Business

See other Business Articles

Title: Financial/Investment News and Comments

Source:

[None]

URL Source: [None]

Published: Feb 9, 2018

Author: To be determined

Post Date: 2018-02-09 07:55:59 by A K A Stone

Keywords: None

Views: 13644

Comments: 58

This is the place for financial talk. A place to share entrepreneuial ideas. To discuss investment strategies whether they be stocks, real estate or starting a new business. Or improving an existing business. Anything money and finance related is welcome to be shared right here.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: A K A Stone (#0)

"A group of complete morons" who traded little-known, leveraged products that bet on volatility is "blowing up" everything, Cramer said on "Squawk on the Street." Cramer has been particularly critical of the VelocityShares Daily Inverse VIX Short-Term exchange-traded note, which is traded under the symbol XIV, and those who put money into it. The XIV is supposed to give the opposite return of the VIX, Cboe's volatility index, which is often referred to as the market's fear gauge. Amid the market tumult, Credit Suisse said Tuesday it will end trading for its XIV later this month after the note lost most of its value and sent investors scrambling for cover. "What bothers me is the people who have never looked at a stock and don't know how to analyze it [are] out in full force today," said Cramer, host of "Mad Money." "They've never been better about not knowing anything about the stocks," he said. "They got it all figured out," he added, sarcastically.

Comparisons and baselines. Here's a list of things you could invest in. With all investments there are transaction costs. With all but one there are taxes. With many there are holding costs as well. To be able to compare investments, a benchmark is needed. I think that the yield on triple-tax-free municipal bonds is the best benchmark because it is a "safe" investment, with no taxes on it, so it's "pure". Everything else can be compared to the TTF bonds to see how each stacks up.

You posted to me: Exactly! I have the same view about gold hoarding. If these companies advertising for people to buy their gold because of the imminent meltdown of the economy and hyperinflation of the dollar really believed their own hype, why are they selling the gold in exchange for those soon-to-be-worthless dollars? They sure want dollars rather than holding onto their piles of gold, so THEY obviously don't believe what they say. I was speaking about those who have ideas on investments and make their money selling those ideas instead of hiring a staff and primarily working those “great” ideas. As far as the hawkers of precious metals are concerned, they are playing percentages. They are going for volume and percentage using the “60/40 Rule.” They have to buy the metals to sell them. As the market fluctuates, they will actually at times sell some metals at below their cost. But with the volume and by playing the ups and downs like Swing Traders do.....they will over a period of time sell more metals higher than they do lower. If they have a million dollars of gold, instead of holding it and hoping for a ten percent increase....they will turn it multiple times while making a percent off each sale. Therefore, as merchants....they will make more money buying and selling than buying and holding. Holding (hoarding) gold is for the individuals who wish to preserve assets. But as we discusses, undeveloped land with extremely low property taxes, like farm land, is a much better investment. Make sense?

In general I agree with that; what you want to watch for is "My magic system will make you rich if you follow it." That's a dead giveaway for a huckster; even if it's not a lie, there are many reasons his "magic" system won't work for you. I did a lot of reading and research to figure out which trading style fit me best; if it wasn't for different styles there wouldn't be markets. I learned the techniques I use from a Soviet-Union escapee, an M.D./Psychiatrist who developed trading methods based on the mass psychology of the markets. He has written books and taught classes because he enjoys doing both in addition to making very good money trading his own accounts, and is a very enjoyable guy to spend time with. I get this; I enjoy teaching others as well, but won't join a union or be in harness, so I do it for fun on rare occasions. An exception to the rule "If you can do it, do it. Don't waste time teaching it." He doesn't sell a "magic system", he sells understanding of what drives markets and provides the analysis tools he uses (most of which are freely available for any trading platform) - the system is up to you. And I helped out a friend for a couple of years who was in the rare-coin and gold/silver bullion business. He had his own collection of graded rare coins, but in general you're right - turnover for the spread is how he made (a ton) of money and if you're in the business you don't hold bullion or bullion coins except for inventory to sell.

Absolutely. I wasn't suggesting that the gold sellers are foolish. I was suggesting that the people who buy the hype that they're buying gold against Armageddon are, and that the gold sellers who press that hype (and they DO! I see the commercials and hear the arguments) are not honest.

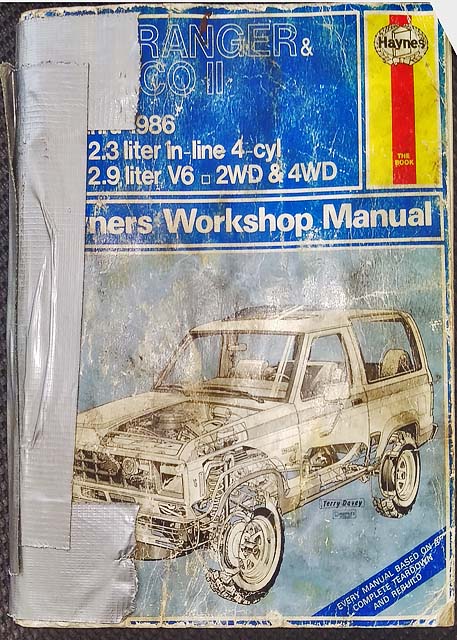

One of the best investments I ever made: A vehicle is a significant investment that can easily become a money pit. Unexpected vehicle repairs often end up on a credit card or high interest Pay-day loan. So Be Be Be Prepared. Even if you don't feel comfortable making repairs or doing maintenance yourself - The shop manual specific to your vehicle has valuable information that can help you to be an informed part of the process... and less likely to get fleeced by "professionals" who salivate like wolves when they see their prey, which is you and your vehicle, wobbling (or being towed) into the service bay.

Paper, Binary, or Actual gold-painted Tungsten "gold"?

Yep. Good information and food for thought here:

I prefer YouTube videos when you can find them. Sometimes the words in directions are hard to understand and you have to read over and over. Just

I have a ranger with about 280,000 miles on it. I plan oputting it back to work this spring.

You Tube videos are a great source too. https://www.youtu be.com/watch?v=c1aHY74Vk4E&list=PL6qkWbxcri_dI6nsUuORl67SA27w7ZVb3 Especially when you have a vehicle in which something like changing a spark- plug isn't as simple as it should be, because some super-genius "engineer" evidently never had to change a spark-plug in one of her "projects". {ehem} But, anyhow, videos typically won't have things like torque specs, wiring diagrams etc. I like to follow along in the manual with videos - as a sort of virtual dry run to thoroughly understand the process. Especially if it might have some special tool that requires another trip to Autozone or wherever to procure/borrow.

Sidebar - Personal Story: I started trading stocks as the result of careful research and many long hours of study. I was invested in a number (4 as I remember) of mutual funds. They were not making the returns I felt they should be. One was doing fairly well and showing a return that was acceptable. I knew from the daily reports that the fund would go higher and then lower, sometime almost one day after another. So, next time the fund reached a high point, I sold it. Then, when it was down...I bought into it again. I repeated this cycle three or so more time. Hot Damn....I was making money and this was so EASY. The all of a sudden and out of the clear blue, I get this somewhat nasty letter for a big wig in the firm telling me: “Hey, STOP IT, you can’t do this. Our mutual fund is not designed or structured to buy and sell like you are doing.” I thought, okay....and sold the mutual fund for the last time. Being the logically clear thinking old country boy that I am, I figured that mutual fund had to disclose somewhere the funds it was invested in. I realized I was right when I discovered a complete listing by percentage....the names of the companies that mutual fund held stock in. I told a broker what I wanted to do and asked if it was against their procedures. He looked at me like I had just gotten off the turnip truck from Two Egg, Alabama (yes, there is such a place and I have relatives from there)....then smiled and told me it was okay. He said that was the way many of his clients called “traders” do their thing in the market. That was the beginning of my education to Swing Trading. I took from the list of stocks held by the mutual fund I just left....picked the 3 they had they greatest percent invested in, and started on the long road leading to many years of trading. BTW: The broker knew what I was doing and wanted to do, of course. So, he got me started on buying and selling options and naked options. He was making a bunch of money on commissions and I was losing money rapidly. So I stopped trading in those and considered it a lesson I had paid for. I am still shell shocked when I read those terms each day. I will try to find the name of the “Soviet-Union escapee, an M.D./Psychiatrist” so I can read his book and maybe modify my Swing Trading procedures. My plan always stays the same since I started on the road to success after some dismal failures....but my I oftentimes tweak my procedures, sometimes daily. Good post from you....thanks for sharing.

You too, eh? LOL ...

Check your PM.

Nothing wrong with buying gold and investing in it in whatever form one wishes. It is essentially an investment in enter It's the mindset that the world is ending and this here gold's gonna SAVE me that is problematic.

Should You Own Bitcoin Or Gold? That's Easy Summary Gold bugs are rarely, if ever, bearish on gold. To them, it’s the only real currency in a world of money-printing central banks endlessly devaluing their fiat (that is, paper) currencies. There are few people who believe so fervently as gold bugs. But bitcoin fanatics come pretty close. These folks believe that this decentralised digital currency is the ultimate means of easily transferring value without the need for centralised entity, intermediary, or central bank. Bitcoin is a libertarian dream. Now, given that gold bugs and bitcoin fanatics share a common desire – a completely independent store of value – and a common enemy (central banks), you’d think they might be the best of friends. But they’re not. In fact, they’re more like dogs and cats – or chalk and cheese. They don’t mix well, at all. I know this because I’m privy to a private mailing list that’s run by an old family friend who’s a consigliere of one of Hong Kong’s wealthiest families. He, along with a couple dozen business and financial gurus and veterans, some with names you recognise, share their investment ideas and opinions on all things related to global finance and investing. And recently the topic of cryptocurrencies and bitcoin came up. After watching carefully thought-out emails travel back and forwards within the group, I drew a few conclusions. Gold bugs don’t like bitcoin Most of the guys (and they’re almost all men) on this email list are grizzled investors, and they like their gold. To be precise, their physical gold. They dismiss bitcoin as a fad, a craze, all hype and no substance. As I said, bitcoin is frequently compared to gold. They’re the only two widely distributed, decentralised methods of exchanging value as currency. There is no central authority issuance like there is with U.S. dollars or any other fiat currency.

Why gold could soon get a boost from the wild market volatility

Another problem for stocks: Earnings may be getting too strong for the market's own good When it comes to corporate earnings, there actually can be too much of a good thing. History has shown that years with particularly high profit growth, the chances are actually better that the market finishes lower. This comes about primarily when expectations get so high that even strong performance isn't enough, and when invstors get concerned that the strong earnings are indicative of an economy that is overheating. Counterintuitive though it may seem, the pattern is important. That's because many investors are using the strong performance on both the top and bottom lines for corporate America as the foundation for their bull market thesis. History has shown, though, that froth comes in many forms, even profits. "If you look at the years where earnings were up double-digits, you actually had a slightly higher probability of having a down market vs. other years, which is really quite fascinating," said Dan Suzuki, equity and quant strategist at Bank of America Merrill Lynch. During the bull run of 2009-17, there was a strong correlation between profit growth and the rise of the stock market indexes. However, 2018 looks to be a particularly robust earnings year, potentially the best since the recovery began in 2009 and continuing off a powerful gain in the fourth quarter of 2017. The end period for last year now is tracking for a 13.4 percent earnings gain with 80 percent of companies beating on revenue, the highest level since FactSet began tracking the number in 2008. With such big numbers, though, comes a coordinating level of expectations, and that's where the market can run into trouble. "When optimism is very high and valuations are high, the market is much more vulnerable," Suzuki said."Even a small uptick in fear can have an outsized effect in that type of backdrop." There already have been some manifestations of the trend. Over the past several quarters, investors have provided little reward to companies that beat Wall Street earnings estimates. Most recently, outperformers have been rewarded with just a median 0.3 percent gain after reporting for Q4, compared with the historical norm of 0.3 percent. All of this comes amid ever-higher expectations for market performance, at least before the recent correction that has hit the major averages. While outsized profits may sound like a good problem to have, they're adding another dynamic to an investing minefield that's getting trickier to navigate. "When we're getting late into the cycle and sentiment-driven market expectations and optimism gets more and more bullish, this is what it leads to," Suzuki said. "It really sets a high bar, in which it's easy to disappoint."

That doesn't surprise me at all. Gold bugs also like physical possession. It's the form of wealth that ranks among the highest in personal security. If you have gold in your home or possession then it can be very highly secured against theft or loss, even considered more secure than a bank vault or safe deposit box. Cryptocurrency is not so secure. It doesn't have that tangibility that gold has, or the history, and it's value is much more variable and dependent upon public demand. And its a lot easier to understand solid weight than a computer program. However, everyone who likes bitcoin will also like gold.

It may surprise you to learn, that I am starting to warm up to bitcoin. I kept reading bad articles before and now I am running across some good articles. I will post one next. Let me go fetch it.

Forget the Stock Market. Investors Are Trading in Gold for Bitcoin By LUCINDA SHEN - February 8, 2018 Bitcoin, the heavyweight of the cryptocurrency world, has billed itself as digital gold —a safe haven for investors to park their assets. Apparently that image is having an impact. While Bitcoin’s status as a potential substitute investment to the shiny precious metal with thousands of years of human history is debatable, some investors are foregoing physical gold for its significantly younger brethren. As Bitcoin prices inched toward an all-time high price above $19,500 in December, Byron Salamida, 48, of San Diego took some of his gold coins and decided to sell them at a local precious metals dealer. He planned to take the cash and purchase cryptocurrencies including Bitcoin—as he had been doing for the past two years. After all, while his gold coins were simply sitting there, with roughly the same value minute after minute, the price of the cryptocurrencies he owned was shooting up—seemingly into the stratosphere. “Why keep something in gold? It’s stable. But why keep it in gold when it stays in a $100 range, when I could buy Bitcoin when it is increasing everyday? ” Salamida said. He was surprised to find when he got to the precious metals seller where he planned to offload his wares that he wasn’t the only gold owner who had the same idea. The shop owner bought the gold from Salamida for about $5 to $10 below spot price, citing low demand. The owner mentioned he had noticed a recent surge in customers who were selling gold in a bid to buy Bitcoin. “There was definitely a trend where it seemed like for a month people were selling precious metals for cryptocurrencies,” says Michael McConnell, the owner of precious metal seller San Diego Coin and Bullion, where Salamida has been selling his gold coins for the past two years. “It seemed like it was every day—some days two or three times—[customers] would talk about Bitcoin.” While McConnell says that the price at which he bought and sold Salamida’s coins had little to do with Bitcoin demand (those prices are actually determined by yet another, larger precious metal dealer), recent research reports have pointed to a larger trend at play. “The rapidly accelerating popularity and price in cryptocurrencies, such as Bitcoin…diverted substantial amounts of capital away from precious metals last year,” Thomson Reuters analysts wrote of gold demand in the U.S. in their 2017 Gold Survey released in January. “Retail investors tend to have a shorter investment horizon these days and with cryptocurrencies recording parabolic increases over the year, many consumers were not able to withstand the temptation to get on board.” It’s a relatively recent development, says RBC Capital Markets Commodity Strategist Christopher Louney, who said he has noticed a potential correlation between cryptocurrency prices and the value of gold. While the relationship appeared nonexistent before, Louney said the trend emerged late in 2017 and continued into early 2018—suggesting that as the price of Bitcoin soared into the quadruple digits, some investors may have been offloading gold to pay for cryptocurrencies. There’s some logic behind the correlation. Gold and Bitcoin certainly have their differences, but in several ways, they also appeal to the same set of investor sensibilities. “They’re stateless, with some people perceiving both as stores of value,” says Louney. “There’s a similar psychology happening among the investors.” For Salamida, the two assets did tug at similar heartstrings. One of the reasons why he was attracted to gold was because he didn’t trust the existing financial powers that be. “I got foreclosed on in 2011. The banks weren’t really working with me to come to a resolution. I was just laid off in 2010. It just snowballed,” he said. “I kind of had a distrust of banks and the monetary system.” He then made a living off of selling goods on eBay and buying into gold. In 2014, Salamida met Bitcoin, and “everything just clicked into place.” But Bitcoin’s proponents should stay their hands before crowning the cryptocurrency the new gold. Louney stresses that the correlation is minor—not quite enough to move gold prices, and not quite enough to say that investors are currently seriously considering Bitcoin as gold’s replacement. Another caveat: the data is sparse. The same macroeconomic factors that have traditionally affected gold prices still dominate the playing field, with stock market performance being one of those factors. Mostly due to rising equity returns, Louney says he expects gold prices to end the year lower than they started, and at around $1,303 on average for the year. Bitcoin is, after all, far more volatile than gold, and still relatively unknown compared to other investment assets. Gold, on the other hand, is well established with institutional investors and has quite a bit of liquidity. While Bitcoin trading volumes tallied up to just over $3 billion daily in recent trading, gold trading volumes reach $250 billion a day, according to the World Gold Council. Though that’s not to say a Bitcoin-gold correlation won’t deepen with time, says Looney, who admits he will continue tracking the relationship. Though the emerging relationship also means that the converse may one day also be true—spooked Bitcoin investors could cash in their cryptocurrency in hard times for a less volatile asset. So it wouldn’t be strange if Salamida, to some extent, wished he had held his assets in something steadier than Bitcoin. After all, the cryptocurrency’s ups and downs have occasionally left him queasy, with the asset soaring to $20,000 on some exchanges in December, before falling below $6,000 earlier this month. Now, it rests just above $8,000. But Salamida said he is holding tight and waiting for the bottom. He is saving cash from his day job in cybersecurity and from gold sales. He maintains, however, that he would never go into debt to buy cryptocurrency, or use his credit card account to purchase the digital assets. “I am loading up on cash on the sidelines to accumulate crypto on the dips. Like the old saying from Rothschild, ‘the time to buy is when there’s blood in the streets,’ ” he said. And to those who have left the fold of the gold bugs for the den of the “crypto crazies“? You’re always welcome back. “We wish you luck. More power to you,” precious metal retailer McConnell said, professing that he himself knows little about Bitcoin and its peers. “But if you want gold, we’re here.”

After I read her article, I read this article by Matthew J. Belvedere: Buying stocks at the 3 worst times in the past 30 years still proved the best place to invest. While reading the article by Matthew, I was thinking: “Buying bitcoin at the worst time after a huge decline could prove the best place to invest.” I have never seen anyplace where the brokerage firm I use deals in bitcoins. I will call Monday ad check if they have anyway I can trade in bitcoin. I no longer like “buy and hold” and I haven’t done that for many years....however this may be an exception. I can see using my trading method as it climbs back up [notice I did not say “if” it climbs back up] should there be some avenue open to me.

Here Are All The Ways You Can Buy, Trade, And Invest In Bitcoin

One of the stocks listed in that last article:

This may be informaton overkill for you.

Riot Blockchain Claims 500 Bitcoins in U.S. Marshals' Auction

BitBull Capital CEO Joe DiPasquale discusses Bitcoin’s plunge and global regulation of cryptocurrencies.

Indeed it would shock me, given my impression of you. But having an open mind is a virtue, even if one is already correct about an issue. And naturally, if one is currently incorrect, so much the better to have an open mind. I suggest though that if your opinion about issues is determined solely by the articles you read, then you are not coming up with them correctly. Do you not question what you read? Whether pro-bitcoin or counter-bitcoin, articles have bias and their degree of correctness can vary to any degree. I know you know that. But if we're going to converse, it helps a lot to know how open minded you are.

$250 billion in PAPER gold gets traded a day. Real gold is about 1% of that, I understand, which puts it in the same scale as bitcoin. And there is paper bitcoin now, in the form of futures trading.

You can open up new accounts in a number of sites that deal in bitcoin. Bitfinex.com and binance.com are 2 that get mentioned a lot, it seems, and are probably of reasonably good repute. Do diligence though. With some outfits, it's akin to meeting someone on a street corner to deal. Might be legit, and might be safe too. As has been pointed out, the market is new and in need of maturing. But those qualities also make greater gains more likely, as after markets mature, all the fun is gone. Also, as an aside, the reports I have on the senate hearing about it the other day was very favorable for cryptos, with both regulators and senators both seemingly knowledgeable about cryptos and reportedly agreeing that cryptos were "here to stay". If true, there's no ban of cryptos in the US in at least the foreseeable future, and that means the world will likely be forced to follow suit. That was on Monday and bitcoin is up over 25% for the week. If cryptos do survive and take real root in the retail market, I could easily see bitcoin reaching the 100k-500k range in the next few years, as in my view, it would have to go that high in order for there to be enough spending power to go around to everyone that will want to use it.

In addition to the four stocks listed in one of the articles in a post above, I also found this: Fundstrat says investors need to have some exposure to bitcoin and its blockchain technology as a handy tool for diversification. These are the dozen equities that could propel your portfolio as bitcoin continues its gains. One of the twelve stocks listed in the article above is also listed as one of the four in the first article. From those 15 stocks, I found 2 bitcoin “associated stocks” that fit my trade perimeters. I list those below. Reading the plus and minus signs from right to left shows their daily increase/decrease for the past 5 days. The first plus number after that is the % increase on Friday. The plus number after that, and to the far right, shows the % increase for the last 5 days. I have never traded these two stocks since they were never alert flagged to me because they are on the OTC exchange. I will need to be careful because there are no Stop Loss orders on the OTC exchange. There are excellent points in your last few posts with some good reminders on cautions, that I a well aware of and practice. But, is is always good to see them again. As to the caution, I don’t read the articles because I have no time or interest in that point, yet....but I see a number of article involving “bitcoin fraud.” I will try to read those article when I find time.

Dollar Will Be Replaced By Gold And Bitcoin By 2040 – Robert Kiyosaki (Part 2)

www.google.com/search?q=fake+gold+tungsten And they're sellllllling a staaaairway to Heaaaaaven. Bullion or Bullshyte?

Trading in bullish markets: Finding reasons to be bullish Most investors are familiar with the phrase "bull market," which is a term typically used to describe a period of time when the major stock market indexes— and the majority of stocks — experience an extended and meaningful advance in price. To be "bullish" on the outlook for a given stock, index, ETF or other asset means that you are comfortable holding existing positions while possibly looking for other opportunities to buy stocks and benefit from a rise in price. Before assuming a bullish position in any security, it's important to have some identifiable reason why you believe it is a worthwhile idea to do so rather than simply relying on a whim or a passing notion. A trader should be able to point to some concrete reason why they believe that the price of a given security will be propelled to higher ground. Many look at several different factors for those potential reasons. A trader might identify a security that is already in an established uptrend and figure that the trend is likely to continue. As a result the trader will enter a bullish position and hope to "ride the trend" as long as the trend appears to remain in force. Another trader may see a stock that has been beaten down sharply and decide that at some point the selling has been overdone and assume that the stock price is due to "bounce." Other traders may look at chart patterns and/or momentum indicators to determine when the time is right to enter a bullish position. Many traders focus on the performance of the underlying company when considering buying stock. These traders tend to look for either a company that is performing exceedingly well in terms of growing its earnings and sales, or for a situation where they believe that the stock is trading below the implied underlying value of the company itself. In either case, these traders examine individual companies' financial statements to determine if the stock is a buy based on their own preferred growth or value-based criteria. Some traders and investors believe stock market seasonality has merit and use this type of information to aid in their analysis. While this apparent seasonality can offer insights, like any single piece of research, it should not be the sole consideration for investment. The overall stock market has displayed a historical tendency to perform better between November and April than between May and October. As a result, some traders may choose to be more or less active in pursuing bullish positions depending on the time of year. When the underlying fundamentals for a given market sector (technology, financial, utilities, etc.) change for the better it can take a long time for this to be recognized by the majority of investors and for the positive effects to play out. As a result, many traders will pay close attention to the fundamental and technical action of various market sectors and/or industry groups in an effort to forecast areas where above average and/or persistent price strength may be likely to occur. Some traders use a variety of other miscellaneous factors to attempt to identify indicators that may drive bullish investments. Among these may be dividend yields, stock buybacks, lesser known technical analysis methods such as Elliott Wave or Gann, and simple "common sense," which alerts them to a company that they may be aware of (perhaps one whose products they use regularly or one that is a leader in the industry in which they work) that they believe has above-average investment prospects. Rather than relying on one factor, some traders believe that, by combining a variety of factors such as those listed above, they can improve their chances for success. For example, a trader can first identify a sector they're bullish on and then identify an undervalued company within that sector using fundamentals, then use technical analysis to find the right time to establish a long position. When it comes to identifying a catalyst that may drive a perceived bullish security higher, there is no one best factor. As a result, it is not so much which factor or combination of factors a trader chooses to use that matters most, but rather, how consistently he or she applies those factors and how effective those factors have proven to be in the past. One of the biggest mistakes that traders make is to buy something just because it "seems like the right time" to do so. For traders seeking long-term success, one litmus test they should consider each time they plan to buy a security is to spell out exactly what factor or set of factors has led them to take action at this time. If time passes and the factors that led to the trader's bullish view are no longer present, the decision to maintain the position should be reevaluated. This method can help a trader to become more consistent and decisive when it comes to making investment and trading decisions.

You may be paying off your credit card debt wrong—here’s the best way

This crypto-millionaire bought a Lamborghini for $115 thanks to bitcoin

Russian nuclear scientists arrested for 'Bitcoin mining plot'

I was waiting for stock tips to buy in Monday's trading and all I got was a lousy link about bitcoin. Very sad.

I was waiting for stock tips to buy in Monday's trading and all I got was a lousy link about bitcoin. Very sad. The stock was un +7.79% on Friday and up +31.98% fpr the last five days. (RIOT) Historical Prices & Data - NASDAQ.com Riot Blockchain, Inc (RIOT) After Hours Trading - NASDAQ.com Riot Blockchain, Inc (RIOT) Stock Report – NASDAQ.com - NASDAQ ... Barchart: Riot Blockchain Inc (RIOT): Barchart Technical Opinion: HOLD

Following RIOT, the next stocks on my list to consider after opening tomorrow morning are: Is there anything else I can do for you this evening?

Since I am having to spoon feed you....you might as well as have this info also. Reading the (+) and (-) from Right top Left is the up and down movement up for the last 5 days. XRM: +++++ / +6.42 +11.02 We will NOT make this a habit ...

Comments (42 - 58) not displayed.

Top • Page Up • Full Thread • Page Down • Bottom/Latest Cramer blames this week's crazy market on a 'group of complete morons' out speculating

#2. To: A K A Stone (#0)

#3. To: Vicomte13 (#2)

(Edited)

This is a response to your post on another thread and more fitting for discussion on this new thread. I always figured if they were any good, they could hire a bunch of people to work directly for them and clean up on making money and forget about selling advice.

#4. To: Gatlin (#3)

(Edited)

I always figured if they were any good, they could hire a bunch of people to work directly for them and clean up on making money and forget about selling advice.

#5. To: Gatlin (#3)

Make sense?

#6. To: A K A Stone, vicomte13, all (#0)

#7. To: Vicomte13, Gatlin (#5)

people who buy the hype that they're buying gold against Armageddon

#8. To: Hank Rearden, all (#4)

"My magic system will make you rich if you follow it."

#9. To: VxH (#6)

#10. To: VxH (#6)

#11. To: A K A Stone (#9)

(Edited)

I prefer YouTube videos when you can find them.

#12. To: Hank Rearden (#4)

(Edited)

He has written books and taught classes because he enjoys doing both in addition to making very good money trading his own accounts ...

Oh, I totally agree with this. I am a firm believer in sharing information for others to learn and learing from others who share information. Back, way back, many years ago....I paid for a couple subscription newsletters and “how to” courses. I was hoping to start trading and thought: “Man, I can learn from these experts and it will be easy.” It did not take me long to realize it was all for naught. I remember those unfortunate happening each time I now see individuals trying to sell monthly subscriptions and “how to” courses.

#13. To: A K A Stone (#9)

Sometimes the words in directions are hard to understand and you have to read over and over.

#14. To: Gatlin (#12)

I will try to find the name of the “Soviet-Union escapee, an M.D./Psychiatrist” so I can read his book and maybe modify my Swing Trading procedures.

#15. To: VxH (#7)

people who buy the hype that they're buying gold against Armageddon Paper, Binary, or Actual gold-painted Tungsten "gold"?

#16. To: All, Pinguinite (#15)

#17. To: All (#16)

#18. To: All (#17)

#19. To: Gatlin (#16)

Gold bugs don’t like bitcoin

#20. To: Pinguinite (#19)

#21. To: Pinguinite, All (#20)

#22. To: Pinguinite (#21)

Lucinda Shen wrote this piece yesterday, after the price dip. I have discovered a couple more articles that are optimistic and the authors see this dip as a great buying opportunity.

#23. To: All (#22)

#24. To: Pinguinite (#23)

Riot Blockchain’s stock jumps as company set to acquire digital-currency exchange.

#25. To: Pinguinite (#24)

But then, you may have an interest

#26. To: All (#25)

#27. To: All (#26)

#28. To: Gatlin (#20)

It may surprise you to learn, that I am starting to warm up to bitcoin. I kept reading bad articles before and now I am running across some good articles. I will post one next. Let me go fetch it.

#29. To: Gatlin (#21)

gold trading volumes reach $250 billion a day, according to the World Gold Council.

#30. To: Gatlin (#22)

I have never seen anyplace where the brokerage firm I use deals in bitcoins. I will call Monday ad check if they have anyway I can trade in bitcoin. I no longer like “buy and hold” and I haven’t done that for many years....however this may be an exception. I can see using my trading method as it climbs back up [notice I did not say “if” it climbs back up] should there be some avenue open to me.

#31. To: Pinguinite (#30)

You can open up new accounts ...

Thanks, I have considered that as an option. Top 12 Stocks to Own Should Bitcoin Price Rally Continue RIOT ++++- +7.79 +31.99

GBTC ++++- +2.83 +19.50

#32. To: All (#31)

2018 Predictions -- Dollar Will Be Replaced By Gold And Bitcoin By 2040 – Robert Kiyosaki

#33. To: Vicomte13 (#15)

(Edited)

Nothing wrong with buying gold and investing in it in whatever form one wishes.

#34. To: All (#32)

Honing in on a potential reason

Technical factors

Fundamental factors

Seasonal factors

Sector strength

Other factors

Combining different factors

Summary

#35. To: All (#34)

(Edited)

#36. To: All (#35)

(Edited)

#37. To: All (#36)

#38. To: Gatlin (#37)

http://www.bbc.com/news/world-europe-43003740

#39. To: buckeroo (#38)

(Edited)

http://www.bbc.com/news/world-europe-43003740

The Barchart Opinion rating is a Hold. Short term, the outlook is Falling.

#40. To: buckeroo (#38)

I was waiting for stock tips to buy in Monday's trading and all I got was a lousy link about bitcoin. Very sad.

XRM,TPR,PRO,TWTR,NEWS,EMP,BKE,ENVA,FLO,MIXT

#41. To: buckeroo, (#40)

(Edited)

The first + number is what the stock did on Friday....the second + number is what the stock did for the last five days.

TPR: +-++- / +0.43 +6.76

PRO:- +++- / +0.28 +14.54

TWTR: ++++- / +4.41 +21.57

NEWR: +-++- / +2.19 +8.55

EPM: +++- / +1.26 +8.78

BKE: +-++- / +1.90 +9.18

ENVA: +-+-+ / +1.49 0.74

ERN: +-++- / +1.43 +7.58

FLO: ++++- / +2.05 +6.25

MIXT: --+-+ / +0.85 +3.77

.

.

.

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]