia.org/wiki/Potter_Stewart

So, we're going to count judges nominated by Republican Presidents as "Democrat" judges? Well then, given that the Supreme Court has been continuously controlled by Republican nominees since Nixon, please tell us the date after which the Republican nominees were nominally Republican. I believe that occurred under Reagan. O'Connor, Kennedy, Souter, Roberts - these are Republican nominees who are nominally Republican. And they've provided the bulwark to prevent the Republican majority Court from overturning Roe.

LOL! If the facts are inconvenient, just make something up...

No, I advocated for no such conclusion. I only reposted my years old recitation of the party of the justices and the presidents who nominated them. I find the entire argument absurd. Lo these many years, I have never found the abortion clause of the Constitution. I do not find it to be a constitutional matter at all. Whether a judge is a Catholic, Protestant, Jew or other, he or she should decide based on United States law, not some personal perception of God's law. Finding something morally repugnant or acceptable does nothing to determine it to be either constitutional or unconstitutional. The first law citing murder was in 1790 and only applied to places under the sole and exclusive jurisdiction of the United States. Murder elsewhere was not a Federal matter. Even if abortion were considered infanticide, it would not have been a crime against the United States. The argument over Roe proceeds from the false choice of Roe, or a reversal of Roe prohibiting all abortion. I believe it should be a matter of state jurisdiction. Roe should be overturned for lack of jurisdiction, and the matter returned to the States. Whether a judge is Dem or GOP should not determine how he rules. Jonathan Turley just proved that it is possible for a Democrat attorney to interpret the law independent of the general political leanings of his party. At the time of Roe, it was entirely possible for a conservative Southern Democrat to be much more conservative than what was then a moderate Northeastern moderate Republican. A party indicator from nearly 50 years ago provides no indicator of that justice's legal leanings. Even a current party indicator does not identify how one would interpret the Constitution. The party indicator of the nominating official provides less than nothing.

Your summary is inaccurate. It is more like this. Person X holds an evil act as a good act. So person X is a piece of shit or a communist in your case. In your case because you espouse communist ideology in some manners. You can disagree and think people that support murdering children are admirable and not pieces of shit. But according to Stones rules if you admire a piece of shit you are a piece of shit.

Yes he did. He is still a bad person though.

By their political party. Still the Catholics could end abortion if they wanted to. They must not want to. Which makes sense you being a supporter of an abortion candidate Bloomdork.

Should states be allowed to make it legal to murder adults or just innocent never hurt anyone babies?

Where should the power lie? Should the Supreme Court have the power to make it legal to murder adults or anyone's babies? Should the Supreme Court have such power in the absence of any decision by the Federal political branch (the Legislature) in the form of a law? There was no Federal law at issue in Roe. No Federal law prevented a State from banning abortion. Roe relied on constitutional interpretation to strike down a Texas State law. In doing so, it made that interpretation applicable to all the States, striking down all conflicting State law. Remember, vesting such power in the Supreme Court can, and did, result in Roe v. Wade, striking down all laws contrary to that vision of the Constitution.

No one vested such power in the Supreme court. They usurped it in Marbury vs Madison. But you didn't answer the question. You seem to be ok with allowing states to determine if you can murder a child. So I will ask again. Should states be allowed to pass laws making it lawful to kill adults? Why ok for babies but not adults?

True.

Marbury was decided by the Founders. The Founders also manned Congress, the state legislatures and the White House. They did not move to strike down the Marbury decision. Instead, they accepted it, thereby ratifying it. The Founders, by their decision in Marbury and their ratification of Marbury by their non-reaction to it, demonstrated that Supreme Court review WAS the "original intent" of the Constitution. The Founders gave us the Constitution, and they gave us Washington's presidential precedents, and they gave us Marbury v. Madison - the Marbury Supremes were Founding Fathers too, and the President Jefferson and Marybury Congress were Founders too. Marbury is part of the "original intent" of the Constitution - it is part of the legacy of the Founding Fathers.

...had a moral compass. Now it's not even PC to articulate what the Washington Monument represented...

The subject of abortion is rapidly becoming a moot point in the context of the next level of moral challenge rendered by our self-worshiping technocracy... www.google.com/search?&q=Designer+Babies+in+ukraine Got CRISPR?

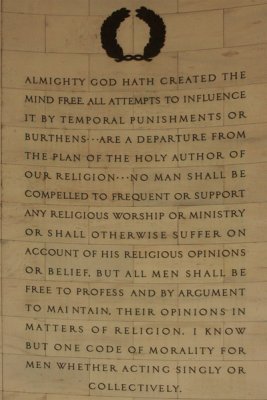

Human Nature? "I KNOW BUT ONE CODE OF MORALITY FOR MEN WHETHER ACTING SINGLY OR COLLECTIVELY" What did Jefferson have in mind and how did that work in the context of the Tyranny of the Majority that was subsequently observed by De Tocqueville?

Only if they're on private property. /sarc. BTW - Jeffrey Epstein's island was private. How'd that work out?

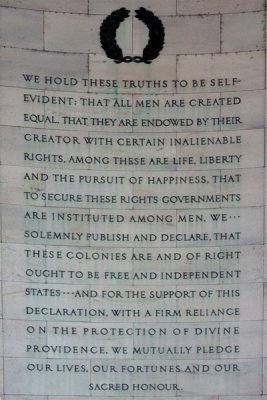

Trump and Netanyahoo's playmates are Tribal, Organized Criminal, Oligarchs. They are not operating under the constraint of a lawful republic - constituted to have TO SECURE THESE RIGHTS as its specified purpose. The original article “Bratva” (“Bros,” a slang term for “mob”) is abridged and re-structured for the Western readers not familiar with the intricate details of Russian politics and the history of organized crime. I have also inserted links to my research showing the longterm ties between the Russian organized crime bosses and Trump and his immediate environment...

We could go back to the eugenics movement and find lots of Republicans. Eugenics, birth control (population control), and abortion are tightly linked. I am going to start with Prescott Bush, who was Finance Chairman of the Birth Control League. Peggy Goldwater (Barry's wife) helped fund Planned Parenthood. The California legislature had near parity between R's and D's, yet passed an abortion legalization bill in 1967. Reagan was told that they would override his veto (requiring 2/3). He signed the bill. George "Rubbers" Bush introduced Family Planning Services Act in 1970. George's main interest in Congress was population control. He supported Planned Parenthood, and he advocated family planning as a way to protect a woman's health & to combat poverty. In those days, family-planning advocates spoke openly of contraception, and legal abortion was the goal of many, including Bush. "He was most definitely pro-choice--then," said former Rep. James Scheuer (D-NY). "He was very supportive until he became Reagan's VP. Then he had to adopt Reagan's backward position. After that, when George would see me in the House, he'd say, 'Jim, don't break my cover.' And I never did--until now. George couldn't have continued supporting family planning and still made the national ticket." Republican National Committee co-chair Mary Dent Crisp, a former Goldwater supporter and the highest-ranking woman in the party, believed that abortion was a woman's individual right. These are just a few of the mucky mucks that set the stage for Roe v Wade and Doe v Bolton which struck down Texas and Georgia abortion prohibition laws in 1973. They were authored by Republican SC Justice Harry Blackmun and joined by 3 other Republican Justices to form a 7-2 majority.

Powell was a Republican corporate lawyer (tobacco), and anti-communist, anti-socialist. He falls within the population control crowd of Rockefeller Republicans.

Technology set the stage for a hedonistic attempt to alter the consequences of behavior rendered by 1.2 billion years of sexual reproduction. Human culture is still figuring out how to balance those technological "benefits" against the moral cost of them. The apex predators perched atop post-modern culture are not the first to figure out that "Sex Sells". Romans Chapter 1. RTFM.

Thanks for the link. Putin came up through the system. He appears to be doing good things for his country now. Trump did business wherever he could. I am more interested in what they are doing now than in some hysterical hit piece.

My impression of Putin is that his ideological affinity with Aleksandr Solzhenitsyn appears to be legitimate and is consistent with his support of/by the Russian Orthodox Christian Church. Putin also appears to be a pragmatist who understands the historical relationships between the Organized Criminals who ran the Soviet Gulag system - and their present-day successors. Ie: Cut off one cockroach head and 6 grow back in its place. IMHO, the dots connecting Trump (in the role of Useful Idiot) to Simeon Mogilevich's Odessa Mafia are much more self-evident than those connecting Putin to Mogilevich... but YMMV. "COMMERCE BETWEEN MASTER AND SLAVE IS DESPOTISM"

No one vested such power in the Supreme court. They usurped it in Marbury vs Madison. But you didn't answer the question. You seem to be ok with allowing states to determine if you can murder a child. So I will ask again. Should states be allowed to pass laws making it lawful to kill adults? Why ok for babies but not adults? Yours is an inapplicable question and I will walk you through why that is so. 10th Amendment ALL power resides in either: Unless you strike down the Constitution, those are your three choices for who has the power to decide whether abortion is constitutional or unconstitutional, lawful or unlawful. Either the Federal government or the States must be empowered to decide whether to prohibit abortion, or it is left to the people to decide. You must pick one, and only one. If you choose the Federal government, then you choose to If you choose the States, then you choose to If you choose the People, then you choose to Nothing is murder, or any crime at all, until there is a law stating that it is murder or a crime. It is an absolute fact that abortion, at this time, is not murder. Whoever is empowered is empowered to decide abortion is a crime by passing a law so stating. Should they not pass such a law, then abortion is not a crime within that jurisdiction. Whoever is empowered is empowered to pass a law making interference with lawful abortion a crime, or to regulate abortion in the manner of its choosing. As you seem to support Federal jurisdiction, where the power now resides, States cannot decide whether to make abortion a crime. Why ok for babies but not adults? The inapplicability of your question is shown by the fact that States have no power to declare abortion lawful or unlawful. The Federal government has declared that it is empowered to decide the matter and it has decided it by declaring to all 50 States that abortion is not unlawful, much less murder, and that it is a constitutional right. Everything is legal unless there is a law stating it is illegal. Whoever is empowered makes something legal by doing nothing. They make something lawful by not passing a law making it unlawful. As a matter of law, you are simply wrong about Marbury. However, assume arguendo that you are correct. You appear perfectly happy to support an activist Supreme Court deciding the legality of abortion, just as long as the majority agrees with you in exercising jurisdiction you alternately appear to deny exists. Marbury actually resolved whether the Federal courts could strike down a Federal law as repugnant to the Constitution. In Roe, there was no Federal law involved. Had there been an inconsistent Federal law, the Federal law would have prevailed pursuant to Article 6.

The birth control pill is, in effect, abortion. Most folks just don't understand how it works -- how it prevents a fertilized egg from implanting in the womb. And the subject of abortion will be moot in the context of...

While what you state is absolutely correct, it may also be worth observing that the Constitution and Washington created a Supreme Court that was packed with 100% Federalists. Never since those early days has the court been packed so one-sidedly. Comparing the Federal government as founded, to the Federal government of today, reveals that something has gone askew.

www.google.com/search?&q=designer+babies+in+ukraine Abortion has always been moot in the context of strongly desired pregnancies. Aspiring baby mamas can always find a way to get knocked up the old fashioned way, and subsequently invoke a lady's prerogative to change her mind.

Will it still be abortion/murder if the zygote is vaporized after a scan detects an undesirable trait in its genome?

Abortion is not murder. It is not any crime. Aborting a zygote will not be murder. Nothing is a crime unless a law says it is. Do you have a law in mind that says vaporizing a zygote is murder? Cite the statute.

Abortion is also clearly a violation of the 9th amendment.

Noun: crime krIm Noun: zygote zIgowt You and your buddy like to dehumanize people you want to beat, imprison, or kill, yet that organism is a human being by definition, and completely innocent. Killing a human being is homicide, which may rise to murder if there is premeditation and demonstrated intent, and there is no self-defense or in defense of anothers' life or great bodily harm. The fact that there is no law at this time that punishes this particular homicide doesn't mean it isn't a crime. Our founding documents cover the sanctity of life, starting with George Mason: Is made by the representatives of the good people of Virginia, assembled in full and free convention which rights do pertain to them and their posterity, as the basis and foundation of government. Section 1. That all men are by nature equally free and independent and have certain inherent rights, of which, when they enter into a state of society, they cannot, by any compact, deprive or divest their posterity; namely, the enjoyment of life and liberty, with the means of acquiring and possessing property, and pursuing and obtaining happiness and safety.

Noun: crime krIm Noun: zygote zIgowt Abortion cannot be a criminal act while it is a constitutional right. Roe v. Wade, 410 U.S. 113, 153 (1973) You may disagree with Roe, but it is the law. Any law inconsistent with Roe is unconstitutional, null and void. No State may criminalize abortion. Try using a real law dictionary. Black's Law Dictionary, 6th Ed "Crime” and "misdemeanor”, properly speaking, are synonymous terms; though in common usage "crime” is made to denote such offenses as are of a more serious nature. In general, violation of an ordinance is not a crime. A crime may be defined to be any act done in violation of those duties which an individual owes to the community, and for the breach of which the law has provided that the offender shall make satisfaction to the public. A crime or public offense is an act committed or omitted in violation of a law forbidding or commanding it, and to which is annexed, upon conviction, either, or a combination, of the following punishments: (1) death; (2) imprisonment; (3) fine; (4) removal from office; or (5) disqualification to hold and enjoy any office of honor, trust, or profit. While many crimes have their origin at common law, most have been created by statute; and, in many states, such have been codified. In addition, there are both state and federal crimes (as to the latter, see Title 18, U.S.C.A.). - - - - - - - - - - - - - - - - - - - - Yeah, it does. One cannot be charged with a crime that does not exist. I can say you are guilty of mopery, but you cannot be charged and convicted. Geroge Mason's Declaration of Rights and Thomas Jefferson's Declaration of Independence are no part of United States law. Thomas Jefferson wrote All men are created equal while being tended to by his slave Jupiter. When Jefferson went to France, he was accompanied by his slave Sally Hemings, who was the half-sister of his wife. TJ father about six kids withy Sally and started a whole branch of the Jefferson family tree. A load of jefferson DNA was discovered in that tree.

Abortion is a constitution right. See Roe v. Wade, where you defend the jurisdiction of the court.

It isn't in the constitution. The supreme court gave itself powers not given to it by the framers. That is indisputable truth. Abortion is also indisputable murder I

You are welcome to live in your alternate reality. It is indisputable truth that people interfering with others entering or leaving abortion clinics are charged with a crime, while people receiving or performing abortions are not. The only way to overturn Roe is by constitutional amendment or by another action of the Supreme Court itself. A blog entry declaring Roe null and void does not get it. You appear to actively support the Court usurping power to impose their opinion upon the fifty states and the federal legislature. Your only disagreement is with the opinion they issued. Just imagine the Framers' surprise when they learn that they created a constitutional right to gay marriage.

If you lived in Nazi Germany in stead of abortion murder America. You would be saying the Jew are being gassed and the Germans are gassing and not being arrested. Abortion is murder in this world. The intentional taking of a human life is murder no matter what some douchebag you worship in a black robe says. It is av violation of the 9th amendment. The right to life once conceived. It is a human being that is being murdered. A human being not a fuckiing zygote. That is idiot liberal talk. Don't you respect the 9th amendment. I don't think you do. Just like the second amendment didn't give us the right to bear arms. We already had that right. Can you give us some of the rights the 9th gives us. I don't think you can. Also the Declaration of Independence is superior the constitution. It suts higher in the pecking order. Also no good people give a shit what the Supreme Court says when they get it wrong. If you want to know when they get it wrong ask me and I will tell you. The constitution means what it says not what the majority votes on a given day. You can disagree but you would be wrong. What you promote is color of law. I don't have tine to explain what color of law is go look it up. The framers didn't make a right to faggots pretending to be married just like they didn't make a right to abortion. Most of the framers would kill, the abortionists with muskets or hanging.

Preferably after tarring and feathering them to make sure the public understood how amorally repugnant and inhumane the abortionists were.

If I were living in Nazi Germany and you asked me what the law was, I would try to respond with an accurate recitation of Nazi German law. I would not make believe that Nazi German law was an A K A Stone brainfart. Abortion is not murder if the law says it is legal. Murder defines a criminal act punishable under the law. Try charging someone with criminal abortion. 9th Amendment It does not say a mumbling word about abortion or the right to life of a fetus. 5th Amendment Black's Law Dictionary, 6th Ed. Yea verily, under the Constitution, living people have been gassed, shot, hanged, and electrocuted until dead. And then there is lethal injection. The right to life, liberty and the pursuit of happiness is in the Declaration of Independence which has never been the law of anyplace. Murder is punished as murder under a murder statute, not the Constitution. Zygotes were brought up at #62 by Anthem, to whom I responded. Take it up with Anthem. I never claimed a zygote is a human being. A zygote is a fertilized egg. It appears you either have not read it, or you find therein some imaginary provision that criminalizes abortion. But then, the District Court in Roe found therein the right to abortion, and the Supreme Court opined that, "This right of privacy, whether it be founded in the Fourteenth Amendment's concept of personal liberty and restrictions upon state action, as we feel it is, or, as the District Court determined, in the Ninth Amendment's reservation of rights to the people, is broad enough to encompass a woman's decision whether or not to terminate her pregnancy." Then there is Section 1 of 14th Amendment where SCOTUS finds the imaginary right to abortion, An abortion clinic is not a State. Remember, you are the one supporting the power of SCOTUS to strike down all the state laws that prohibited abortion. My personal finding is that abortion is not addressed by the Constitution, Roe took up an argument based on a non-existent provision of the Constitution, and the case should have been dismissed for lack of jurisdiction. You, on the other hand, ignore the constitutional and jurisdiction issue and find the court should decide the lawfulness of abortion on constitutional grounds. Note that at the time of Roe, there was no Federal law banning abortion to overturn. Note also that the final arbiter in interpreting a State law is the highest court of the State, not the U.S. Supreme Court. SCOTUS decided that abortion was a right under some vaguely identified provision emanating from a penumbra. Neither the 9th Amendment, nor the 2nd Amendment, created or gave any new right. Neither purports to do so. The right to keep and bear arms was cut and pasted from English common law, which was the law in the colonies before independence. The DoI sits in equal status with a blog entry as far as being law. It is not law. In fact, it was crafted before there was a United States. When SCOTUS gets it wrong according to you or me, their interpretation of the law is still the law of the land. Tell yourself whatever you want. Since SCOTUS said abortion is a constitutional right, abortion has been legal. Since they said gay marriage is a constitutional right, gay marriage is legal. Recognizing that something is legal is not the same as agreeing with it. Believing something is murder does not make it murder. An act may be murder in Texas and less than murder elsewhere. It simply depends on what the applicable statute says. SCOTUS is the final arbiter in interpreting the Constitution and what it says is the governing interpretation. Abortions and gay marriage are legal. You can disagree with SCOTUS and it does not change the law. They are empowered as the final arbiter in interpreting Federal law, including the Constitution, and you and I are not. Our opinions are not binding on the courts, Their's are. I will take the time to clear up your evident confusion about color of law and Federal constitutional law. Black's Law Dictionary, 6th Ed. When used in the context of federal civil rights statutes or criminal law, the term is synonymous with the concept of "state action" under the Fourteenth Amendment, Timson v. Weiner, D.C.Ohio, 395 F.Supp. 1344, 1347; and means pretense of law and includes actions of officers who undertake to perform their official duties, Thompson v. Baker, D.C.Ark., 133 F.Supp. 247; 42 U.S. C.A. § 1983. See Tort (Constitutional tort). Action taken by private individuals may be "under color of state law” for purposes of 42 U.S.C.A. § 1983 governing deprivation of civil rights when significant state involvement attaches to action. Wagner v. Metropolitan Nashville Airport Authority, C.A.Tenn., 772 F.2d 227, 229. Acts "under color of any law” of a State include not only acts done by State officials within the bounds or limits of their lawful authority, but also acts done without and beyond the bounds of their lawful authority; provided that, in order for unlawful acts of an official to be done "under color of any law”, the unlawful acts must be done while such official is purporting or pretending to act in the performance of his official duties; that is to say, the unlawful acts must consist in an abuse or misuse of power which is possessed by the official only because he is an official; and the unlawful acts must be of such a nature or character, and be committed under such circumstances, that they would not have occurred but for the fact that the person committing them was an official then and there exercising his official powers outside the bounds of lawful authority. 42 U.S.C.A. § 1983. https://en.wikipedia.org/wiki/Color_(law) The US Supreme Court has interpreted the US Constitution to construct laws regulating the actions of the law enforcement community. Under "color of law," it is a crime for one or more persons using power given by a governmental agency (local, state or federal), to deprive or conspire wilfully to deprive another person of any right protected by the Constitution or laws of the United States. Criminal acts under color of law include acts within and beyond the bounds or limits of lawful authority. Off-duty conduct may also be covered if official status is asserted in some manner. Color of law may include public officials and non-governmental employees who are not law enforcement officers such as judges, prosecutors, and private security guards. "Color of law" is completely irrelevant to this discussion. And yet, it is the law. Abortion and gay marriage are legal. Pete Buttigieg, a candidate for president, has a husband. We even have laws against using the wrong pronouns. And guys who identify as girls are transformed into record breaking "lady" track stars and "lady" weight lifters.

Then what rights toes the 9th protect. It doesn't list any. You have to use your common sense. Mayor buttplug is not married. He is pretending to be married. That is the truth. If the SUpreme court told you two plus two was five you would believe them. They don't get it right that often. I know you are just saying what the government says the law is. But when they lie aboutit why do you go along with it. Just like when they lied about Obamacare.

Yep clearly a 9th amendment violation. Clear as day.

I wanna see that law. Can you cite it? Why not?

Good example. Is a man a man because he has a penis or because some bullshitting judge says a woman with a vagina is a man? If the Supreme court says a man is a woman you will have to say you agree. Me I will go with the truth and say the chick has a dick and is a man who belongs in a mental institution.

Use YOUR common sense. SCOTUS has held that abortion is a constitutional right. If you want to go there, the right to abortion, not enumerated elsewhere, is protected by the 9th Amendment.

Kook talk. You're better than that Chan.

If their opinons differ from the words of the constitution it is color of law. They usurped power that is why you can't cite their power in the constitution. If you want to worship the Supreme court as infallible that is your prerogative. Sure they rule and their rulings are enforced. Their rulings can put you in jail. But it is still TRUTHFULLY color of law.

Obergefell v. Hodges, 576 U.S. ___ (2008) Obergefell at 4: I didn't write it, but it is now the law. You can make believe otherwise.

That isn't a law it is an opinion. Laws are passed by congress and signed by the president. Can you cite a law? Because you said it was a law.

More color of law.

Yo8u quite obviously refuse to recognize what "color of law" signifies, despite my quoting it to you from Black's Law Dictionary. Your attempted usage is meaningless. What SCOTUS is the law. What you say is your opinion and does not displace the opinion of SCOTUS. They are empowered by the Constitution as the final arbiter of federal law, you are not.

If you do not know what it means, stop trying to use it. Black's Law Dictionary, 6th Ed. When used in the context of federal civil rights statutes or criminal law, the term is synonymous with the concept of "state action" under the Fourteenth Amendment, Timson v. Weiner, D.C.Ohio, 395 F.Supp. 1344, 1347; and means pretense of law and includes actions of officers who undertake to perform their official duties, Thompson v. Baker, D.C.Ark., 133 F.Supp. 247; 42 U.S. C.A. § 1983. See Tort (Constitutional tort). Action taken by private individuals may be "under color of state law” for purposes of 42 U.S.C.A. § 1983 governing deprivation of civil rights when significant state involvement attaches to action. Wagner v. Metropolitan Nashville Airport Authority, C.A.Tenn., 772 F.2d 227, 229. Acts "under color of any law” of a State include not only acts done by State officials within the bounds or limits of their lawful authority, but also acts done without and beyond the bounds of their lawful authority; provided that, in order for unlawful acts of an official to be done "under color of any law”, the unlawful acts must be done while such official is purporting or pretending to act in the performance of his official duties; that is to say, the unlawful acts must consist in an abuse or misuse of power which is possessed by the official only because he is an official; and the unlawful acts must be of such a nature or character, and be committed under such circumstances, that they would not have occurred but for the fact that the person committing them was an official then and there exercising his official powers outside the bounds of lawful authority. 42 U.S.C.A. § 1983. https://en.wikipedia.org/wiki/Color_(law) The US Supreme Court has interpreted the US Constitution to construct laws regulating the actions of the law enforcement community. Under "color of law," it is a crime for one or more persons using power given by a governmental agency (local, state or federal), to deprive or conspire wilfully to deprive another person of any right protected by the Constitution or laws of the United States. Criminal acts under color of law include acts within and beyond the bounds or limits of lawful authority. Off-duty conduct may also be covered if official status is asserted in some manner. Color of law may include public officials and non-governmental employees who are not law enforcement officers such as judges, prosecutors, and private security guards. "Color of law" is completely irrelevant to this discussion.

I get you chan. Don't take my disagreement as desrespect. You just quote what the governent currently says the law is. Even when they get it wrong. You quote what will happen to you if you disobey it. See i'm different. I'm interested in the truth of what the words actually mean and not some lawyer spin. The Constitution means what it actually says. Even when a usurping supreme court (yes small letters like in the Constitution) says differently. I agree that they have the actual power to do that. It doesn't make it truth though as the actual meaning and intent of the Constitution. Another example would be the interstate commerce clause doesn't mean what the traitors on the Supreme court said it means. You know that. You do know that. Admit it. Please.

Yep color of law. The Supreme court usurped authority it didn't have. Now we all pretend the Constitution gave them that power. It didn't which is why you can't cite it. You also can't cite any rights the 9th gives us. Except your pretend abortion argument that you know isn't true.

What SCOTUS says is not law but opinion. They even call them opinions. You are correct what I say does not displace opinions (you got it right that time and called them opinions) of the supreme court. They are not empowered by the Constitution as the final arbiter of federal laws. If I am incorrect please cite me the passage in the constitution that says such. You can't it doesn't say that. Truthfully he Supreme court usurped authority and give themselves that power with no legislation and no constitutional provisions that say such. You can pretend all you want but truth is that it is not in the Constitution anywhere. You are also correct that I am not the final arbitrator on the matter. But that doesn't mean I am wrong. It means that they are liars or stupid or corrupt. The words in the Constitution mean what they say. Not black robe spin like interstate commerce and abortion murders.

Oh and the last comment I forgot to say it was color of law from the little s supreme court.

You can beat me and shut me up. If you could only prove that the Supreme court is the final arbitrator using the Constitution. You can't do that though. You just ignore that point. You can't do it because those words aren't in there. They aren't Chan and you know it.

"You shall not murder" --Exodus 20:13 Not that you or your fellow Log Cabin Pipe Fitters would ever care about any of those statutes.

U.S. Constitution, Article III. Section 1. The judicial power of the United States, shall be vested in one Supreme Court, and in such inferior courts as the Congress may from time to time ordain and establish. The judges, both of the supreme and inferior courts, shall hold their offices during good behaviour, and shall, at stated times, receive for their services, a compensation, which shall not be diminished during their continuance in office. Section 2. The judicial power shall extend to all cases, in law and equity, arising under this Constitution, the laws of the United States, and treaties made, or which shall be made, under their authority;—to all cases affecting ambassadors, other public ministers and consuls;—to all cases of admiralty and maritime jurisdiction;--to controversies to which the United States shall be a party;—to controversies between two or more states;—between a state and citizens of another state;—between citizens of different states;—between citizens of the same state claiming lands under grants of different states, and between a state, or the citizens thereof, and foreign states, citizens or subjects. [...] Who do you think is the final arbiter when interpreting the Constitution? Liberty's Flame? Free Republic? Democratic Underground? dKos? Cite the authority which empowers anyone but the U.S. Supreme Court. SCOTUS is the only court created by the Constitution.

Natural Law, as illustrated in Romans Chapter 1.

What is destroying rural America? Socialist Trumpkin Republican, Wealth Spread.

Appeal Roe and Obergefell to the imaginary court of natural law. Enjoy your Big Mike lunch and good luck.

The CDC provides a plethora of documentation establishing how UN-imaginary the court of Natural Law is. Got Due Penalty? Romans Chapter 1. RTFM.

Misleading photo. There is no such critter as the traditional farmer anymore. They are all owned by Corporations,and ruled by the corporate board. The traditional "family farm" only exists now as a "hobby farm".

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

Very true. A farmer either has to go big, specialize, or have a second job "in town". With one exception...the organic farmer. There are an ever increasing number of organic farmers here in Maine. And I know they are plentiful in upstate NY. These farmers are making good money on small acreage. Their vegetables and meats are in high demand...and they take food stamps! There are two organic farms within a mile of my place. One guy has been here for 20 years. The other guy started his farm about 6 years ago. They make big bucks. A good friend of mine is just starting out. He grew 800 Cornish cross chickens this year and sold every one of them (at around $20 per bird). He grows several organic crops as well.

I don't doubt that is happening in some areas where the farms are small,but what about the HUGE farms in the mid-west,and some areas of the south. We are talking farms that have thousands of acres of tillable land. No way are they going to survive from roadside stands.

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

Those huge farms will be okay. As you mentioned, many of them are owned by corporations. It's the midsize farms that have my attention. The farmer who supplies my hay was running 300 head of beef cattle until this year. Now he has reduced his herd to maybe 50 head. He told me that he cannot sell a year old calf for $700 and make money. He's heading for the door. I'm hearing this from others, as well. My hay supplier's calves are the calves that find their way to the feed lots and eventually to the grocery stores, etc. And when he quits farming cattle he'll stop making hay which will affect me. You don't even want to know what is happening to dairy farms. Suffice it to say, I'm glad just to be in the "hobby farm" category... Today, grain prices went up 15% from my supplier. People say, "Why do we need farmers? We can just go to the grocery store and get our food" ;-)

[Judas Goat #91] The CDC provides a plethora of documentation establishing how UN-imaginary the court of Natural Law is. By all means, take your case to the Centers for Disease Control (CDC) and argue God's law in the imaginary CDC Ecclesiastical Court. Good luck and may ooga booga be with you. Black's Law Dictionary, 6th Ed. Constitutional Law, 6th Ed., Jerome A. Barron and C. Thomas Dienes, Black Letter Series, West Group, 2003, p. 165. 1. NATURAL RIGHTS Despite some contrary judicial opinion in the early years of the Republic, the claim that there are extra-constitutional "natural rights" limiting governmental power has generally not been accepted by the courts. If the federal government exercises one of its delegated powers or the states exercise their reserved powers, some express or implied constitutional, statutory, or common law limitation must be found if the government action is to be successfully challenged.

That is because the courts have gone rouge. The enumeration in the Constitution, of certain rights, shall not be construed to deny or disparage others retained by the people. Your post shows that originally they knew the truth before asshole liars came to power. Deceivers. Fakers. Murderers.

Your post shows that originally they knew the truth before asshole liars came to power. Ah, yes. They knew the troof before asshole liars came to power, and they inserted a clause, (The enumeration in the Constitution, of certain rights, shall not be construed to deny or disparage others retained by the people) ensuring that Natural Law, God's Law, philosophical speculations of the Roman jurists of the Antonine age, was retained by the people. Not to be mistaken, slaves were considered persons. Before the assholes and liars took over, the Framers found a unique way to refer to slaves while bestowing to representation in Congress based on an enumeration of persons (census) and "adding to the whole number of free persons, including those bound to service for a term of years, and excluding indians not taxed, three fifths of all other persons." Slaves were that "three fifths of all other persons." And before the asshole liars came to power, the Framers enshrined slaves with the rights of livestock and other property. All men were created equal, but only white people were accorded the right to naturalization. All men and women were equal, but only white, male landowners could vote. In adopting the Law of God into the American legal system, so said the Founders and Framers before the assholes took over. About seventy-five years later, President Abe Lincoln went on a three-day drunk and passed out in his bed, his bed perhaps being the bed at the Soldier's Home cottage where President Lincoln frequently went to stay, to be joined in his bed by Captain David Derickson, but I digress. A cabinet member awakened Abe from his slumber and gave him the news. Lincoln jumped from his bed startled, and exclaimed, "I freed the who?"

WHOLESALE prices????? Yikes!

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

????

Not to be mistaken, slaves were considered persons. Before the assholes and liars took over, the Framers found a unique way to refer to slaves while bestowing to representation in Congress based on an enumeration of persons (census) and "adding to the whole number of free persons, including those bound to service for a term of years, and excluding indians not taxed, three fifths of all other persons." Slaves were that "three fifths of all other persons." And before the asshole liars came to power, the Framers enshrined slaves with the rights of livestock and other property. All men were created equal, but only white people were accorded the right to naturalization. All men and women were equal, but only white, male landowners could vote. In adopting the Law of God into the American legal system, so said the Founders and Framers before the assholes took over. About seventy-five years later, President Abe Lincoln went on a three-day drunk and passed out in his bed, his bed perhaps being the bed at the Soldier's Home cottage where President Lincoln frequently went to stay, to be joined in his bed by Captain David Derickson, but I digress. A cabinet member awakened Abe from his slumber and gave him the news. Lincoln jumped from his bed startled, and exclaimed, "I freed the who?" blah blah blah The 9th amendment is real. It was voted on. It is part of the constitution. Can you name some of the rights it protects? Or are you going to go off on a strange tangent again?

Your comment prompted me to investigate. Grain prices went up 15%...but it was specific to this local mill...and specific to dairy grain...go figure. Not the end of the world yet lol

Thanks. I wonder why? Could it be the bank is trying to force them to sell so they can buy it at a bankruptcy sale?

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

This mill is a big facility that sells custom blended grain in bulk to farmers. But I noticed they were making improvements...adding a retail space. Perhaps they're passing those costs on to me. Thing is, I can buy Blue Seal Milk Maker at full retail (for 15% cheaper!) at the farm co-op. To add insult to injury, the mill had to stop selling molasses from their bulk tank (because the FDA inspector decided it was unsanitary). I was only paying $1.80/gallon. The co-op wants $6/gallon for the same molasses! Between the grain increase and the FDA...well, I'm stunned I tell ya But that's okay, Pete, we'll just keep on milking!

It appears that youtube has disabled the embed. The video is still there. www.youtube.com/watch?v=IdwH066g5lQ

It embeds fine. You have to wait for the ad to finish playing first. The embed wasn't present when ad was playing.

I appreciate what you've done on this thread. You'd be a fine lawyer in the legal realist tradition (where I also reside).

Laws are passed by congress and signed by the president. Thank you, A K A Stone! Finally, somebody's figured it out.

Lets see how real you are. What does interstate commerce mean in the constitution? Do you pretend like the Supreme court or are you REAL honest? Will Vic go with color of law or real truth?

Well, let's see how honest you are. The FAA regulates interstate flights. I'm sure you agree they have that power. But they also regulate intrastate flights. According to you they don't have that power, correct? So let's leave it up to the 50 individual states to do that. Hey, a few mid-air collisions are a small price to pay for honoring the "honest" meaning of the Commerce Clause.

But they also regulate intrastate flights. According to you they don't have that power, correct? Never thought about it. I'm talking about something else.

Can you name some of the rights it protects? No. The 9th Amendment states a rule of constitutional construction and does not, in itself, contain a guarantee of any right, or proscription of any infringement. Can you name the rights protected by the 9th Amendment? Which ones does the 9th Amendment name? It only protects against construing the constitution’s enumeration of some rights to attack or deny or disparage others because they are not enumerated. As the right to keep and bear arms is enumerated in the 2nd Amendment, the 9th Amendment has no application to it whatever. However, assuming arguendo the the RKBA were not enumerated, the 9th Amendment would not prohibit restrictions or regulations upon the RKBA. If the RKBA were not enumerated, the 9th Amendment would prevent denying that right on the sole and exclusive basis that it was not enumerated. That is all. As an historical note, I would observe that James Madison did NOT write the 2nd Amendment. Madison proposed a set of amendments on 8 June 1789. The introduction of the proposed amendments and the associated colloquy on that occasion are in The Annals of Congress I, at pp. 439-68. Madison’s draft of what led to the 9th Amendment reads: The assholes of 1789 put Madison’s wording through the congressional committee sausage making process to create the wording that was ultimately offered and ratified, as quoted above. The purpose of the 9th Amendment was to gain approval for the Constitution as a whole, and the inclusion of a Bill of Rights in particular. Several of the eleven (11) states in the Union at that time were opposed to the enumeration of any rights, lest the enumerated rights be construed as a denial of those rights not so enumerated. Two states were opposed to the Constitution as it was framed and adopted, and had not joined the new Union. As an historical note I reference the comments of James Madison and Roger Sherman upon the introduction of the proposed amendments. [...] [Roger Sherman, 8 June 1789] I do not suppose the constitution to be perfect, nor do I imagine if Congress and all the Legislatures on the continent were to revise it, that their united labors would make it perfect. I do not expect any perfection on this side the grave in the works of man; but my opinion is, that we are not at present in circumstances to make it better. It is a wonder that there has been such unanimity in adopting it, considering the ordeal it had to undergo; and the unanimity which prevailed at its formation is equally astonishing; amidst all the members from the twelve States present at the federal convention, there were only three who did not sign the instrument to attest their opinion of its goodness. Of the eleven States who have received it, the majority have ratified it without proposing a single amendment. This circumstance leads me to suppose that we shall not be able to propose any alterations that are likely to be adopted by nine States; and gentlemen know, before the alterations take effect, they must be agreed to by the Legislatures of three-fourths of the States in the Union. The 9th Amendment was part of a sales pitch and looks like it says more than it does. I have frequently made disparaging reference to penumbras formed by emanations from various rights. With the 9th Amendment, you stepped squarely into the penumbras and emanations divined by the U.S. Supreme Court in Griswold v. Connecticut, 381 U.S. 479, 484 (1965). The Fourth and Fifth Amendments were described in Boyd v. United States, 116 U. S. 616, 116 U. S. 630, as protection against all governmental invasions "of the sanctity of a man's home and the privacies of life." * We recently referred 381 U. S. 485 in Mapp v. Ohio, 367 U. S. 643, 367 U. S. 656, to the Fourth Amendment as creating a "right to privacy, no less important than any other right carefully an particularly reserved to the people." See Beaney, The Constitutional Right to Privacy, 1962 Sup.Ct.Rev. 212; Griswold, The Right to be Let Alone, 55 Nw.U.L.Rev. 216 (1960). We have had many controversies over these penumbral rights of "privacy and repose." See, e.g., Breard v. Alexandria, 341 U. S. 622, 341 U. S. 626, 341 U. S. 644; Public Utilities Comm'n v. Pollak, 343 U. S. 451; Monroe v. Pape, 365 U. S. 167; Lanza v. New York, 370 U. S. 139; Frank v. Maryland, 359 U. S. 360; Skinner v. Oklahoma, 316 U. S. 535, 316 U. S. 541. These cases bear witness that the right of privacy which presses for recognition here is a legitimate one. The present case, then, concerns a relationship lying within the zone of privacy created by several fundamental constitutional guarantees. While nobody can recite a list of rights guaranteed by the 9th Amendment, some may divine that such rights are found within a penumbra emanated by some fundamental constitutional guarantee within the Bill of Rights.

lol how cute. Words don't mean what they say.