Other

See other Other Articles

Title: 45 percent of Americans pay no federal income tax

Source:

NY Post

URL Source: http://nypost.com/2016/02/24/45-per ... ans-pay-no-federal-income-tax/

Published: Feb 24, 2016

Author: MarketWatch

Post Date: 2016-02-24 19:05:36 by cranky

Keywords: None

Views: 7909

Comments: 28

Many Americans don’t have to worry about giving Uncle Sam part of their hard-earned cash for their income taxes this year. An estimated 45.3 percent of American households — roughly 77.5 million — will pay no federal individual income tax, according to data for the 2015 tax year from the Tax Policy Center, a nonpartisan Washington-based research group. (Note that this does not necessarily mean they won’t owe their states income tax.) Roughly half pay no federal income tax because they have no taxable income, and the other roughly half get enough tax breaks to erase their tax liability, explains Roberton Williams, a senior fellow at the Tax Policy Center. Despite the fact that rich people paying little in the way of income taxes makes plenty of headlines, this is the exception to the rule: The top 1 percent of taxpayers pay a higher effective income tax rate than any other group (around 23 percent, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50 percent. On average, those in the bottom 40 percent of the income spectrum end up getting money from the government. Meanwhile, the richest 20 percent of Americans, by far, pay the most in income taxes, forking over nearly 87 percent of all the income tax collected by Uncle Sam. The top 1 percent of Americans, who have an average income of more than $2.1 million, pay 43.6 percent of all the federal individual income tax in the US; the top 0.1 percent — just 115,000 households, whose average income is more than $9.4 million — pay more than 20 percent of it. When it comes to all federal taxes — individual income, payroll, excise, corporate income and estate taxes — the distributions of who pays what is more spread out. This is partially because nearly everyone pays excise taxes, which include taxes on gasoline, alcohol and cigarettes.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: cranky (#0)

There is no doubt it is a travasty, the rich paying income tax while others pay none. There is a simple solution, abolish all tax breaks, a politically suicide measure, or reform the tax scales. I know it has little relevence but might gtive some perspective, where I live the big political debate of the year has been tax reform, with the suggestion of broad ranging reform but slowly, the options have been whittled away until we are left with changing the rate on superannuation earnings and the amount that may be claimed on comntibutions and some vague provisiosn on rental income which we know will disappear before an election, because it is political suicide to do anything with tax but give a tax break. How lame is changing one step in the rate from $80,000 to $85,000, who earns $85,000 anyway? So you are stuck with the decisions of the past unless you are willing to make structural reform

About 20% of those reporting AGI in 2015 reported $85K or higher. потому что Бог хочет это тот путь

Viddy well, droogies, viddy well and tell me who isn't paying their fair share of federal income taxes. An you can beat that if someone isn't paying Fed income taxes they are not paying any state and city income taxes as well. потому что Бог хочет это тот путь

That's one of the favorite ways the Federal government controls or at least tries to control the behavior of taxpayers. They're not about to give that up. There are three kinds of people in the world: those that can add and those that can't

Social Security

You had better get after those 10% to 1% they are not paying there fair share. It isn't the super rich who are the problem, just those top end earners, doctors and lawyers and CEO and the like

careful now . Romney got destroyed when he was recorded making similar claims . https://www.youtube.com/watch?v=M2gvY2wqI7M "If you do not take an interest in the affairs of your government, then you are doomed to live under the rule of fools." Plato

In the top 10% of tax payers accounted for about 48% of AGI but paid over 70% of the federal income taxes that year, a ratio of Taxes/AGI of 1.46. The top 25% 69% of AGI and 84% of the federal income taxes, a ratio of Taxes/AGI of 1.22 Just look at the charts in the link. The top 10% has consistently paid proportionately more in federal income taxes relative to its income for decades. Those that claim otherwise are just plain full of sh*t. потому что Бог хочет это тот путь

What about them? Cui bene for SS and Medicare payments? The top 10%? 25%? How about the bottom 50%? What group gets paid Medicaid benefits? потому что Бог хочет это тот путь

Ask the lying commie SOS what percentage of total federal income taxes should the top 10% of income earners pay. 75% 90% 125% 200%

потому что Бог хочет это тот путь

They're income taxes, moron.

They're income taxes, moron. And they are also income, moron, income that DOES NOT get counted in AGI for those in the bottom 50%. The Top income group pay these taxes as well but if they receive any benefits from SS it is taxed again at the higher marginal tax rate. Be careful who you call a moron when you present like a mindless, ignorant halfwit. And FYI, the same is true when you include SS and medicare taxes, the top 10% pays a grossly disproportionate amount of Federal taxes with respect to AGI and AGI plus SS and medicare benefits. Do the math, if you can. потому что Бог хочет это тот путь

Plenty of people who pay those income taxes never receive a dime from the programs, liar.

Which one do you expect, idiot? Poor people wouldn't need Medicaid if the rich people didn't get rich by downsizing and outsourcing all the goddam good-paying jobs to Mexico, India and China. If you want to get people off welfare here at home, then you gotta give them jobs that pay enough wages and benefits so they can support themselves.

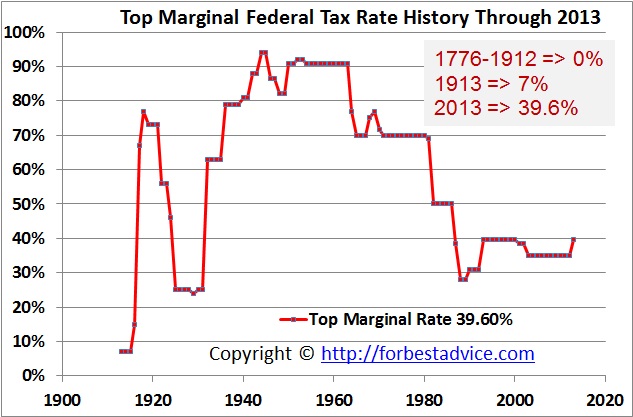

You do not get two facts. 1 Federal Income Tax is only one of several taxes and when it was introduced in early XX century it was indented to be paid by the high income people. 2 Rich people do not need to work and to have income subject to this tax. If the purpose of liberal state ("liberal" in the classic meaning) is to be a night watchman, ie to protect wealth, the fair tax is to tax wealth, not wages of the working class who barely make ends meet. If the rich and their brown-nosing sycophants to not like this idea, let them protect their wealth by their own means. There is not reason why the person who is not wealthy should pay for the protection of the privileged.

Plenty of people who pay those income taxes never receive a dime from the programs, liar. And plenty do. Many people as young as 62 are collecting SS benefit payments and are still working, as are many people over 66 and 70. No lie. Look it up. Again, the higher income groups also pay SS and medicare taxes, the latter being index and subject to a surcharge beginning at relatively low income level. And what BS is it that the higher income group first pays taxes on their SS tax and then pay taxes again at the higher marginal tax rates on 85% of the SS benefits that they receive. Do the math if you are capable and you will find that the top 10% pays far more income, SS and medicare taxes in proportion of their AGI than the bottom 50%. It's not call a progressive tax system for nothing. But let's cut to the chase, are you advocating that those at the 50% and below AGI pay no taxes at all as in none, zip, nada? And exactly what percentage of the total federal tax burden should the top 10% pay? 50%? 75%? 100%, 200%? потому что Бог хочет это тот путь

Plenty of people who pay those income taxes never receive a dime from the programs, liar. Way to go Willie Boy. Another knee jerk mindless leftist response based on nothing but BS propaganda. потому что Бог хочет это тот путь

So people who are below the 10% income bracket receive no protection or any other benefit from the government? Really? And you still don't answer questions. I will modify the first question a little, what percentage of total federal taxes (income, SS, medicare) should the top 10% of income earners pay. 75% 90% 125% 200% Should there be a cap on how much AGI a person/household should be allowed to have? If so, at what amount? Is $176,000 p.a. too much? That was the threshold for the top 5% of filing taxpayers in 2012. Do you even know how much taxable income the top 5% represent? Assuming that even a commie like you thinks $176,000 is not too much, let's redistribute all of the income of the top 5% to the bottom 95%. In 2012 136,080,353 tax returns represented a total AGI of $9,041,744 million of which there were 6,804,018 returns making up the top 5% with a total AGI of $3,330,944 million. Let's redistribute all of the top 5% AGI to the 129,276,000 filers representing the bottom 95% that would come to $25,766 AGI per each return. If you redistribute all of the $3,330,944 million of the top 5% AGI to the 68,040,177 of the bottom 50% this would work out to about $49,000 per each return for a total threshold income of about $85,000, which is more than the top 25% (which includes the top 5%) But if you did that just how long do you think that the government would actually collect taxes from the exiting top 5%. HINT: Maybe one year. Then you would be right back to were you started, only in a much worse position. No-one would strive for higher income if the government takes all of it away from them. A simple truth is you get less of what you tax. a href= https://www.nationalpriorities.org/budget-basics/federal-budget- 101/revenues/>Now let's deal with the greedy corporations. Federal Revenue: Where Does the Money Come From "Federal Budget 101 The federal government raises trillions of dollars in tax revenue each year, though a variety of taxes and fees. Some taxes fund specific government programs, while other taxes fund the government in general. When all taxes for a given year are insufficient to cover all of the government's expenses - which has been the case in 45 out of the last 50 years1 - the U.S. Treasury borrows money to make up the difference. In 2015, total federal revenues in fiscal year 2015 are expected to be $3.18 trillion.2 These revenues come from three major sources: 1.Income taxes paid by individuals: $1.48 trillion, or 47% of all tax revenues. 2.Payroll taxes paid jointly by workers and employers: $1.07 trillion, 34% of all tax revenues. 3.Corporate income taxes paid by businesses: $341.7 billion, or 11% of all tax revenues. There are also a handful of other types of taxes, like customs duties and excise taxes that make up much smaller portions of federal revenue. Customs duties are taxes on imports, paid by the importer, while excise taxes are taxes levied on specific goods, like gasoline. This pie chart below shows how much each of these revenue sources is expected to bring in during fiscal year 2015. I remind you that about of the SS taxes are paid by corporation/businesses. How much more taxes do you want U.S. corporations to pay? How much do you think they can pay and stay in business? From who do you think corporations obtain the money to pay taxes, both income and SS? потому что Бог хочет это тот путь

I repeat, you are not my boss. You are a rude disingenuous bully.

I repeat, you are not my boss. You are a rude disingenuous bully. And you are a lying SOS that can only spew the mindless commie propaganda dictated to you by your handlers. You never have an original thought, much less one that reflects critical thinking. And true to form you continue to weasel away because you can't answer any questions put to you. You are a mindless tool. потому что Бог хочет это тот путь

Increase the Customs Duties on imported goods. That way you won't have to raise corporate income and SS tax.

Increase the Customs Duties on imported goods. That way you won't have to raise corporate income and SS tax. And who do you think actually pays these duties? потому что Бог хочет это тот путь

You are, as a bully, a coward. Learn some manners and logic first.

The importers pay the duties. Middlemen... traders...

Your supporting Trump now I see. Good of you to see Hillary will nnnnnnnnnnnnnnnnnnnnnnnnnnnnever do that.

Wrong as wrong can be. Just like all business taxes those duties are in the price of the product sold to the consumer. It is the consumer that pays these taxes. If you really do not understand that just look at how much taxes you are paying in every gallon of gas that you put into your car, it is usually posted on the pump. Then to that add the taxes that the producers, refiners, marketers, distributors, etc. pay in their respective income, SS, medicare, and other taxes that are also in the price of a gallon of gas. потому что Бог хочет это тот путь

Unlike you, you lying SOS, rude or not I support things that I say with documented references. All you do is spout off you mindless commie talking points given to you by your handlers. You haven't supported a single comment that you have made. And that is because you can't. You are a dickless turd. "Learn some manners and logic first." I do not suffer fools and lying propagandist assholes well. You are just that. потому что Бог хочет это тот путь

#2. To: paraclete (#1)

..... who earns $85,000 anyway?

#3. To: Willie Green, vicomte13, All (#0)

#4. To: paraclete (#1)

abolish all tax breaks

#5. To: cranky (#0)

Medicare

#6. To: SOSO (#3)

#7. To: cranky (#0)

#8. To: cranky (#0)

The top 1 percent of taxpayers pay a higher effective income tax rate than any other group (around 23 percent, according to a report released by the Tax Policy Center in 2014) — nearly seven times higher than those in the bottom 50 percent.

#9. To: All (#3)

#10. To: Roscoe, cranky (#5)

Social Security Medicare

#11. To: cranky (#8)

#12. To: SOSO (#10)

What about them?

#13. To: Roscoe (#12)

What about them?

#14. To: SOSO (#13)

And they are also income

#15. To: SOSO (#10)

What group gets paid Medicaid benefits?

Rich people don't collect Medicaid because they can afford their own insurance.

#16. To: SOSO, paraclete, Willie Green, Vicomte13, TooConservative (#11)

Ask the lying commie SOS what percentage of total federal income taxes should the top 10% of income earners pay. 75% 90% 125% 200%

#17. To: Roscoe (#14)

And they are also income

#18. To: Willie Green (#15)

And they are also income

Any questions?

Any questions?

#19. To: A Pole, paraclete, Willie Green, Vicomte13, TooConservative (#16)

There is not reason why the person who is not wealthy should pay for the protection of the privileged.

#20. To: SOSO (#19)

And you still don't answer questions.

#21. To: A Pole (#20)

And you still don't answer questions.

#22. To: SOSO (#19)

From who do you think corporations obtain the money to pay taxes, both income and SS?

#23. To: Willie Green (#22)

From who do you think corporations obtain the money to pay taxes, both income and SS?

#24. To: SOSO (#21)

And you are a lying SOS that can only spew

#25. To: SOSO (#23)

And who do you think actually pays these duties?

Domestic manufacturers do not.

Advantage goes to domestic manufacturers and their employees, as well it should.

#26. To: Willie Green (#25)

he importers pay the duties. Middlemen... traders... Domestic manufacturers do not. Advantage goes to domestic manufacturers and their employees, as well it should.

#27. To: Willie Green (#25)

The importers pay the duties. Middlemen... traders... Domestic manufacturers do not. Advantage goes to domestic manufacturers and their employees, as well it should.

#28. To: A Pole (#24)

You are, as a bully, a coward.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]