Economy

See other Economy Articles

Title: Stocks Of Socialized Countries Have Outperformed U.S. Since Reagan Era

Source:

huffingtonpost.com

URL Source: http://www.huffingtonpost.com/2011/ ... countries-reagan_n_882270.html

Published: Jun 22, 2011

Author: Alex Wagner

Post Date: 2011-06-22 22:23:39 by Godwinson

Keywords: None

Views: 46443

Comments: 67

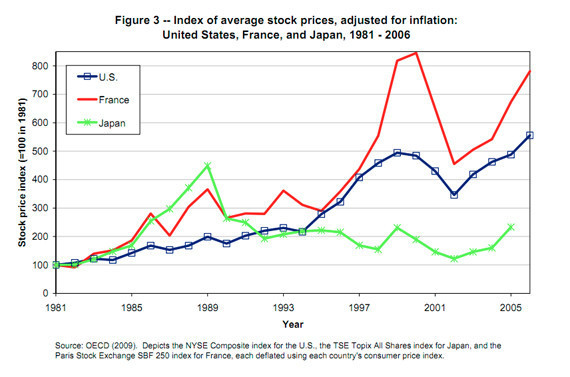

Stocks Of Socialized Countries Have Outperformed U.S. Since Reagan Era Alex Wagner First Posted: 06/22/11 02:49 PM ET Updated: 06/22/11 03:35 PM ET American traders aren't likely to take kindly to the suggestion that big government might be good for the stock market. But data from a paper on the job- and income-growth of top earners shows that stock prices in some socialized countries, relative to themselves and adjusted for inflation, have done considerably better than those in the U.S over the last two and a half decades. Specifically, during the twenty five years after Ronald Reagan took office -- a pro-market honeymoon that Ryan Chittum of the Columbia Journalism Review this week termed "the ascent of laissez-faire economic policies" -- French stock prices have performed significantly better than Americans ones, according to the report by Jon Bakija, Adam Cole, and Bradley Heim. A further examination of the 39-year period extending from the end of the Nixon administration until 2008 shows the Swedish economy, known for its high taxes and heavy regulation, growing at a significantly higher rate than the US. The authors conclude that big government might not actually stand in contradiction to a productive economy: "Countries with typically high levels of government involvement in the economy, such as Sweden, Denmark and Canada, do not appear to have experienced stifled economic growth relative to countries where government involvement is more limited, like the US," the report says. With bastions of socialism -- Sweden Canada and France -- outpacing American market prices, does this mean it's time for Wall Streeters to start calling croissants "Freedom bagels?" Probably not. According to Jacob Funk Kirkegaard, a research fellow specializing in European economies at the Peterson Institute for International Economics, the disparity between the American and European markets might have more to do with the period in question than governmental forces. "In 1981, [Francois] Mitterand was elected president of France, and the first thing he did was to nationalize a bunch of French businesses and most of the banking system," Kirkegaard explained. "But going forward, France has moved quite dramatically towards a market-oriented economy, though not anywhere near the scope of market and economic freedom as perceived in the U.S." If Swedish and French markets have shown considerable strength compared to American ones, Kirkegaard posited that "these countries benefited from a more rapid shift to a market economy than in the U.S. over this period. The starting point was much more hostile. That’s what you see in the growth." That said, Kirkegaard also dismissed the traditional American capitalist contention that socialism is bad for market growth: "A lot of the finger-pointing we do at these countries is totally misleading. It's a myth." Kirkegaard says that many socialized governments provide critical support for business growth, including first class infrastructure built by the public sector, retraining of workers and public education systems that result in better-prepared workforces, comparative to the US. "There are a lot of areas where the role of government is a benefit for the businesses in these countries." "The idea that they are socialists and condemned to living in these bread bin-style housing complexes is illusional," he said. "It's ideological slander." Compare the stocks of Japan, France, and U.S., or get the report here:

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 33.

#2. To: Godwinson, capitalist eric (#0)

(Edited)

Whoever wrote this article is a no-nothing idiot who still thinks that it is the 1970s. According to the Organization for Economic Cooperation and Development, American is the most socialist of any developed country, as measured by the progressivity and anti-business nature of our tax system. America has the most progressive personal income tax system. Sweden's income tax system isn't progressive at all. America also has the highest corporate taxes. Sweden's are in the middle. Look at the table. America soaks the rich, while the top 10% of income earners in Sweden pay the same percentage in taxes that they take in income: American also has the highest corporate tax rates in the world (Japan recently lowered theirs by 5 points), while Sweden's are rather moderate: I've been to Sweden in the last 5 years. It's not the same country that it was in the 1970s. Yes, the government is still too big, but average and lower class people in Sweden pay a larger percentage of the bill than they do in America. The same goes for Canada and Germany. In Germany, people hit the close to the top tax rate at about $50K in income. On the other hand, in America, the bottom 50% of income earners pay no federal income taxes. Instead, our government tries to soak the rich and business (unless they are politically favored businesses who have 8,000 pages of special interest deductions). The results are very clear. America politicians are the true Marxists in the world today.

Of course, the answer to our economic problems is to get rid of most tax deductions and dramatically lower tax rates. This would vastly simplify the tax system and encourage investments in innovation and productive capacity.

What we had for years and it did not work. Doubling down on failure won't work.

I've just posted the numbers from an unbiased international organization. Yet, you still sit here an recite your socialist baloney. What this tells me about you is that the driving the force is your life is not accomplishment, self-improvement, discovery, innovation, or any other positive trait of human nature. The driving force in your life, and that of the entire left, is envy. People like you are nothing more than a cancer that slowly eats away at society until you finally overwhelm it and kill it. You need to be dealt with accordingly, with radical surgery, radiation, and chemo-therapy. We need politicians who have the vision and cajones to kick all of you SOBs off of the government dole once and for all. Only then, will things change for the better.

Anyone citing the US's statutory tax rate is engaging in sophistry.

This bulletin presents new estimates showing that the United States has one of the highest effective tax rates on corporate capital in the world at 36 percent, which compares to an average of just 19.5 percent for 79 other countries studied. http://www.cato.org/pubs/tbb/tbb_1008-50.pdf

If Cato is claiming that then the plain and simple truth is that Cato is wrong. Corporate taxes are paid on a graduated scale, based upon income, up to the highest rate. "on corporate capital " Capital isn't what gets taxed.

Income tax alone doesn't provide a complete picture, just as you are claiming statutory income tax rates don't provide a complete picture.

Wha...huh? This is the cold hard fact...publishing the TOP STAUTORY rate as being representative of the ACTUAL rate at which coporate revenues are taxed is SOPHISTRY.

#34. To: war (#33)

Claiming income tax alone is representative of a corporation's total tax liability is also sophistry.

Top • Page Up • Full Thread • Page Down • Bottom/Latest Country 1. Tax Share of taxes of richest decile 2. Share of market income of richest decile 3. Ratio of tax to income shares for richest decile (1/2) United States 45.1 33.5 1.35 Australia 36.8 28.6 1.29 Netherlands 35.2 27.5 1.28 Ireland 39.1 30.9 1.26 Canada 35.8 29.3 1.22 Finland 32.3 26.9 1.2 United Kingdom 38.6 32.3 1.2 New Zealand 35.9 30.3 1.19 Italy 42.2 35.8 1.18 Czech Republic 34.3 29.4 1.17 Korea 27.4 23.4 1.17 Luxembourg 30.3 26.4 1.15 Slovak Republic 32 28 1.14 OECD-24 31.6 28.4 1.11 Austria 28.5 26.1 1.1 France 28 25.5 1.1 Germany 31.2 29.2 1.07 Denmark 26.2 25.7 1.02 Japan 28.5 28.1 1.01 Sweden 26.7 26.6 1 Norway 27.4 28.9 0.95 Belgium 25.4 27.1 0.94 Iceland 21.6 24 0.9 Switzerland 20.9 23.5 0.89 Poland 28.3 33.9 0.84 Country Combined Central and Provisional Corporate Tax Rate Japan 39.5 United States 39.2 France 34.4 Belgium 34 Germany 30.2 Australia 30 Mexico 30 Spain 30 Luxembourg 28.8 New Zealand 28 Norway 28 Canada 27.6 Italy 27.5 Portugal 26.5 Sweden 26.3 Finland 26 United Kingdom 26 Austria 25 Denmark 25 Netherlands 25 Korea 24.2 Israel 24 Switzerland 21.2 Estonia 21 Chile 20 Greece 20 Iceland 20 Slovenia 20 Turkey 20 Czech Republic 19 Hungary 19 Poland 19 Slovak Republic 19 Ireland 12.5

#3. To: All (#2)

(Edited)

#4. To: jwpegler (#3)

Of course, the answer to our economic problems is to get rid of most tax deductions and dramatically lower tax rates. This would vastly simplify the tax system and encourage investments in innovation and productive capacity.

#10. To: Godwinson (#4)

What we had for years and it did not work.

#12. To: jwpegler (#10)

>

>

#29. To: war (#12)

Anyone citing the US's statutory tax rate is engaging in sophistry.

#30. To: no gnu taxes (#29)

(Edited)

This bulletin presents new estimates showing that the United States has one of the highest effective tax rates on corporate capital in the world at 36 percent, which compares to an average of just 19.5 percent for 79 other countries studied.

#32. To: war (#30)

These tax rates take into account the corporate income tax, sales taxes on capital purchases, and other capital-related taxes.

#33. To: no gnu taxes (#32)

(Edited)

Income tax alone doesn't provide a complete picture, just as you are claiming statutory income tax rates don't provide a complete picture.

Replies to Comment # 33. These tax rates take into account the corporate income tax, sales taxes on capital purchases, and other capital-related taxes.

End Trace Mode for Comment # 33.

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]