Business

See other Business Articles

Title: Are stocks overvalued and overloved?

Source:

[None]

URL Source: http://www.marketoracle.co.uk/Article25448.html

Published: Jan 8, 2011

Author: Anthony_Cherniawski

Post Date: 2011-01-08 16:11:55 by Capitalist Eric

Keywords: None

Views: 2013

Comments: 2

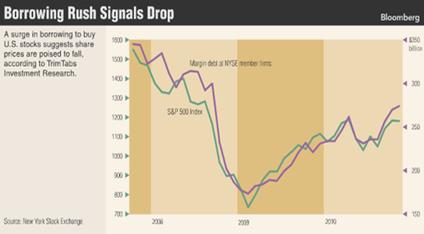

The unemployment rate fell by 0.4 percentage point to 9.4 percent in December, and nonfarm payroll employment increased by 103,000, the U.S. Bureau of Labor Statistics reported today. Employment rose in leisure and hospitality and in health care but was little changed in other major industries. The number of unemployed persons decreased by 556,000 to 14.5 million in December, and the unemployment rate dropped to 9.4 percent. Over the year, these measures were down from 15.2 million and 9.9 percent, respectively. (This is largely due to unemployed workers running out of benefits. It appears that these people are no longer counted in the labor force, leaving as many as 3.91 million unaccounted for and a real unemployment number closer to 11.7%. We must ask our lawmakers to make the BLS account for these people.) U-6 Total unemployed, plus all persons marginally attached to the labor force, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force rose from 16.3% in November to 16.6% in December. The CES Birth/Death Model added 24,000 hypothetical jobs to the payroll numbers. This leaves only 79,000 probable new jobs created in the month of December. Remember, we need 150,000 to 200,000 new jobs just to maintain at the current employment level. Bernanke Sees Slow Drop in Joblessness Even With Growth Gold investors are surprised by the decline. After an Ugly 2010, the Housing Market Won't Look Much Better in 2011 Gasoline Prices Up Five Weeks in a Row. Food Stamp Usage Hits New High Of 43.2 Million (ZeroHedge) One look at the M2 chart (left) shows that the reliquification of the market by the Fed is proceeding according to plan: having increased for 23 of the past 25 weeks, the M2 has hit another all time high in the final week of 2010 at $8,848 billion, a $14 billion weekly increase, and a $316 billion annual increase. Margin Debt Outpaces S&P

(Bloomberg) Federal Reserve Chairman Ben S. Bernanke said the decline in the unemployment rate is likely to be slow even with a pickup in U.S. growth this year, signaling no change in the central bank’s monetary stimulus. Are stocks overvalued and overloved?  -- The Investment Company Institute reported that domestic equity mutual funds received inflows in the last two weeks of December. Municipal bonds are still seeing outflows, while taxable bonds have reversed back into inflows after a serious decline. Last June, Smithers & Co. estimated that the S&P 500 index was 48% overvalued. Recently the firm announced the number is now revised to over 70%. The disconnect between value and price is ever widening.

-- The Investment Company Institute reported that domestic equity mutual funds received inflows in the last two weeks of December. Municipal bonds are still seeing outflows, while taxable bonds have reversed back into inflows after a serious decline. Last June, Smithers & Co. estimated that the S&P 500 index was 48% overvalued. Recently the firm announced the number is now revised to over 70%. The disconnect between value and price is ever widening.

The Long Bond is still in the dumps. --Treasuries declined, heading for their steepest weekly loss in almost a month, as economists said a report will show the U.S. added jobs in December for a third month.

--Treasuries declined, heading for their steepest weekly loss in almost a month, as economists said a report will show the U.S. added jobs in December for a third month.

U.S. bonds have lost investors 3.2 percent since Nov. 5, when the Labor Department announced employment increased in October for the first month in five, according to Merrill Lynch indexes.  --Gold rose for the first time in four days after a report showed U.S. employers added fewer jobs than expected in December, sending the dollar lower and boosting the appeal of the precious metal as an alternative to the currency.

--Gold rose for the first time in four days after a report showed U.S. employers added fewer jobs than expected in December, sending the dollar lower and boosting the appeal of the precious metal as an alternative to the currency.

Gold is still headed for the biggest weekly loss since October as reports this week signaled an improving labor market and expansion in manufacturing and services. Gold advanced 30 percent in 2010 and touched a record last month on concern that a rebound from a global recession would falter. Before today’s jobs report, the metal slipped to a five-week low.

Japan’s Stocks Hang on to a Gain This Week. --Japanese stocks climbed, boosting the Topix index to its best first week in 15 years, as carmakers rose on speculation U.S. demand will expand and employment will improve in the world’s largest economy.

--Japanese stocks climbed, boosting the Topix index to its best first week in 15 years, as carmakers rose on speculation U.S. demand will expand and employment will improve in the world’s largest economy.

The Nikkei 225 Stock Average climbed 0.1 percent to 10,541.04 at the close in Tokyo, after falling as much as 0.3 percent. The broader Topix advanced 0.2 percent to 926.42. The Topix gained 3.1 percent this week, its best yearly start since 1996. The Nikkei also rose 3.1 percent.

The Forecast for China’s Stocks is Bullishhttp://www.marketoracle.co.uk.the Chart is not. -- China’s stocks, the worst-performing among major global equity markets last year, are set to gain as much as 34 percent in 2011 as concerns of interest rate increases have been discounted and valuations are “attractive,”according to Standard & Poor’s. S&P’s year-end forecast for the Shanghai Composite Index is 3,800, according to Lorraine Tan, director of equity research for Asia. That’s a 34 percent gain from today’s close of 2,838.80.

-- China’s stocks, the worst-performing among major global equity markets last year, are set to gain as much as 34 percent in 2011 as concerns of interest rate increases have been discounted and valuations are “attractive,”according to Standard & Poor’s. S&P’s year-end forecast for the Shanghai Composite Index is 3,800, according to Lorraine Tan, director of equity research for Asia. That’s a 34 percent gain from today’s close of 2,838.80.

The Dollar Weathers a Cyclical Pullbackhttp://www.marketoracle.co.uk.and Comes Back for More. -- The dollar headed for its biggest weekly gain since August as evidence of a U.S. economic recovery spurred demand for assets denominated in the greenback.

-- The dollar headed for its biggest weekly gain since August as evidence of a U.S. economic recovery spurred demand for assets denominated in the greenback.

The gauge of the greenback rose today for a fifth consecutive day, increasing 0.3 percent. The index’s weekly rally would be the biggest since an advance of 3.2 percent during the five days ended Aug. 13. That week the Federal Reserve said the economic recovery will be “more modest,”spurring demand for the dollar’s safety.  -- (The Atlantic) Although the housing market looked like it might have been on the road to stabilization in early 2010, the second half of the year dashed those hopes. Ultimately, housing prices ended the year down 4.1%, according to housing industry consulting firm Clear Capital. The company released its 2010 report today, which includes 2011 forecasts. In short, 2011 won't be much better than 2010.

-- (The Atlantic) Although the housing market looked like it might have been on the road to stabilization in early 2010, the second half of the year dashed those hopes. Ultimately, housing prices ended the year down 4.1%, according to housing industry consulting firm Clear Capital. The company released its 2010 report today, which includes 2011 forecasts. In short, 2011 won't be much better than 2010.  --The Energy Information Agency weekly report states, “The U.S. average retail price for a gallon of gasoline increased for the fifth straight week, advancing almost two cents versus last week to $3.07 per gallon, $0.41 per gallon higher than last year at this time. Residential heating oil prices continued to rise during the period ending January 3, 2011... The average residential heating oil price increased by approximately $0.03 per gallon last week to reach $3.34 per gallon, an increase of $0.46 per gallon from the same time last year.”

--The Energy Information Agency weekly report states, “The U.S. average retail price for a gallon of gasoline increased for the fifth straight week, advancing almost two cents versus last week to $3.07 per gallon, $0.41 per gallon higher than last year at this time. Residential heating oil prices continued to rise during the period ending January 3, 2011... The average residential heating oil price increased by approximately $0.03 per gallon last week to reach $3.34 per gallon, an increase of $0.46 per gallon from the same time last year.”

There are Plentiful Supplies of Natural Gas.  -- The U.S. Energy Information Administration reports, “Prices traced out a general uptrend pattern over the past week as predictions for a warmer-than-normal January gave way to expectations of a prolonged arctic blast, followed by yet another forecast for moderating temperatures. However, a backdrop of continuing robust storage served to ameliorate the overall price rise.”

-- The U.S. Energy Information Administration reports, “Prices traced out a general uptrend pattern over the past week as predictions for a warmer-than-normal January gave way to expectations of a prolonged arctic blast, followed by yet another forecast for moderating temperatures. However, a backdrop of continuing robust storage served to ameliorate the overall price rise.”

(ZeroHedge) Ever wonder where all the money for equity inflows came from? Here's the answer: with all the money saved from participating in the Supplemental Nutrition Assistance Program, better known as food stamps, which in October hit a brand new record, 43.2 million Americans decided to join in on this “wealth effect” they had been hearing so much about and buy Apple stock. After all 190 hedge funds are doing it: and there is no way that 190 hedge funds can possibly be wrong. As a result, the chart below shows our nation's pending wealth effect in its full glory. Just think: 43.2 millionaires in waiting. Just consider the guaranteed explosion to money velocityhttp://www.marketoracle.co.uk.

(ZeroHedge) Ever wonder where all the money for equity inflows came from? Here's the answer: with all the money saved from participating in the Supplemental Nutrition Assistance Program, better known as food stamps, which in October hit a brand new record, 43.2 million Americans decided to join in on this “wealth effect” they had been hearing so much about and buy Apple stock. After all 190 hedge funds are doing it: and there is no way that 190 hedge funds can possibly be wrong. As a result, the chart below shows our nation's pending wealth effect in its full glory. Just think: 43.2 millionaires in waiting. Just consider the guaranteed explosion to money velocityhttp://www.marketoracle.co.uk.

M2 Goes Stratospheric As Liquidity Deluge Accelerates

They’re going to need every penny.  (Yelnick) Margin debt - borrowing to buy stocks - has shot ahead of the S&P. It normally follows the index up and down. When margined stock gets ahead of the market, any significant drop is in danger of snowballing as stock is sold to cover the margin. Call it the old fashioned type of Flash Crash, of the sort we saw in 1929 when stock was bought with subprime margin (90% margin on 10% cash), or right after the Lehman debacle when TARP was pronounced (see chart, courtesy PragCap). How the 'bots might handle that we may find out - technicians are all over themselves with expectations of a 5-7% drop as early as tomorrow.

(Yelnick) Margin debt - borrowing to buy stocks - has shot ahead of the S&P. It normally follows the index up and down. When margined stock gets ahead of the market, any significant drop is in danger of snowballing as stock is sold to cover the margin. Call it the old fashioned type of Flash Crash, of the sort we saw in 1929 when stock was bought with subprime margin (90% margin on 10% cash), or right after the Lehman debacle when TARP was pronounced (see chart, courtesy PragCap). How the 'bots might handle that we may find out - technicians are all over themselves with expectations of a 5-7% drop as early as tomorrow.

Ron Paul: “The U.S. Government Must Admit It Is Bankrupt”

(ZeroHedge) Any time you bring the two Pauls together in an interview, and start discussing items such as the debt ceiling, government spending, and monetary policy you know the results will be good. Sure enough, in this rare ABC interview with father and son, the sparks fly, and among the topic touched is the most popular story on Zero Hedge from yesterday, namely President Obama fabulous hypocrisy, who after bashing the debt ceiling as a senator 4 years ago, has bet the outcome of his entire economic policy on maxing out every single credit card available to him.

Food Riots Commence As The Fed's Loose Money Policy Leads To First Violence Of 2011

(ZeroHedge) We were only partially serious when we predicted that following the just released FAO data confirming food prices have just hit an all time high, we were expecting food riots to ensue imminently. Alas, as all too often happens these days, we were right. 2011 first and certainly not last rioting comes out of Algeria, where Bernanke's genocidal policies are first to take root. From the Associated Press: "Riots over rising food prices and chronic unemployment spiraled out from Algeria's capital on Thursday, with youths torching government buildings and shouting “Bring us Sugar!”

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Capitalist Eric (#0)

That was going to be the title of my autobiography and you stold it for your's.

Do you happen to know what used Hummers are going for these days?

“Commonsense Conservatives & lovers of America: "Don't Retreat, Instead - RELOAD!" Pls see my Facebook page.” - Sarah Palin

Overvalued and Overloved

#2. To: Boofer After 5 (#1)

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]