Cult Watch

See other Cult Watch Articles

Title: Justice Anthony Kennedy, Clarence Thomas, Ruth Bader Ginsburg, Samuel Alito and Neil Gorsuch levy internet taxes

Source:

Yahoo News / Associated Press

URL Source: https://www.yahoo.com/news/supreme- ... x-case-142423168--finance.html

Published: Jun 21, 2018

Author: Jessica Gresko

Post Date: 2018-06-21 21:37:24 by Hondo68

Ping List: *The Two Parties ARE the Same* Subscribe to *The Two Parties ARE the Same*

Keywords: None

Views: 7002

Comments: 52

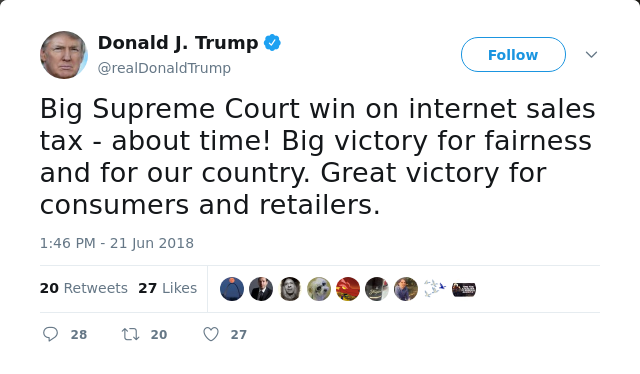

WASHINGTON (AP) -- States will be able to force more people to pay sales tax when they make online purchases under a Supreme Court decision Thursday that will leave shoppers with lighter wallets but is a big financial win for states. Consumers can expect to see sales tax charged on more online purchases — likely over the next year and potentially before the Christmas shopping season — as states and retailers react to the court's decision, said one attorney involved in the case. The Supreme Court's 5-4 opinion Thursday overruled a pair of decades-old decisions that states said cost them billions of dollars in lost revenue annually. The decisions made it more difficult for states to collect sales tax on certain online purchases, and more than 40 states had asked the high court for action. Five states don't charge sales tax. The cases the court overturned said that if a business was shipping a customer's purchase to a state where the business didn't have a physical presence such as a warehouse or office, the business didn't have to collect sales tax for the state. Customers were generally responsible for paying the sales tax to the state themselves if they weren't charged it, but most didn't realize they owed it and few paid. Justice Anthony Kennedy wrote that the previous decisions were flawed. "Each year the physical presence rule becomes further removed from economic reality and results in significant revenue losses to the States," he wrote in an opinion joined by Justices Clarence Thomas, Ruth Bader Ginsburg, Samuel Alito and Neil Gorsuch. Kennedy wrote that the rule "limited States' ability to seek long-term prosperity and has prevented market participants from competing on an even playing field." The ruling is a victory for big chains with a presence in many states, since they usually collect sales tax on online purchases already. Now, rivals will be charging sales tax where they hadn't before. Big chains have been collecting sales tax nationwide because they typically have physical stores in whatever state a purchase is being shipped to. Amazon.com, with its network of warehouses, also collects sales tax in every state that charges it, though third-party sellers who use the site don't have to. Until now, many sellers that have a physical presence in only a single state or a few states have been able to avoid charging sales taxes when they ship to addresses outside those states. Online sellers that haven't been charging sales tax on goods shipped to every state range from jewelry website Blue Nile to pet products site Chewy.com to clothing retailer L.L. Bean. Sellers that use eBay and Etsy, which provide platforms for smaller sellers, also haven't been collecting sales tax nationwide. Under the ruling Thursday, states can pass laws requiring out-of-state sellers to collect the state's sales tax from customers and send it to the state. More than a dozen states have already adopted laws like that ahead of the court's decision, according to state tax policy expert Joseph Crosby. Retail trade groups praised the ruling, saying it levels the playing field for local and online businesses. The losers, said retail analyst Neil Saunders, are online-only retailers, especially smaller ones. Those retailers may face headaches complying with various state sales tax laws, though there are software options to help. That software, too, can be an added cost. The Small Business & Entrepreneurship Council advocacy group said in a statement, "Small businesses and internet entrepreneurs are not well served at all by this decision." Chief Justice John Roberts and three of his colleagues would have kept the court's previous decisions in place. "E-commerce has grown into a significant and vibrant part of our national economy against the backdrop of established rules, including the physical-presence rule. Any alteration to those rules with the potential to disrupt the development of such a critical segment of the economy should be undertaken by Congress," Roberts wrote in a dissent joined by Justices Stephen Breyer, Elena Kagan and Sonia Sotomayor. The lineup of justices on each side of the case was unusual, with Roberts joining three more liberal justices and Ginsburg joining her more conservative colleagues. The case the court ruled on involved a 2016 law passed by South Dakota, which said it was losing out on an estimated $50 million a year in sales tax not collected by out-of-state sellers. Lawmakers in the state, which has no income tax, passed a law designed to directly challenge the physical presence rule. The law requires out-of-state sellers who do more than $100,000 of business in the state or more than 200 transactions annually with state residents to collect sales tax and send it to the state. South Dakota wanted out-of-state retailers to begin collecting the tax and sued several of them: Overstock.com, electronics retailer Newegg and home goods company Wayfair. After the Supreme Court's decision was announced, shares in Wayfair and Overstock both fell. Shares in large chains with more stores traded higher. South Dakota Gov. Dennis Daugaard called Thursday's decision a "Great Day for South Dakota," though the high court stopped short of greenlighting the state's law. While the Supreme Court spoke approvingly of the law, it sent it back to South Dakota's highest court to be revisited in light of the court's decision. The Trump administration had urged the justices to side with South Dakota. On Twitter, President Donald Trump called the decision a "Big victory for fairness and for our country." He also called it a "Great victory for consumers and retailers," though consumers will ultimately be paying more and businesses weren't uniformly cheering the decision. The case is South Dakota v. Wayfair, 17-494. ___ Associated Press reporter Zeke Miller contributed to this report. Poster Comment: Internet retailers forced into servitude, as tax revenuers for State governments. It's slavery, and you're going to pay for it in taxes. Thank President Trump's wonderful SCOTUS Justice Gorsuch, and the other tyrants in black robes. Legislating from the bench, more taxes for you.

High Court: Online shoppers can be forced to pay sales tax

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Comments (1-11) not displayed.

.

.

.

#12. To: A K A Stone (#9)

I'm not really trying to reason with him at all. I was merely using his post as a vehicle to state a philosophical position on taxation that anybody with common sense would read and agree with.

It is wrong, unjust, and unfair. What is the justification for the state sales tax? By that I mean what is the seller getting in return for the tax he paid to the state? Police and fire services? Utilities? Roads? Without a physical presence in the state, the seller gets none of these benefits. So how is Internet taxation right and just and fair to those sellers? I seem to recall we had a national revolution that centered around "taxation without representation".

The seller is simply collecting the tax from the consumer and remitting it to the state. It is my understanding that the tax will be based on the local sales tax rate of the consumer. Therefore the consumer is actually paying the tax, and receiving the benefits.

Oh? Those Internet companies usually provide free shipping -- something your "traditional" brick and mortar companies do not have to do. That places them at a financial disadvantage does it not? So how about we add "anticipated shipping costs" to each item in the brick and mortar stores to make it right, fair, and just. You agree?

What benefits? What if Illinois wanted to collect a state sales tax on all Internet orders shipped to, say, Florida? Why not? Hey, they certainly need need the revenue. And it's not fair that they're on the brink of bankruptcy and Florida is not. There is no justification for the sales tax. None. And I argue that an arbitrary tax like this interferes with interstate commerce and penalizes consumers who are getting nothing for their tax dollars.

Really? The people voted on Internet taxation? I thought this was a U.S. Supreme Court ruling, forcing consumers to pay this tax despite not getting anything in return. That said, I agree with you. Let's put it to a vote. Let the people decide if they want to be taxed this way.

There's an election coming up this November, and the people will decide this issue and all of the others on the national and local plate, based on who they elect and send to the legislature and executive mansions, and to the bench in those places where judges are elected.

The U.S. Supreme Court justices are on the ballot? We get to vote for who we want? Oh, goody. I can't wait.

That is not what this ruling is about. For instance, in Ohio we have a "use tax" - Ohioans are "required" to report their internet purchases and pay the "use tax" on these purchases. Not very effective. This ruling would allow states to demand taxes be collected by online sellers on sales made to consumers in their state. "What Benefits"? I'm willing to share this: http://obm.ohio.gov/Budget/operating/fy18-19.aspx if you want more, please do your own research.

If the citizens of Ohio are going to be taxed, shouldn't they vote on it? Sure, you can say it's for their own good, but I don't think it works that way.

Oh, goody. I can't wait. That's not how our republic works. The Senators ARE on the ballot. So is the President, every four years. The people who choose the Supreme Court justices, and who have the power to remove them, are elected. The people CAN choose to elect people who will choose justices, or remove them, based on what those justices do. If the people do not choose to make that their primary issue for voting for or against a candidate, that too is a choice. For my part, I would be more than happy to put the various forms of taxation to a DIRECT vote of the people, forgetting about this republican filter thing, and let the people set the tax code in its entirety by their DIRECT vote. I am not afraid of the result that would come about. I think it would be pretty reasonable, and it would CERTAINLY meet the criteria of "the will of the People" to which you are so solicitous. I have a feeling you would quail in terror at the idea of giving the authority to decide the matter of taxation directly to the people. I expect that you would loudly declaim the danger of "mob rule" and extol the virtues of a "republic" where elected representatives decide, lest the people make choices that too sharply disfavor the people and classes and rules you support. So, you rely on a republican form of government to protect your essentially minoritarian views of things. I'm not afraid of having the people decide the tax code by direct democracy. You are. But I'm fine with a republic too. I've just defended that. And our republic includes the further distance of judges from the voting polity. We can choose the representatives who pick the judges, and who can throw them out if desires. You will normally proclaim the virtues of a republic over direct democracy. But here, the republic has itself come up with a decision you don't like. So you're going past democracy and the republic, to a rule that simply denies the government the power to tax the internet, because you don't like taxes. I'm happy to put that to a direct plebiscite. I'll be you're not. Failing that, I'm happy to rely on the decisions of the Supreme Court, duly appointed and approved through the legislature and subject to removal thereby. You're not. You simply want a result, and are unhappy with any form of government that doesn't get you there. I understand. I also would like to be King.

Only if the people who don't pay taxes weren't allowed to vote. Truth be told, I quail in terror at the idea of giving the authority to decide the matter of taxation directly to unelected and unaccountable judges who give cover to cowardly legislators. Remember Missouri v. Jenkins, the 1995 Kansas City, Missouri school desegregation case where federal judges ordered more than $2 billion in new spending by the school district to encourage desegregation by doubling property taxes and imposing an income tax surcharge on everyone who lived or worked in the city to pay this huge bill?

I see you're familiar with my past postings. And you're correct. But given that fact that this case represents an outside influence on state tax matters, I would support a referendum which would prohibit the state legislature from changing the status quo.

Perhaps, but the taxing authority is already in place....so it's sort of pointless.

The U.S. Supreme Court?

No, the Ohio Revised code.

Taxes and Tariffs for the items specified in the US constitution are OK, but forcing someone on the internet to collect taxes on a used item that they've already paid the taxes on when they first bought it, is wrong. Why should some guy in Missouri selling you a used can opener that he already paid taxes for in his State, have to collect taxes for your State, and be punished by the feds if he doesn't? You want to turn the guy into a revenuer slave who collects taxes for YOUR State, and then is also forced to deliver them to your state?

Buy a used car - you have to pay taxes on the auto that has already been taxed. Resell it to someone else, the buyer pays taxes again on the same car. And so on...and so on. Pretty nifty scheme they got going. It's never enough for these money-grubbing assholes.

These four justices are right, the other 5 are legislating from the bench. If someone in another State is selling you an item, it's wrong to coerce them under penalty of federal prosecution, to be a tax collector slave for YOUR State. Are you going to pay for their benefit and retirement packages, for working as a revenuer slave for your State?

Speaking for Ohio only....used goods are exempt from sales and use tax - there are some exceptions, like cars, trucks, boats, heavy equipment....I doubt that a can opener would qualify...

Thank you Pebbles If you sell and ship a used widget to someone in California, you're OK with being a tax collector for Governor Moonbeam?

Everybody who spends money pays taxes.

This is about the states not federal government. If the state has a right to tax in that state then it can tax products bought off the internet and delivered to that state. The federal court just affirmed the right of the state which should make you happy as a state's right person. Im not sure why you have a problem with this?

If you don't comply with the SCOTUS orders to collect taxes for some other State, the Federal Government will prosecute you. It's not your State that's directly forcing a seller in another State to collect taxes for them, it's the Federal Government. So it IS federal.

So? I have to collect taxes for other cities or counties even though im from another. Its just doing business in a state that charges sales tax. This is about states that charge sales tax having people buy stuff from other states bring it here to get around state taxes. So no its a state rights issue affirmed by the federal court. You do believe in states rights? The only alternative is to not allow people to buy from other states which is centralized control!

Yes, but not everyone is spending their own money. Some could care less what the tax rate is.

… to tax an out-of-state private company without providing any services in return.

They are not tax them they are taxing the product that is bought by its citizen to be brought to that state. This is a good ruling. This is a proper ruling.

A State has no right to force someone in another State to collect taxes for them. Bad decision.

THAT I will agree with. The rest of your arguments are brain farts. It is RETAILERS that going to be charged with collecting taxes on sale items,and crap like used can openers are never going to sell out of state because it would cost more to ship it than a new one would cost. AND.....,like it or not,but governments,both local and national,MUST collect tax money to operate. Without tax money we have no cops,fire departments,rescue squads,building inspectors,roads,water systems,etc,etc,etc.

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

Uhhhh,you DO know it Hondo68,right? He has theories,and by GAWD he is NOT going to allow something as simple as reality interfere with them.

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

Its called cost of doing business. If you do not want to deal with this then don't sell to states that have state taxes. Companies that do will learn to comply with that states laws even if they are not from that state if it pertains to that state.

Sorry wrong poster lol

Its called cost of doing business. If you do not want to deal with this then don't sell to states that have state taxes. Companies that do will learn to comply with that states laws even if they are not from that state if it pertains to that state. Its the proper decision. Its the only one that is fair and it affirms a state's right.

Yup,EVERYTHING in life has it's cost.

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

They pay the tax to the state.

Like I told Hondo. I am required to collect sales tax for any business I do in other cities and other counties and pay it to the state. Same principle here. If I sale something to a person in a sales tax state and I send it cross state lines then I am going to held responsible to pay that tax to the state. If I do not want to be responsible for the tax then the person buying the product must come here to pick it up. There is nothing unconstitutional about it and its only fair.

Yes I have found this out the hard way so many times that it should be tattooed on my forehead! lol

Yes I have found this out the hard way so many times that it should be tattooed on my forehead! lol People who keep talking about free lunches have never considered how much that burger cost the cow. Nothing in life is free but grief,and even that is only free occasionally.

In the entire history of the world,the only nations that had to build walls to keep their own citizens from leaving were those with leftist governments.

The Taxman Internet stocks tank, Donnell rejoices that America is becoming a third world sh*thole country.

Fair? You collect and send taxes to State "A". What has State "A" done for you? Do they provide police and fire protection? Roads? Snow plowing? They do for your competition located in State "A". Do they pay your shipping costs? Your competitor in State "A" has no shipping costs. How is that fair?

You are trying to rason with a low iq anarchist. He still lives in his mom's basement. He won't get it. He will post some anarchist slogan at you.

#13. To: Vicomte13 (#7)

Internet taxation is right and just and fair.

#14. To: misterwhite (#13)

"...what is the seller getting in return for the tax he paid to the state? ..."

#15. To: Vicomte13 (#7)

It is an unwarranted advantage given to the Internet companies.

#16. To: Jameson (#14)

(Edited)

Therefore the consumer is actually paying the tax, and receiving th th t th th the benefits.

#17. To: Vicomte13 (#7)

They are voted upon by the people, and upheld in election after election.

#18. To: misterwhite (#17)

Let's put it to a vote. Let the people decide if they want to be taxed this way.

#19. To: Vicomte13 (#18)

There's an election coming up this November, and the people will decide this issue

#20. To: misterwhite (#16)

What if Illinois wanted to collect a state sales tax on all Internet orders shipped to, say, Florida?

#21. To: Jameson (#20)

"What Benefits"?

I'm willing to share this: http://obm.ohio.gov/Budget/operating/fy18-19.aspx

#22. To: misterwhite (#19)

The U.S. Supreme Court justices are on the ballot? We get to vote for who we want?

#23. To: Vicomte13 (#22)

I have a feeling you would quail in terror at the idea of giving the authority to decide the matter of taxation directly to the people.

#24. To: Vicomte13 (#22)

I expect that you would loudly declaim the danger of "mob rule" and extol the virtues of a "republic" where elected representatives decide, lest the people make choices that too sharply disfavor the people and classes and rules you support.

#25. To: misterwhite (#21)

If the citizens of Ohio are going to be taxed, shouldn't they vote on it?

#26. To: Jameson (#25)

Perhaps, but the taxing authority is already in place.

#27. To: misterwhite (#26)

Perhaps, but the taxing authority is already in place. The U.S. Supreme Court?

#28. To: sneakypete (#11)

Where is the money going to come from to pay for your minimalist government?

#29. To: hondo68, sneakypete (#28)

(Edited)

Why should some guy in Missouri selling you a used can opener that he already paid taxes for in his State, have to collect taxes for your State, and be punished by the feds if he doesn't?

“Truth is treason in the empire of lies.” - Ron Paul

Trump: My People Should ‘Sit Up in Attention’ Like Kim Jong-un’s Staff.

#30. To: Vicomte13, slaver, cracka (#7)

"E-commerce has grown into a significant and vibrant part of our national economy against the backdrop of established rules, including the physical-presence rule. Any alteration to those rules with the potential to disrupt the development of such a critical segment of the economy should be undertaken by Congress," Roberts wrote in a dissent joined by Justices Stephen Breyer, Elena Kagan and Sonia Sotomayor.

#31. To: hondo68 (#28)

used can opener

#32. To: A K A Stone, Fred Mertz (#8)

#33. To: misterwhite (#23)

Only if the people who don't pay taxes weren't allowed to vote.

#34. To: hondo68 (#6)

SCOTUS is federal. The fedgov is broke,

#35. To: Justified (#34)

This is about the states not federal government.

#36. To: hondo68 (#35)

If you don't comply with the SCOTUS orders to collect taxes for some other State, the Federal Government will prosecute you. It's not your State that's directly forcing a seller in another State to collect taxes for them, it's the Federal Government.

#37. To: Vicomte13 (#33)

Everybody who spends money pays taxes.

#38. To: Justified (#34)

(Edited)

"The federal court just affirmed the right of the state …"

#39. To: misterwhite (#38)

#40. To: Justified (#36)

its a state rights issue

#41. To: hondo68 (#30)

If someone in another State is selling you an item, it's wrong to coerce them under penalty of federal prosecution, to be a tax collector slave for YOUR State.

#42. To: Justified (#34)

(Edited)

Im not sure why you have a problem with this?

#43. To: sneakypete (#41)

#44. To: sneakypete (#43)

#45. To: hondo68 (#40)

A State has no right to force someone in another State to collect taxes for them.

#46. To: Justified (#43)

Its called cost of doing business.

#47. To: Justified (#39)

They are not tax them ...

#48. To: misterwhite (#47)

#49. To: sneakypete (#46)

Yup,EVERYTHING in life has it's cost.

#50. To: Justified (#49)

(Edited)

Yup,EVERYTHING in life has it's cost.

#51. To: Deckard, Fiddling while Rome burns, Emperor Donnell (#29)

(Edited)

Trump Gloats After SCOTUS Dings Online Retailers: "Great Victory For Consumers"

Internet Stocks Tumble After SCOTUS Rules On State Internet Tax Collection

#52. To: Justified (#48)

There is nothing unconstitutional about it and its only fair.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]