International News

See other International News Articles

Title: ‘Peak Oil’ Debunked, Again

Source:

SOS

URL Source: http://www.wsj.com/articles/peak-oil-debunked-again-1417739810

Published: Jan 13, 2015

Author: WSJ

Post Date: 2015-01-13 19:35:51 by SOSO

Keywords: None

Views: 17053

Comments: 53

‘Peak Oil’ Debunked, Again The world relearns that supply responds to necessity and price. Dec. 4, 2014 7:36 p.m. ET It has been 216 years since Thomas Malthus gave birth to the idea that mankind’s appetite for natural resources would outstrip nature’s capacity to supply them. There have since been regular warnings that the world is running out of soybeans, helium, chocolate, tunsgsten, you name it—and that population growth has become unsustainable. The warnings create a political or social panic for a while, only to be proved wrong. The latest reckoning with reality is the end of the obsession with “peak oil,” which for years had serious people proclaiming that we were entering an era of permanent fossil fuels scarcity. It didn’t work out that way. That’s a central lesson from this year’s dramatic fall in the price of oil, which reached $69.49 a barrel of Brent crude on Thursday from a June high of $112.12. As recently as early November, when oil hovered at $80, OPEC officials warned they would intervene to hold the price at $70. But Saudi officials conspicuously refused to support an output cut at last week’s OPEC meeting, and Saudi oil minister Ali al-Naimi has made clear that he’d be comfortable with lower prices. The short-term Saudi calculation is to drive oil prices down to squeeze their geopolitical adversaries and higher-cost producers. That goes especially for their adversaries across the Persian Gulf in Iran, which depends on oil exports for over 40% of its revenues, and where the regime had designed its budget based on $100 oil. The Saudis also hope to slow the explosive growth of U.S. production, which, thanks to the tapping of domestic shale resources through the combination of horizontal drilling and hydraulic fracturing, has risen to some nine million barrels a day from five million in 2008. By some estimates, the price of oil needs to be as high as $90 a barrel for oil extracted from “tight” deposits such as shale, though oil market research firm IHS believes most tight oil wells have a break-even cost of between $50 and $69 dollars a barrel. But even if the Saudi move slows U.S. drilling, the International Energy Agency forecasts that U.S. production will still surpass Saudi Arabia’s output of 9.7 million barrels a day, and overtake Russia’s 10.3 million, perhaps sometime next year. This would make America the world’s largest oil producer, which it was from the dawn of the oil age through 1974. Thanks to the fracking boom, the U.S. surpassed Russia as the world’s largest natural-gas producer in 2013. All this is a useful reminder, as IHS’s Daniel Yergin told us the other day, that “technology responds to need and to price.” It was the same story in the 1970s, when the world responded to OPEC’s embargoes by exploiting new resources in Alaska and the North Sea, and again in the 1980s and 1990s, when offshore drilling became technologically feasible and economically profitable at ever-greater depths. And expect more from where that came, as the frackers continue to figure out how to drive down costs, and if new shale deposits in places such as Mexico, Ukraine and Argentina start to be exploited. Also worth remembering is how spectacularly wrong some recent predictions of doom turned out to be. This is shooting fish in a barrel, but here is Paul Krugman in December 2010, declaring that “peak oil has arrived.” “What the commodity markets are telling us,” Mr. Krugman averred, “is that we’re living in a finite world, in which the rapid growth of emerging economies is placing pressure on limited supplies of raw materials, pushing up their prices. And America is, for the most part, just a bystander in this story.” Far from being a bystander, America has been the main oil-market innovator. Such doomsaying is that much more embarrassing because warnings of peak oil are nearly as old as the oil industry. In his book “The Quest,” Mr. Yergin records that in 1885 the state geologist of Pennsylvania warned that “the amazing exhibition of oil” was “a temporary and vanishing phenomenon—one which young men will live to see come to its natural end.” Given this 130-year record of predictive failure, why does the end-of-oil myth persist? Part of it is that peak oil is more wish than prediction—a desire to see the end of fossil fuels to serve a larger political agenda. It is also a way of scaring governments into pouring money into alternative energy sources that can’t compete with oil and natural gas without subsidies and mandates. Predicting disaster can also be a profitable business and a path to speech-making celebrity. The happy ending is that the notion that the world is running out of resources always fails because the ingenuity of entrepreneurs, spurred by necessity and incentive, always exceeds the imagination of doomsayers. So we are learning again, and let’s hope memories will be longer this time. Poster's comment - This article is over a month old. Oil is now about $46/bbl. It is worth dusting off as it was probably glossed over during the Holiday season and certainly eclipsed by recent events in France. There should be a new Operaesque reality show, "Where are the Peak Oil Henny Pennies today?" It is amazing how just when Russia needed to be punished the price of oil, Russia's economic lifeblood, falls by 50%. The Lord sure does work in mysterious ways.

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 1.

#1. To: SOSO (#0)

What's really stupid is when you hear the suits saying that nobody can make money selling gas at $2 a gallon when oil is $50 a barrel. As a young man, they were making the big bucks selling me gas at 20 cents a gal, when oil was well under $5.

#3. To: tpaine, SOSO (#1)

Gas was .23 in 1955. http://www.westegg.com/inflation/infl.cgi What cost $.23 in 1955 would cost $1.97 in 2013.

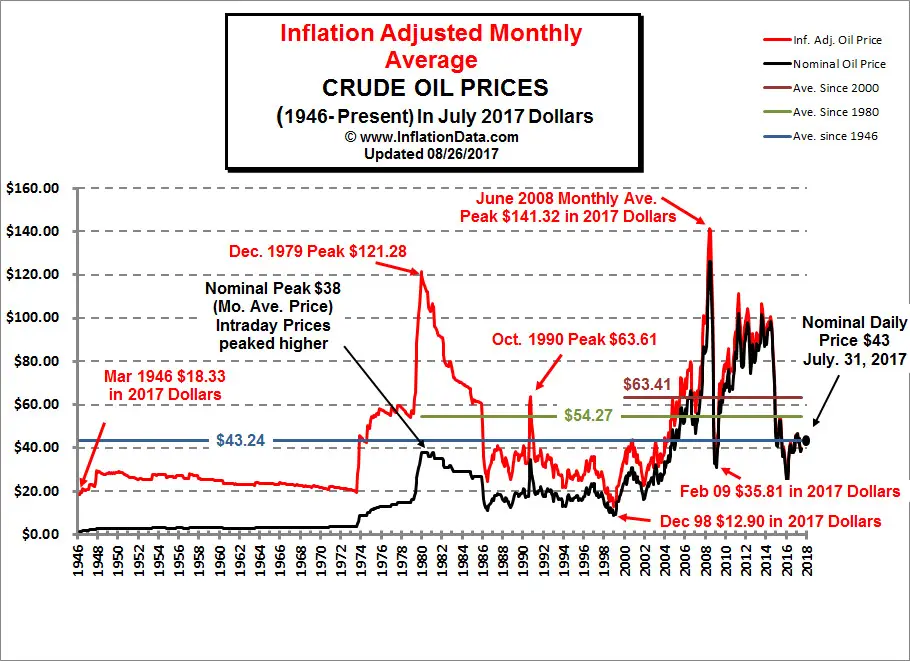

Yep, that was in the days in which the Texas Railroad Commision determined the price of oil. To be more accurate we need to compare the inflation adjusted price of oil then and now as the following chart does. The inflation adjusted price of oil was about $25/bbl in 1948 and it continually declined to about $20/bbl in 1972. You can see what has happened since. The average inflation adjusted price for oil is about $0/bbl, not to far form where it is priced today. Oil stayed below the $40/bbl mark from 1986- 2006. It's been the highest for the longest under Obama's administration. Has the price of oil over the past 40+ years been governed by market forces?

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Replies to Comment # 1. As a young man, they were making the big bucks selling me gas at 20 cents a gal, when oil was well under $5.

#5. To: tpaine (#1)

As a young man, they were making the big bucks selling me gas at 20 cents a gal, when oil was well under $5.

End Trace Mode for Comment # 1.

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]