Business

See other Business Articles

Title: The Deflation Bogey [Paging Nebuchadnezzar: LEARNING Opportunity For You!]

Source:

marketoracle.com

URL Source: http://www.marketoracle.co.uk/Article21777.html

Published: Aug 10, 2010

Author: William_Anderson

Post Date: 2010-08-10 18:28:17 by Capitalist Eric

Keywords: None

Views: 18190

Comments: 40

The Paul Reveres of the economics profession are riding their horses, warning Americans, "Deflation is coming! Deflation is coming!" From Paul Krugman to Joseph Gagnon to the various mainstream news publications, the message is the same — the government needs to induce inflation now, or else the economy will sink further into the Slew of Despond and unemployment will increase.

A recent U.S. News article declared,

A recent U.S. News article declared,

When the price of cars or sweaters or iPods declines, it's a break for consumers and a welcome sign that economic productivity is improving. That helps drive up living standards. But when the price of everything drops, it's an alarming development that portends stagnation.

The consumer price index, which measures inflation, declines every now and then, usually when there's a big drop in the price of volatile goods like energy or food. But there hasn't been sustained deflation in America since the early 1930s. Now, we may be on the verge of yet another unnerving economic adventure. Inflation over the last 12 months has been a scant 1.1 percent, which is below the level most economists deem optimal. And so far this year, inflation on a monthly basis has been negative as often as it's been positive. The odds are growing that low inflation could become deflation — with some economists worried that it has already started to happen.

The article continues,

Falling prices cut into revenue at firms that build things and provide services, so they need to cut costs to remain profitable. That usually leads to layoffs and pay cuts. When people bring home less money, they invariably feel worse off and buy less. So demand for products falls further, forcing even deeper price cuts to entice consumers. Breaking the cycle becomes a destructive game of chicken between companies and consumers, with neither willing to take the first step.

But it is not just the journalists who are sounding the alarm. Gagnon writes,

it is now apparent that deflation is a more serious risk for the US economy than inflation. The latest data show overall declines in consumer and producer prices. Even after excluding the volatile food and energy components, core inflation has trended well below the 2-percent level that central banks view as optimal for economic growth and that the Fed has adopted as its goal.

Unfortunately, all of these warnings fail to note what Frédéric Bastiat once wrote about what is seen, and what is not seen. All of the antideflation/pro-inflation writings (and that includes everything Paul Krugman currently is putting out) operate solely upon the initial effects both of inflation and deflation. We know that in the early stages of inflation, economic activity picks up, as the boom begins. Later, as Austrian economists have noted time and again, the boom is unsustainable. The earlier economic gains are seen to be illusory as the crisis begins, and ultimately the economy sinks into recession.

The pro-inflation writings of the current class of economic "experts" demonstrate a great misunderstanding of the role of money in the economy. In its most crude form, this view is based upon the belief that an addition of money to an economy is an addition of wealth itself, although I doubt seriously that either Gagnon or Krugman would admit such a thing.

There are some education issues here, the most important being an explanation of what really happens during a period of deflation — the entire period — as opposed to how most economists (especially Keynesians) and journalists, not to mention nearly everyone else, explains it.

The important thing that most people do not understand is that inflation and deflation have a profound effect upon the factors of production. Furthermore, people don't understand that during the course of either an inflationary period or deflationary period, the adjustments of the factors is continuous, not static, and the early stages of either situation are not permanent.

When we think of rising or falling prices, generally we are referring to consumer prices, and certainly they are affected by inflation and deflation. However, that is only part of the equation. Because so much mainstream economic analysis is done either with factor prices as a "given" or done with the assumption that factors are homogeneous, the most important effects of inflation and deflation often are not recognized by "professional" economists or the general public.

Rothbard's Analysis

One economist who did not make the error of overlooking the effects of monetary changes on factors was Murray N. Rothbard, and his classic Man, Economy, and State deals with these issues in great detail. Obviously, a short article like this cannot give justice to all of Rothbard's explanations, so I strongly recommend that you sit down with this book and read it in its entirety.

In this article, however, I will point out why Rothbard's explanations of inflation and deflation are more complete and more accurate than what we see in the mainstream today. First, Rothbard takes on inflation and its effects on the economy. He writes,

Credit expansion has, of course, the same effect as any sort of inflation: prices tend to rise as the money supply increases. Like any inflation, it is a process of redistribution, whereby the inflators, and the part of the economy selling to them, gain at the expense of those who come last in line in the spending process. This is the charm of inflation — for the beneficiaries — and the reason why it has been so popular, particularly since modern banking processes have camouflaged its significance for those losers who are far removed from banking operations. The gains to the inflators are visible and dramatic; the losses to others hidden and unseen, but just as effective for all that. Just as half the economy are taxpayers and half tax-consumers, so half the economy are inflation-payers and the rest inflation-consumers.

Most of these gains and losses will be "short-run" or "one-shot"; they will occur during the process of inflation, but will cease after the new monetary equilibrium is reached. The inflators make their gains, but after the new money supply has been diffused throughout the economy, the inflationary gains and losses are ended.

Indeed, that is precisely why so many people who have benefitted from inflation are likely to call for another round. As the political and monetary authorities continue to inflate, Rothbard notes that the following things happen, things that seemingly are invisible to economists not trained to see inflation's effects upon the factors:

Inflation also changes the market's consumption/investment ratio. Superficially, it seems that credit expansion greatly increases capital, for the new money enters the market as equivalent to new savings for lending. Since the new "bank money" is apparently added to the supply of savings on the credit market, businesses can now borrow at a lower rate of interest; hence inflationary credit expansion seems to offer the ideal escape from time preference, as well as an inexhaustible fount of added capital.

Likewise, this economic activity will seem profitable at first, drawing more firms into an industry. Rothbard continues,

Conversely, there will be a deficiency of investment elsewhere. Thus, the error distorts the market's system of allocating resources and reduces its effectiveness in satisfying the consumer. The error will also be greatest in those firms with a greater proportion of capital equipment to product, and similar distorting effects will take place through excessive investment in heavily "capitalized" industries, offset by underinvestment elsewhere.

At this point, the crisis is inevitable and only can be stopped when the malinvestments themselves are stopped. Unfortunately, as we have seen, people in these industries (especially if they are politically well-connected, as we saw in the General Motors/Chrysler and Wall Street debacles and bailouts) are often able to convince authorities to continue to prop up these malinvestments by taking the resources away from the relatively healthy firms and individuals. In other words, they often are successful in continuing the transfer, not by inflation per se, but by more overt means of direct expropriation of property.

That is where we are today, and we can see the results. However, there really is a cure, even if people like Gagnon and Krugman cannot see it — deflation. Once again, Rothbard's clearheaded analysis leads the way.

First, Rothbard points out that deflation is a secondary development; that is, it comes after the initial malinvestments crises and is an effect, not a cause, of the downturn. He writes,

After the crisis arrives and the depression begins, various secondary developments often occur. In particular, for reasons that will be discussed further below, the crisis is often marked not only by a halt to credit expansion, but by an actual deflation — a contraction in the supply of money. The deflation causes a further decline in prices. Any increase in the demand for money will speed up adjustment to the lower prices. Furthermore, when deflation takes place first on the loan market, i.e., as credit contraction by the banks — and this is almost always the case — this will have the beneficial effect of speeding up the depression-adjustment process.

Most people, including the majority of economists, make their error in the failure to see that the initial effects are not permanent, provided the government and the monetary authorities permit these adjustments to occur. Just as inflation has a very real and harmful effect upon the relative values of factors of production, deflation also has an effect on the factors, but the effect over time is to return those factors to their proper proportional values, according to consumer preferences.

To put it another way, the economy right now needs deflation, yet all of the public voices are shouting that what we really need is for the economy to take another "hair of the dog." Rothbard explains,

Just as inflation is generally popular for its narcotic effect, deflation is always highly unpopular for the opposite reason. The contraction of money is visible; the benefits to those whose buying prices fall first and who lose money last remain hidden. And the illusory accounting losses of deflation make businesses believe that their losses are greater, or profits smaller, than they actually are, and this will aggravate business pessimism.

It is true that deflation takes from one group and gives to another, as does inflation. Yet not only does credit contraction speed recovery and counteract the distortions of the boom, but it also, in a broad sense, takes away from the original coercive gainers and benefits the original coerced losers. While this will certainly not be true in every case, in the broad sense much the same groups will benefit and lose, but in reverse order from that of the redistributive effects of credit expansion. Fixed-income groups, widows and orphans, will gain, and businesses and owners of original factors previously reaping gains from inflation will lose. The longer the inflation has continued, of course, the less the same individuals will be compensated.

Some may object that deflation "causes" unemployment. However, as we have seen above, deflation can lead to continuing unemployment only if the government or the unions keep wage rates above the discounted marginal value products of labor. If wage rates are allowed to fall freely, no continuing unemployment will occur.

However, today's Keynesians (and other so-called free-market mainstream economists) claim that this supposed downward spiral goes on forever, until the economy is mired in long-term depression. Not so, argues Rothbard.

Finally, deflationary credit contraction is, necessarily, severely limited. Whereas credit can expand … virtually to infinity, circulating credit can contract only as far down as the total amount of specie in circulation. In short, its maximum possible limit is the eradication of all previous credit expansion.

In other words, contra the current set of "experts," this economy really needs a strong bout of deflation to eradicate the rest of the malinvestments and to permit the economy to have a real recovery. Unfortunately, we have seen the authorities run the other way, trying to inflate (calling it a "stimulus") and then watching the rates of unemployment increase and confidence decrease.

Right now, the Austrians seem to be the economic version of Cassandra, predicting the future and giving sound advice, only to be rejected by most academic economists and certainly the politicians. Krugman last year demanded that the government "stop the pain" via inflation and dramatic increases in government spending.

Unfortunately, more doses of inflation will not stop the pain, at least any longer, and the more the government inflates and recklessly spends, the worse the pain will be. The very "cure" of inflation will be what makes the economy sicker. However, if we would be willing to experience the real economic pain just a little longer, a real recovery would be around the corner. In fact, had the authorities more than two years ago agreed to stop the foolishness of promoting inflation and malinvestments, we would be in recovery now.

Unfortunately, there is going to be no recovery, at least for a long time. Deflation is the answer, but few are listening. Rothbard understood this fact intimately. Those who reject his wise counsel will live to regret it.

William Anderson, an adjunct scholar of the Mises Institute, teaches economics at Frostburg State University. Send him mail. See William L. Anderson's article archives. Comment on the blog.![]()

© 2010 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors. (2 images)

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

Begin Trace Mode for Comment # 9.

Finally, deflationary credit contraction is, necessarily, severely limited. Whereas credit can expand … virtually to infinity, circulating credit can contract only as far down as the total amount of specie in circulation. In short, its maximum possible limit is the eradication of all previous credit expansion.

You realize that this credit contraction is on-going as we write these words.

This is deflationary. The Fed HAS attempted to re-inflate prices in the housing, CRE and other sectors, but has failed.

Unfortunately, there is going to be no recovery, at least for a long time. Deflation is the answer, but few are listening. Rothbard understood this fact intimately. Those who reject his wise counsel will live to regret it.

I agree with this assessment. Deflation is needed to re-set prices to their free-market level.

#2. To: Nebuchadnezzar (#1)

I agree with this assessment. Deflation is needed to re-set prices to their free-market level.

Sure. But deflation robs power from the elitists. They'll NEVER stand for that...

#3. To: Capitalist Eric (#2)

Sure. But deflation robs power from the elitists. They'll NEVER stand for that...

Hey, at any time you care to stop being a dick-head that would be fine with me. You and I agree with the Austrian's on this problem we have here. I despise Keynesians and the bullshit they spew.

Here is where we disagree: You see hyper-inflation coming and I see a continuance of deflation.

So drop the sanctimonious bullshit, okay?

#5. To: Nebuchadnezzar (#3)

Here is where we disagree: You see hyper-inflation coming and I see a continuance of deflation.

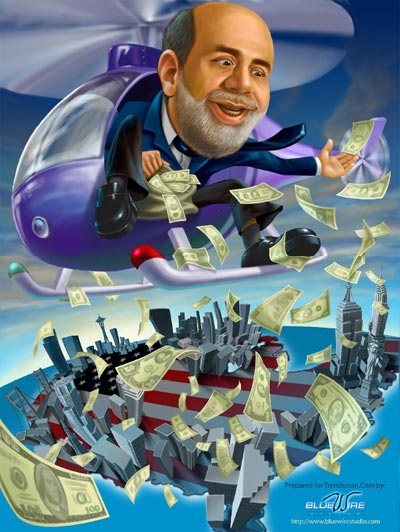

What has this got to do with monetary policy? Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

--Ben S. Bernanke--

Before the National Economists Club, Washington, D.C.

November 21, 2002

#8. To: Capitalist Eric (#5)

Nice pic! But, where is the inflation? Seen what has been happening to housing prices? Commercial Real Estate? Consumer Credit?

Tell me Eric, what direction are these barometers heading?

#9. To: Nebuchadnezzar (#8)

Where are the prices of imported goods going?

And WHY?

Replies to Comment # 9.

Where are the prices of imported goods going?

Like Oil? Shall I start with Oil? Oil is a very important imported good. Tell me, what happened to the price of oil from 7/2008 to 7/2010.

Go on, get back to me little student with your research assignment.

#14. To: Capitalist Eric (#9)

-.1 on the year...+.2 for the last 2...

End Trace Mode for Comment # 9.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]