Other

See other Other Articles

Title: 45 percent of Americans pay no federal income tax

Source:

NY Post

URL Source: http://nypost.com/2016/02/24/45-per ... ans-pay-no-federal-income-tax/

Published: Feb 24, 2016

Author: MarketWatch

Post Date: 2016-02-24 19:05:36 by cranky

Keywords: None

Views: 7939

Comments: 28

Many Americans don’t have to worry about giving Uncle Sam part of their hard-earned cash for their income taxes this year. An estimated 45.3 percent of American households — roughly 77.5 million — will pay no federal individual income tax, according to data for the 2015 tax year from the Tax Policy Center, a nonpartisan Washington-based research group. (Note that this does not necessarily mean they won’t owe their states income tax.) Roughly half pay no federal income tax because they have no taxable income, and the other roughly half get enough tax breaks to erase their tax liability, explains Roberton Williams, a senior fellow at the Tax Policy Center. Despite the fact that rich people paying little in the way of income taxes makes plenty of headlines, this is the exception to the rule: The top 1 percent of taxpayers pay a higher effective income tax rate than any other group (around 23 percent, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50 percent. On average, those in the bottom 40 percent of the income spectrum end up getting money from the government. Meanwhile, the richest 20 percent of Americans, by far, pay the most in income taxes, forking over nearly 87 percent of all the income tax collected by Uncle Sam. The top 1 percent of Americans, who have an average income of more than $2.1 million, pay 43.6 percent of all the federal individual income tax in the US; the top 0.1 percent — just 115,000 households, whose average income is more than $9.4 million — pay more than 20 percent of it. When it comes to all federal taxes — individual income, payroll, excise, corporate income and estate taxes — the distributions of who pays what is more spread out. This is partially because nearly everyone pays excise taxes, which include taxes on gasoline, alcohol and cigarettes.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 27.

#8. To: cranky (#0)

Ask the lying commie SOS what percentage of total federal income taxes should the top 10% of income earners pay. 75% 90% 125% 200%

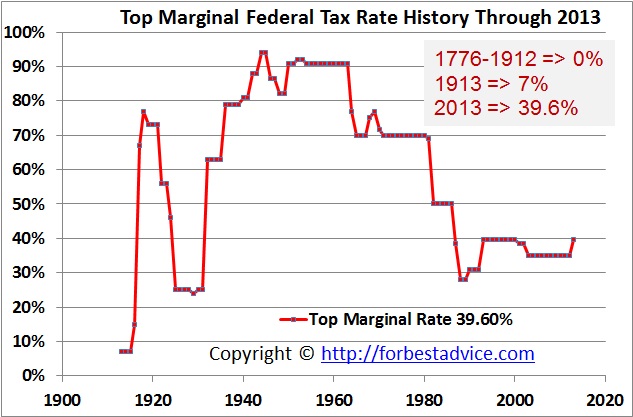

You do not get two facts. 1 Federal Income Tax is only one of several taxes and when it was introduced in early XX century it was indented to be paid by the high income people. 2 Rich people do not need to work and to have income subject to this tax. If the purpose of liberal state ("liberal" in the classic meaning) is to be a night watchman, ie to protect wealth, the fair tax is to tax wealth, not wages of the working class who barely make ends meet. If the rich and their brown-nosing sycophants to not like this idea, let them protect their wealth by their own means. There is not reason why the person who is not wealthy should pay for the protection of the privileged.

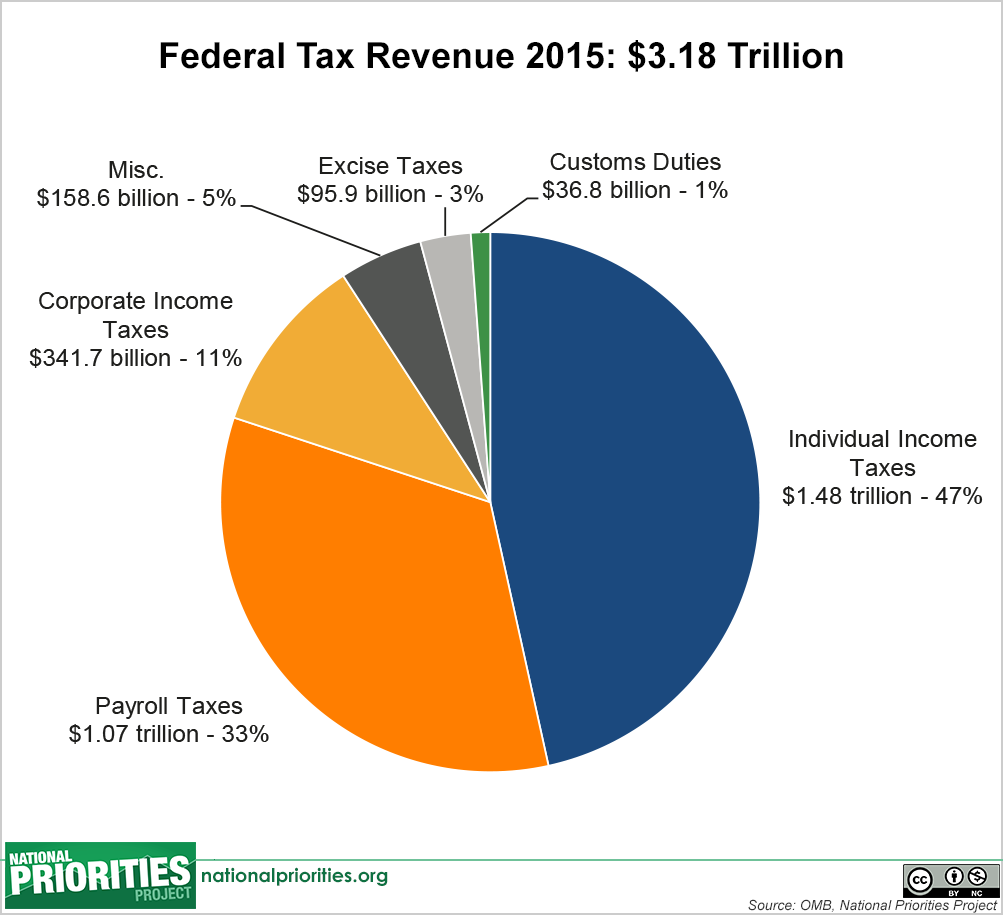

So people who are below the 10% income bracket receive no protection or any other benefit from the government? Really? And you still don't answer questions. I will modify the first question a little, what percentage of total federal taxes (income, SS, medicare) should the top 10% of income earners pay. 75% 90% 125% 200% Should there be a cap on how much AGI a person/household should be allowed to have? If so, at what amount? Is $176,000 p.a. too much? That was the threshold for the top 5% of filing taxpayers in 2012. Do you even know how much taxable income the top 5% represent? Assuming that even a commie like you thinks $176,000 is not too much, let's redistribute all of the income of the top 5% to the bottom 95%. In 2012 136,080,353 tax returns represented a total AGI of $9,041,744 million of which there were 6,804,018 returns making up the top 5% with a total AGI of $3,330,944 million. Let's redistribute all of the top 5% AGI to the 129,276,000 filers representing the bottom 95% that would come to $25,766 AGI per each return. If you redistribute all of the $3,330,944 million of the top 5% AGI to the 68,040,177 of the bottom 50% this would work out to about $49,000 per each return for a total threshold income of about $85,000, which is more than the top 25% (which includes the top 5%) But if you did that just how long do you think that the government would actually collect taxes from the exiting top 5%. HINT: Maybe one year. Then you would be right back to were you started, only in a much worse position. No-one would strive for higher income if the government takes all of it away from them. A simple truth is you get less of what you tax. a href= https://www.nationalpriorities.org/budget-basics/federal-budget- 101/revenues/>Now let's deal with the greedy corporations. Federal Revenue: Where Does the Money Come From "Federal Budget 101 The federal government raises trillions of dollars in tax revenue each year, though a variety of taxes and fees. Some taxes fund specific government programs, while other taxes fund the government in general. When all taxes for a given year are insufficient to cover all of the government's expenses - which has been the case in 45 out of the last 50 years1 - the U.S. Treasury borrows money to make up the difference. In 2015, total federal revenues in fiscal year 2015 are expected to be $3.18 trillion.2 These revenues come from three major sources: 1.Income taxes paid by individuals: $1.48 trillion, or 47% of all tax revenues. 2.Payroll taxes paid jointly by workers and employers: $1.07 trillion, 34% of all tax revenues. 3.Corporate income taxes paid by businesses: $341.7 billion, or 11% of all tax revenues. There are also a handful of other types of taxes, like customs duties and excise taxes that make up much smaller portions of federal revenue. Customs duties are taxes on imports, paid by the importer, while excise taxes are taxes levied on specific goods, like gasoline. This pie chart below shows how much each of these revenue sources is expected to bring in during fiscal year 2015. I remind you that about of the SS taxes are paid by corporation/businesses. How much more taxes do you want U.S. corporations to pay? How much do you think they can pay and stay in business? From who do you think corporations obtain the money to pay taxes, both income and SS?

Increase the Customs Duties on imported goods. That way you won't have to raise corporate income and SS tax.

Increase the Customs Duties on imported goods. That way you won't have to raise corporate income and SS tax. And who do you think actually pays these duties?

The importers pay the duties. Middlemen... traders...

Wrong as wrong can be. Just like all business taxes those duties are in the price of the product sold to the consumer. It is the consumer that pays these taxes. If you really do not understand that just look at how much taxes you are paying in every gallon of gas that you put into your car, it is usually posted on the pump. Then to that add the taxes that the producers, refiners, marketers, distributors, etc. pay in their respective income, SS, medicare, and other taxes that are also in the price of a gallon of gas.

There are no replies to Comment # 27. End Trace Mode for Comment # 27.

Top • Page Up • Full Thread • Page Down • Bottom/LatestThe top 1 percent of taxpayers pay a higher effective income tax rate than any other group (around 23 percent, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50 percent.

#11. To: cranky (#8)

#16. To: SOSO, paraclete, Willie Green, Vicomte13, TooConservative (#11)

Ask the lying commie SOS what percentage of total federal income taxes should the top 10% of income earners pay. 75% 90% 125% 200%

#19. To: A Pole, paraclete, Willie Green, Vicomte13, TooConservative (#16)

There is not reason why the person who is not wealthy should pay for the protection of the privileged.

#22. To: SOSO (#19)

From who do you think corporations obtain the money to pay taxes, both income and SS?

#23. To: Willie Green (#22)

From who do you think corporations obtain the money to pay taxes, both income and SS?

#25. To: SOSO (#23)

And who do you think actually pays these duties?

Domestic manufacturers do not.

Advantage goes to domestic manufacturers and their employees, as well it should.

#27. To: Willie Green (#25)

The importers pay the duties. Middlemen... traders... Domestic manufacturers do not. Advantage goes to domestic manufacturers and their employees, as well it should.

Replies to Comment # 27.

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]