Business

See other Business Articles

Title: U.S. Housing Market Foreclosure-gate Doomsday Revolution Erupts

Source:

[None]

URL Source: http://www.marketoracle.co.uk/Article23629.html

Published: Oct 20, 2010

Author: Chris_Kitze

Post Date: 2010-10-20 17:14:28 by Capitalist Eric

Keywords: None

Views: 6990

Comments: 11

Foreclosure-gate is heating up and the mad scramble for what's left of $45 trillion in real estate is guaranteed to leave homeowners homeless, pension funds unable to pay their pensions and even some of the biggest banks insolvent. A great housing goat rodeo was created when some of the 65 million mortgages on U.S. homes didn't follow proper legal procedures;

- Fraud by homeowners who lied on their loan applications

- Fraud by banks who didn't follow proper legal procedures around the notarization and processing of mortgage documents

- Fraud by investment banks who packaged this junk and resold it to unsuspecting pension funds

- Pension funds promised returns to their pensioners they could never achieve

Lies, lies, lies and more lies. In this jockeying for position, the only thing guaranteed is Leona Helmsley's Law i.e. "Laws and taxes are for the little people". But the little people are starting to fight back in the U.S. and we'll get to that after we do a quick review of the situation at hand and how we got there.

In the old days, that would be pre-1980's, banks and savings and loans actually knew their customers and wrote and maintained loans on property themselves. Something similar to this scene from "It's a Wonderful Life" where George explains to his depositors, who came to withdraw their money, where it all went:

In those days, the corner bank knew the customer, the house, the depositors, they kept the records in a file cabinet at the bank -- it was where you went in to make your payment. Everyone knew that If you didn't keep up with the payments, the banker would foreclose on your property. That part hasn't changed.

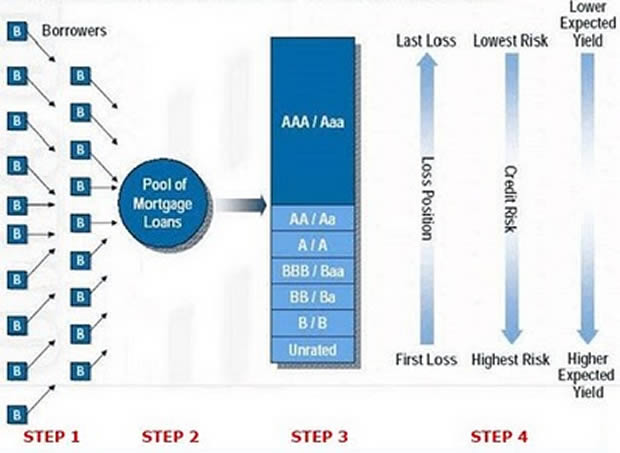

In the 1980's, financial geniuses came up with a new product, a way for the investment banks to make money from a market they couldn't previously tap into in a big way -- the home lending business. As you can imagine, it's a huge market, in the trillions, and the way they approached this market was to convince the originating banks, those who process and write the loans, that they could get more access to cheaper money. This would let them write more loans, generate more fees and make more money by reselling the mortgage. It also eliminated a lot of the risk of the loan, since it was almost immediately resold. But buying an individual mortgage of several hundred thousand dollars wouldn't make sense for the large investors with billions to invest or the investment banks, so they packaged them together in bundles of millions of dollars worth of mortgages.

One problem they had to solve was that many funds have rules on the quality of investment they could invest in; some funds can only invest in AA rated investments or better, others may have more flexibility. The investment banks then carved up these large packages of mortgages into tranches based on the pecking order of who got paid back first and they rated them based on credit score. As an example, the first 20% repaid would be rated AAA, then next 20% might be rated BB and so on. Each tranche represented a claim on the cashflow of the mortgages. The mortgages were supposedly scrutinized and the packaging was complete -- it was called a Mortgage Backed Security (MBS). Here's a little more detail from Wikipedia:

Ginnie Mae guaranteed the first mortgage passthrough security of an approved lender in 1968.[7] In 1971 Freddie Mac issued its first mortgage passthrough, called a participation certificate, composed primarily of private mortgages.[7] In 1981 Fannie Mae issued its first mortgage passthrough, called a mortgage-backed security.[8] In 1983 Freddie Mac issued the first collateralized mortgage obligation.[9]

In 1960 the government enacted the Real Estate Investment Trust Act of 1960 to allow the creation of the real estate investment trust (REIT) to encourage real estate investment. In 1977 Bank of America issued the first private label passthrough,[10] and in 1984 the government passed the Secondary Mortgage Market Enhancement Act (SMMEA) to improve the marketability of such securities.[10] The Tax Reform Act of 1986 allowed the creation of the tax-free Real Estate Mortgage Investment Conduit (REMIC) special purpose vehicle for the express purpose of issuing passthroughs.[11] The Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA) dramatically changed the savings and loan industry and its federal regulation, encouraging loan origination.[12] The Small Business Job Protection Act of 1996 introduced the Financial Asset Securitization Investment Trust(FASIT) that is similar to the REMIC but is able to securitize a wider array of assets.

Today, there are almost $9 trillion worth of mortgage related securities.

Everyone got in a lather when the housing market completely tanked because the value of the MBS plunged.

The ugly reality of the foreclosure market.

There's another very important wrinkle to this story. When the banks resold the mortgages, they didn't just send the paper work to the next bank after George Bailey signed it over to the Cleveland Teacher's Pension Fund. It went into REMICs (the Real Estate Mortgage Investment Conduit). This special entity was set up for tax and accounting reasons and as a vehicle to hold these loans for tax purposes. If a mortgage defaulted, they would need to match the mortgage with the MBS tranche we described above, so they created a system called MERS (the Mortgage Electronic Registration System), which was jointly owned by Fannie Mae and Freddie Mac). This from Doug Ross Journal, a B4IN contributor:

"The purpose of MERS was to help in the securitization process. Basically, MERS directed defaulting mortgages to the appropriate tranches of mortgage bonds... legally [however]...andthis is the important part...MERS didn't hold any mortgage notes: the true owner of the mortgage notes should have been the REMICs.

"But the REMICs didn't own the notes either, because of a fluke of the ratings agencies: the REMICs had to be 'bankruptcy remote,' in order to get the precious ratings needed to peddle mortgage-backed Securities to institutional investors.

"So somewhere between the REMICs and MERS, the chain of title was broken.

"Now, what does 'broken chain of title' mean? Simple: when a homebuyer signs a mortgage, the key document is the note. As I said before, it's the actual IOU. In order for the mortgage note to be sold or transferred to someone else (and therefore turned into a mortgage-backed security), this document has to be physically endorsed to the next person. All of these signatures on the note are called the 'chain of title.'

"You can endorse the note as many times as you please...but you have to have a clear chain of title right on the actual note: I sold the note to Moe, who sold it to Larry, who sold it to Curly, and all our notarized signatures are actually, physically, on the note, one after the other.

"If for whatever reason any of these signatures is skipped, then the chain of title is said to be broken. Therefore, legally, the mortgage note is no longer valid. That is, the person who took out the mortgage loan to pay for the house no longer owes the loan, because he no longer knows whom to pay.

"To repeat: if the chain of title of the note is broken, then the borrower no longer owes any money on the loan.

Foreclosures can only be done by the note-holder, who has the legal standing to show up in court and ask the judge to foreclose and evict. In about half the states, they have to bring the ORIGINAL (not a photocopy or electronic version) document with "wet signature", so the judge can see the actual ink on paper. They have to prove the chain of title and that they own the note they intend to foreclose on.

BECAUSE IF THE CHAIN OF TITLE OF THE NOTE IS BROKEN, THEY WON'T BE ABLE TO FORECLOSE.

Once the people going into foreclosure figure this out, they will stop paying and hire lawyers. Some will keep their homes for free.

Once the people who have been paying their mortgages figure out they might not need to pay, they will stop paying.

Once the lawyers figure this out, they are going to be busy for the next five years helping people sue the banks.

Once the shareholders of the bank stocks figure this out, they will sell the shares.

Once the pension funds figure this out, they will also sue the banks and return their now junk MBS.

Once real estate buyers figure this out, they will stop buying anything with the potential for a tainted chain of title. The foreclosures will stop selling (many already have).

Even the sheriff is figuring this out. What happens when the sheriff refuses to do the foreclosure?

The sheriff for Cook County, Illinois, which includes the city of Chicago, said on Tuesday he will not enforce foreclosure evictions for Bank of America Corp, JPMorgan Chase and Co. and GMAC Mortgage/Ally Financial until they prove those foreclosures were handled “properly and legally.”

and this...

“I can't possibly be expected to evict people from their homes when the banks themselves can't say for sure everything was done properly,” Dart said in the statement.

“I need some kind of assurance that we aren't evicting families based on fraudulent behavior by the banks. Until that happens, I can't in good conscience keep carrying out evictions involving these banks,” he added.

Now that the sheriff won't do the foreclosures, will the banks hire Blackwater (Xe) to breakdown the doors and throw the mortgage deadbeats out on the street.

Today, almost anything is possible, but they have a bigger problem...the middle class is waking up and realizing that all the laws passed by Congress are essentially written by and to protect the monied interests, at their expense. They are starting to fight back...and take the law into their own hands. More from Doug Ross:

"People still haven't figured out what all this means. But I'll tell you: if enough mortgage-paying homeowners realize that they may be able to get out of their mortgage loans and keep their houses, scott-free? That's basically a license to halt payments right now, thank you. That's basically a license to tell the banks to take a hike.

"What are the banks going to do...try to foreclose and then evict you? Show me the paper, Mr. Banker, will be all you need to say.

"This is a major, major crisis. The Lehman bankruptcy could be a spring rain compared to this hurricane. And if this isn't handled right...and handled right quick, in the next couple of weeks at the outside...this crisis could also spell the end of the mortgage business altogether. Of banking altogether. Hell, of civil society. What do you think happens in a country when the citizens realize they don't need to pay their debts?"

Watch this interview for a flavor of what's next - Banks breaking into homes to repo them and homeowners fighting back by taking possession (this is an excellent video):

The money quote (at about 8:50 in the video)...

"Nobody in this country knows for sure who owns any real estate, residential or commercial."

This is just the beginning. Expect to see more people take the law into their own hands and uncertainty of title causing massive damage to the real estate market, the banks and anyone else with their fingers in this tainted pot.

By Chris Kitze (3 images)

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

BECAUSE IF THE CHAIN OF TITLE OF THE NOTE IS BROKEN, THEY WON'T BE ABLE TO FORECLOSE.Once the people going into foreclosure figure this out, they will stop paying and hire lawyers. Some will keep their homes for free.

Hmmm...I wonder if this is and has been planned to be this way . Everyone gets to keep their home and the fucking banks get ANOTHER bailout.

Problem solved.

Clinton and Cuomo are the true bandits who lit the fuse to this economic crisis we're now in. All in the name of getting more minorities in houses: http://libertysflame.com/cgi-bin/readart.cgi?ArtNum=12554

#2. To: Nebuchadnezzar (#1)

If there is no clear title owner, then the house in question cannot legally be owned by anyone. Nothing is free and a house without a title is unowned and unsalable.

Well, [war's] got to do something for attention, his multiple personalities aren't speaking to him any more, and his imaginary friends keep finding excuses not to come over. (Murron)

#3. To: Capitalist Eric, (#0)

In the old days, that would be pre-1980's, banks and savings and loans actually knew their customers and wrote and maintained loans on property themselves.

And I was there. I remember to the day. I had a hedge on copper/lumber.

Ready for either to soar. Instead the Stock Market went thru the roof.

1982. What I didn't know was that Greenspan had authorized the beginning of the $1.5 Quadrillion Fraudulent Debt Derivatives 'Market'.

And that I should've been Frontrunning the Bond Market to Zero % rates.

Oh well, the Next opportunity is always the best one. 8D

See CFTC/Wendy Gramm/Judge/corrupt for details.

#4. To: Nebuchadnezzar (#1)

Hmmm...I wonder if this is and has been planned to be this way . Everyone gets to keep their home and the fucking banks get ANOTHER bailout.Problem solved.

It's a Ponzi, and a Ponzi can never be planned to end in a good way.

Only that the beneficiaries of the Ponzi can get out before everyone else.

Then you have a Depression, then you start a war to cover.

#5. To: All (#4)

And of course, the perps realize that the 'courts' will never prosecute.

See Mozillo, the Orangeman, for details.

#6. To: mcgowanjm (#4)

Then you have a Depression, then you start a war to cover.

Yeah, Jim, I've been hearing "WW3 will get us out of this" for years now.

It ain't going to happen due to MAD.

Clinton and Cuomo are the true bandits who lit the fuse to this economic crisis we're now in. All in the name of getting more minorities in houses: http://libertysflame.com/cgi-bin/readart.cgi?ArtNum=12554

#7. To: Nebuchadnezzar (#6)

It ain't going to happen due to MAD.

WWIII is just a convenient term.

Like WWII never ended. It just devolved into regional conflicts.

IF you take MAD seriously, then you're talking about a devolution to local across the globe.

The lights just go out at the periphery as the new zeitgeist presents itelf.

#8. To: Nebuchadnezzar (#6)

Note how the local sheriff is becoming more important by the day with foreclosures. ;}

#9. To: mcgowanjm (#5)

And of course, the perps realize that the 'courts' will never prosecute.See Mozillo, the Orangeman, for details.

Where did he get that orange complexion from?

#10. To: Fred Mertz (#9)

I'm guessing he got it from this guy . . .

Well, [war's] got to do something for attention, his multiple personalities aren't speaking to him any more, and his imaginary friends keep finding excuses not to come over. (Murron)

#11. To: Fred Mertz (#9)

Where did he get that orange complexion from?

Weird, huh? 8D

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]