Business

See other Business Articles

Title: The Deflation Bogey [Paging Nebuchadnezzar: LEARNING Opportunity For You!]

Source:

marketoracle.com

URL Source: http://www.marketoracle.co.uk/Article21777.html

Published: Aug 10, 2010

Author: William_Anderson

Post Date: 2010-08-10 18:28:17 by Capitalist Eric

Keywords: None

Views: 17731

Comments: 40

The Paul Reveres of the economics profession are riding their horses, warning Americans, "Deflation is coming! Deflation is coming!" From Paul Krugman to Joseph Gagnon to the various mainstream news publications, the message is the same — the government needs to induce inflation now, or else the economy will sink further into the Slew of Despond and unemployment will increase. When the price of cars or sweaters or iPods declines, it's a break for consumers and a welcome sign that economic productivity is improving. That helps drive up living standards. But when the price of everything drops, it's an alarming development that portends stagnation. The consumer price index, which measures inflation, declines every now and then, usually when there's a big drop in the price of volatile goods like energy or food. But there hasn't been sustained deflation in America since the early 1930s. Now, we may be on the verge of yet another unnerving economic adventure. Inflation over the last 12 months has been a scant 1.1 percent, which is below the level most economists deem optimal. And so far this year, inflation on a monthly basis has been negative as often as it's been positive. The odds are growing that low inflation could become deflation — with some economists worried that it has already started to happen. The article continues, Falling prices cut into revenue at firms that build things and provide services, so they need to cut costs to remain profitable. That usually leads to layoffs and pay cuts. When people bring home less money, they invariably feel worse off and buy less. So demand for products falls further, forcing even deeper price cuts to entice consumers. Breaking the cycle becomes a destructive game of chicken between companies and consumers, with neither willing to take the first step. But it is not just the journalists who are sounding the alarm. Gagnon writes, it is now apparent that deflation is a more serious risk for the US economy than inflation. The latest data show overall declines in consumer and producer prices. Even after excluding the volatile food and energy components, core inflation has trended well below the 2-percent level that central banks view as optimal for economic growth and that the Fed has adopted as its goal. Unfortunately, all of these warnings fail to note what Frédéric Bastiat once wrote about what is seen, and what is not seen. All of the antideflation/pro-inflation writings (and that includes everything Paul Krugman currently is putting out) operate solely upon the initial effects both of inflation and deflation. We know that in the early stages of inflation, economic activity picks up, as the boom begins. Later, as Austrian economists have noted time and again, the boom is unsustainable. The earlier economic gains are seen to be illusory as the crisis begins, and ultimately the economy sinks into recession. The pro-inflation writings of the current class of economic "experts" demonstrate a great misunderstanding of the role of money in the economy. In its most crude form, this view is based upon the belief that an addition of money to an economy is an addition of wealth itself, although I doubt seriously that either Gagnon or Krugman would admit such a thing. There are some education issues here, the most important being an explanation of what really happens during a period of deflation — the entire period — as opposed to how most economists (especially Keynesians) and journalists, not to mention nearly everyone else, explains it. The important thing that most people do not understand is that inflation and deflation have a profound effect upon the factors of production. Furthermore, people don't understand that during the course of either an inflationary period or deflationary period, the adjustments of the factors is continuous, not static, and the early stages of either situation are not permanent. When we think of rising or falling prices, generally we are referring to consumer prices, and certainly they are affected by inflation and deflation. However, that is only part of the equation. Because so much mainstream economic analysis is done either with factor prices as a "given" or done with the assumption that factors are homogeneous, the most important effects of inflation and deflation often are not recognized by "professional" economists or the general public. One economist who did not make the error of overlooking the effects of monetary changes on factors was Murray N. Rothbard, and his classic Man, Economy, and State deals with these issues in great detail. Obviously, a short article like this cannot give justice to all of Rothbard's explanations, so I strongly recommend that you sit down with this book and read it in its entirety. In this article, however, I will point out why Rothbard's explanations of inflation and deflation are more complete and more accurate than what we see in the mainstream today. First, Rothbard takes on inflation and its effects on the economy. He writes, Credit expansion has, of course, the same effect as any sort of inflation: prices tend to rise as the money supply increases. Like any inflation, it is a process of redistribution, whereby the inflators, and the part of the economy selling to them, gain at the expense of those who come last in line in the spending process. This is the charm of inflation — for the beneficiaries — and the reason why it has been so popular, particularly since modern banking processes have camouflaged its significance for those losers who are far removed from banking operations. The gains to the inflators are visible and dramatic; the losses to others hidden and unseen, but just as effective for all that. Just as half the economy are taxpayers and half tax-consumers, so half the economy are inflation-payers and the rest inflation-consumers. Most of these gains and losses will be "short-run" or "one-shot"; they will occur during the process of inflation, but will cease after the new monetary equilibrium is reached. The inflators make their gains, but after the new money supply has been diffused throughout the economy, the inflationary gains and losses are ended. Indeed, that is precisely why so many people who have benefitted from inflation are likely to call for another round. As the political and monetary authorities continue to inflate, Rothbard notes that the following things happen, things that seemingly are invisible to economists not trained to see inflation's effects upon the factors: Inflation also changes the market's consumption/investment ratio. Superficially, it seems that credit expansion greatly increases capital, for the new money enters the market as equivalent to new savings for lending. Since the new "bank money" is apparently added to the supply of savings on the credit market, businesses can now borrow at a lower rate of interest; hence inflationary credit expansion seems to offer the ideal escape from time preference, as well as an inexhaustible fount of added capital. Likewise, this economic activity will seem profitable at first, drawing more firms into an industry. Rothbard continues, Conversely, there will be a deficiency of investment elsewhere. Thus, the error distorts the market's system of allocating resources and reduces its effectiveness in satisfying the consumer. The error will also be greatest in those firms with a greater proportion of capital equipment to product, and similar distorting effects will take place through excessive investment in heavily "capitalized" industries, offset by underinvestment elsewhere. At this point, the crisis is inevitable and only can be stopped when the malinvestments themselves are stopped. Unfortunately, as we have seen, people in these industries (especially if they are politically well-connected, as we saw in the General Motors/Chrysler and Wall Street debacles and bailouts) are often able to convince authorities to continue to prop up these malinvestments by taking the resources away from the relatively healthy firms and individuals. In other words, they often are successful in continuing the transfer, not by inflation per se, but by more overt means of direct expropriation of property. That is where we are today, and we can see the results. However, there really is a cure, even if people like Gagnon and Krugman cannot see it — deflation. Once again, Rothbard's clearheaded analysis leads the way. First, Rothbard points out that deflation is a secondary development; that is, it comes after the initial malinvestments crises and is an effect, not a cause, of the downturn. He writes, After the crisis arrives and the depression begins, various secondary developments often occur. In particular, for reasons that will be discussed further below, the crisis is often marked not only by a halt to credit expansion, but by an actual deflation — a contraction in the supply of money. The deflation causes a further decline in prices. Any increase in the demand for money will speed up adjustment to the lower prices. Furthermore, when deflation takes place first on the loan market, i.e., as credit contraction by the banks — and this is almost always the case — this will have the beneficial effect of speeding up the depression-adjustment process. Most people, including the majority of economists, make their error in the failure to see that the initial effects are not permanent, provided the government and the monetary authorities permit these adjustments to occur. Just as inflation has a very real and harmful effect upon the relative values of factors of production, deflation also has an effect on the factors, but the effect over time is to return those factors to their proper proportional values, according to consumer preferences. To put it another way, the economy right now needs deflation, yet all of the public voices are shouting that what we really need is for the economy to take another "hair of the dog." Rothbard explains, Just as inflation is generally popular for its narcotic effect, deflation is always highly unpopular for the opposite reason. The contraction of money is visible; the benefits to those whose buying prices fall first and who lose money last remain hidden. And the illusory accounting losses of deflation make businesses believe that their losses are greater, or profits smaller, than they actually are, and this will aggravate business pessimism. It is true that deflation takes from one group and gives to another, as does inflation. Yet not only does credit contraction speed recovery and counteract the distortions of the boom, but it also, in a broad sense, takes away from the original coercive gainers and benefits the original coerced losers. While this will certainly not be true in every case, in the broad sense much the same groups will benefit and lose, but in reverse order from that of the redistributive effects of credit expansion. Fixed-income groups, widows and orphans, will gain, and businesses and owners of original factors previously reaping gains from inflation will lose. The longer the inflation has continued, of course, the less the same individuals will be compensated. Some may object that deflation "causes" unemployment. However, as we have seen above, deflation can lead to continuing unemployment only if the government or the unions keep wage rates above the discounted marginal value products of labor. If wage rates are allowed to fall freely, no continuing unemployment will occur. However, today's Keynesians (and other so-called free-market mainstream economists) claim that this supposed downward spiral goes on forever, until the economy is mired in long-term depression. Not so, argues Rothbard. Finally, deflationary credit contraction is, necessarily, severely limited. Whereas credit can expand … virtually to infinity, circulating credit can contract only as far down as the total amount of specie in circulation. In short, its maximum possible limit is the eradication of all previous credit expansion. In other words, contra the current set of "experts," this economy really needs a strong bout of deflation to eradicate the rest of the malinvestments and to permit the economy to have a real recovery. Unfortunately, we have seen the authorities run the other way, trying to inflate (calling it a "stimulus") and then watching the rates of unemployment increase and confidence decrease. Right now, the Austrians seem to be the economic version of Cassandra, predicting the future and giving sound advice, only to be rejected by most academic economists and certainly the politicians. Krugman last year demanded that the government "stop the pain" via inflation and dramatic increases in government spending. Unfortunately, more doses of inflation will not stop the pain, at least any longer, and the more the government inflates and recklessly spends, the worse the pain will be. The very "cure" of inflation will be what makes the economy sicker. However, if we would be willing to experience the real economic pain just a little longer, a real recovery would be around the corner. In fact, had the authorities more than two years ago agreed to stop the foolishness of promoting inflation and malinvestments, we would be in recovery now. Unfortunately, there is going to be no recovery, at least for a long time. Deflation is the answer, but few are listening. Rothbard understood this fact intimately. Those who reject his wise counsel will live to regret it. William Anderson, an adjunct scholar of the Mises Institute, teaches economics at Frostburg State University. Send him mail. See William L. Anderson's article archives. Comment on the blog. © 2010 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

A recent U.S. News article declared,

A recent U.S. News article declared, Rothbard's Analysis

![]()

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: Capitalist Eric (#0)

You realize that this credit contraction is on-going as we write these words. This is deflationary. The Fed HAS attempted to re-inflate prices in the housing, CRE and other sectors, but has failed. Unfortunately, there is going to be no recovery, at least for a long time. Deflation is the answer, but few are listening. Rothbard understood this fact intimately. Those who reject his wise counsel will live to regret it. I agree with this assessment. Deflation is needed to re-set prices to their free-market level.

Being a Democratic shill means you check your humanity at the door.

Sure. But deflation robs power from the elitists. They'll NEVER stand for that...

Hey, at any time you care to stop being a dick-head that would be fine with me. You and I agree with the Austrian's on this problem we have here. I despise Keynesians and the bullshit they spew. Here is where we disagree: You see hyper-inflation coming and I see a continuance of deflation. So drop the sanctimonious bullshit, okay?

Being a Democratic shill means you check your humanity at the door.

If pointing out FACTS which you seem blithely unaware of makes me a "dick- head," then fine. Better that, then spout lies to you. You don't seem to understand where I'm coming from, so I'll spell it out... I'm trying to put the information out there, TELL people what's coming, so they can be aware, or (better yet) research it for themselves. I don't give a shit if you prefer I be sweet and nice... the TRUTH is not sweet, it's not nice, and if people don't get their collective heads out of the asses, we're gonna' go Cro-Magnon as we fight the Socialist/Fascist government and their thugs, or on each other, while we're fighting for crumbs of bread, and a few drops of water... If you think that's too harsh for your frail sensibilities, then let me say, "too bad." You think I'm wrong. FINE. PROVE ME WRONG. I look at economics- micro and macro... and while Austrian theory is all well and good (at the consumer level), the reality is that the economy is commanded by an elitist set of modern-day carpet-baggers. And they don't care about the "aggregate good," they care only about how best to fill their own pockets, and increase their own power. They'll piss on the little guy, ALL day, because they don't give a shit about the little guy... We can talk about policies all day, it doesn't mean squat. The elitists will do what they want, WHEN they want it... Because it's all about what they want, and nothing else matters... Rig the game? Fine. Bankrupt the country? Fine. Crush the economy? Fine. They're motto is simple: What's in in for me? Hey, dummy... The Keynesians are IN CHARGE, right now... If you know what this means, You KNOW what the Keynesians are going to do, as the collapse goes on...

What has this got to do with monetary policy? Like gold, U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.

If you think that's too harsh for your frail sensibilities, then let me say, "too bad." You think I'm wrong. FINE. PROVE ME WRONG. I look at economics- micro and macro... and while Austrian theory is all well and good (at the consumer level), the reality is that the economy is commanded by an elitist set of modern-day carpet-baggers. And they don't care about the "aggregate good," they care only about how best to fill their own pockets, and increase their own power. They'll piss on the little guy, ALL day, because they don't give a shit about the little guy... Like I said, we agree on 98% of the things we discuss here. But you're still and always will be a dick-head.

Being a Democratic shill means you check your humanity at the door.

Awwwwww... ((((sniff))))) LMAO!

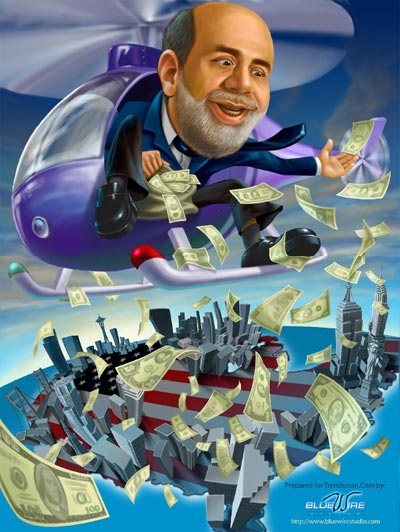

Nice pic! But, where is the inflation? Seen what has been happening to housing prices? Commercial Real Estate? Consumer Credit? Tell me Eric, what direction are these barometers heading?

Being a Democratic shill means you check your humanity at the door.

Where are the prices of imported goods going? And WHY?

Like Oil? Shall I start with Oil? Oil is a very important imported good. Tell me, what happened to the price of oil from 7/2008 to 7/2010. Go on, get back to me little student with your research assignment.

Being a Democratic shill means you check your humanity at the door.

The "peak oil" scam was manipulation to capture excessive profits. Nice try. As to research, maybe you should try it. You'd look less the fool.

Nice try. As to research, maybe you should try it. You'd look less the fool. What's a matter? I destroy your hypothesis and you fail to counter the oil claim. Go on, you claim imported products are going up. Fine, I asked about oil and you failed to respond to the counter. Let's try again, or you can just admit you were wrong. What about the price of oil. Has it gone up or down?

Being a Democratic shill means you check your humanity at the door.

The only thing you've destroyed, is any remaining vestiges of credibility you might have had, with regard to finance, economics or reality. You said we agree on 98% of things. I think that's correct. On the other 2%?

-.1 on the year...+.2 for the last 2...

Deflation is already here...

It's no use talking to him. He's a Ron Paul Gold-bug.

Being a Democratic shill means you check your humanity at the door.

Read How Deflation Creates Hyper-inflation, and then get back to me. Get educated, boy... Then maybe you'll be able to talk with the adults.

Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

Here is from YOUR link: Deflation CAN create Hyperinflation Note the emphsis on the work "CAN". The Fed has been trying it's best to creat inflation, but has failed in a breathtaking fashion. Please note, I'm ruling out the possibility of hyper-inflation in about 4 or 5 years, I just don't see it happening as: A. People right now aren't spending money. Demand is way down. They are paying off debts. This is deflationary. B. You need a mechanism to get all those dollars into the system and if people are not working (U-6) or afraid of losing their jobs they just won't buy homes, cars, etc. And drop the attitude, okay?

Being a Democratic shill means you check your humanity at the door.

LOL. Not surprised, that you would look for a single sentence, to cherry-pick out of the article, and then twisted to match your ignorance. I have a lot of engineers do that, and they always end up looking the fool, with such petty tactics. So, once again, important information is handed to you on a silver platter... And you failed to READ it. From the article: Yes, there is debt deflation, and the overall money supply is shrinking as a result. However, those calling for "multi-year bull market" for the US dollar are insane. These individuals need to review basic monetary theory. The money supply is only one of three factors that determine whether prices rise or fall. The other two are the changes in the velocity of money and the real output of the economy. The danger of hyperinflation lies in a dramatic increase in the velocity of money due to a loss of confidence, not in changes in the money supply. 1) Deflation slows the speed of money to crawl due to fears about the deteriorating economy. The public hoards cash, or, in the case of the US, short term treasuries. 2) The slowing speed of money and debt destruction force the government to create huge quantities of cash to prevent prices and the economy from collapsing. However, because the public is hoarding cash (or short term treasuries), most of the money doesn't reach the real economy, which leads the central bank to print even more money. In essence, cash hoarding acts as a dam, preventing the enormous quantities of printed money from affecting prices. 3) Deflation weakens economy until it leads to a loss of confidence. With doubts about the government's solvency growing, the velocity of money quickly picks up speed, and a flood of hoarded cash comes out of hiding, entering the marketplace all at once and creating hyperinflation. Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

Okay, tell me, when does the hyper-inflation hit?

Being a Democratic shill means you check your humanity at the door.

He won't answer...in his usually circular fashion he'll tell you to read the article and then you'll know. But when you actually read the article and point out how it's long on bullshit and short on anything remotely empirical, he'll claim that you didn't read it and declare victory.

Nope. Deflation causes prices to fall. An economy in which spending slows, is one in which VELOCITY or the speed of money, i.e, how many times a dollar changes hands, slows. Velocity can slow during periods of hyperinflation because people stop spending because they cannot afford anything.

Agreed. You and I disagree on about 90% of the issues, but at least you give a fair and interesting fight. Kudos to you evil War.

Being a Democratic shill means you check your humanity at the door.

Kudos to you evil Neb...

That you disagree with war 90% of the time, indicates you have some scintilla of intellect. Unfortunately, that last 10% is where you can't discern that he's still bullshitting you. Nobody can predict exactly when hyper-inflation will hit. Trying to predict that, has as much reliability as weather predictions. The further out you get, the harder it is to make any meaningful guess. And frankly, once it starts, you'll need a prediction of the exact time, as much as you'll need a weatherman, to tell you it's raining (when you can look out your front window). --Nod to Bob Dylan-- Like yukko the flaccid little clown, war spouts off about what other people do, when he is in fact guilty of the sophmoric attempts to evade and dodge, that he accuses other of. The bit about the "circular argument" is a classic tactic of war. war bullshits people, because that's his purpose. Any argument that stands for American values (outside D.C.), advocates upholding the law and punishing the sick bastards that run our country, war will be there, spouting shit, lying his ass off, and generally attempting to be the biggest turd in the toilet. He gets off on mind-fucking people like you. He's a useless little shit. If you don't get that yet, then that last 10% is going to be painful for you to learn.

Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

Unfortunately, that last 10% is where you can't discern that he's still bullshitting you. Nobody can predict exactly when hyper-inflation will hit. Trying to predict that, has as much reliability as weather predictions. The further out you get, the harder it is to make any meaningful guess. And frankly, once it starts, you'll need a prediction of the exact time, as much as you'll need a weatherman, to tell you it's raining (when you can look out your front window). --Nod to Bob Dylan-- Like yukko the flaccid little clown, war spouts off about what other people do, when he is in fact guilty of the sophmoric attempts to evade and dodge, that he accuses other of. The bit about the "circular argument" is a classic tactic of war. war bullshits people, because that's his purpose. Any argument that stands for American values (outside D.C.), advocates upholding the law and punishing the sick bastards that run our country, war will be there, spouting shit, lying his ass off, and generally attempting to be the biggest turd in the toilet. He gets off on mind-fucking people like you. He's a useless little shit. If you don't get that yet, then that last 10% is going to be painful for you to learn. At least War can answer a direct question.

Being a Democratic shill means you check your humanity at the door.

Notice he responded exactly as I predicted and he didn't even have the balls to PING me.

Yes, he's very immature, and I suspect has some mental issues. I'm through with him. If he can't answer a direct question I won't waste any more time with him.

Being a Democratic shill means you check your humanity at the door.

Velocity can slow during periods of hyperinflation because people stop spending because they cannot afford anything. Jeez... Like a good liar, you take a grain of truth, and manipulate it around, so that it seems reasonable, to those who don't know better... You are the B.S. artist of the forum... But thanks for the laughs. And now that cookies are set (again), buh-BYE. LOL.

Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

I've answered your question. If the answer is too adult for you, how is that MY problem?

Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

Chuckles...of course it would be too much for yo to provide a) where I did bullshit...b) where I did lie and c) where I did manipulate around. FACT: Velocity is the speed of money and is a phenomena dependent purchasing and not the value of it. FACT: Deflation is falling prices. Feel free to disupute either of those facts.

Bullshit.

If the answer is too adult for you, how is that MY problem? Bullshit. All you do is link to long, boring Gold321.com articles. Apparently you're incapable of articulating your opinions and have them make sense.

Being a Democratic shill means you check your humanity at the door.

Interesting read guys.

That's funny! You know, I work with a lot of people from different walks of life... secretaries to VPs, engineers to interning students... It varies with the day, sometimes even with the time of day... And the funny thing that always happens, is that when I start to explain something to them, I go to the drawing board (dry-erase, usually). Use diagrams, write equations, draw graphs that show the results, without dulling the senses by too much detail. The most bizarre thing happened a couple of weeks ago... A civil engineer and a construction manager asked my opinion on a particular system- they felt they were being fed a load of BS by a vendor, who wanted to sell them new stuff (in my area of expertise), so they asked for my analysis, from the perspectives of financial risks/benefits, efficiencies and reliability. I'd started making some quick sketches, as I dove into the facet of the marginal increase in efficiency (such numbers sound good, but rarely have a positive payback in the real world). So I'm talking, writing putting up some quick graphs... I turn around, and both the engineer and manager had pulled up chairs, sat down, and were watching very carefully... I started laughing, because it seemed so... strange. The manager said, "we like the way you give the information, because we always learn cool new stuff..." LOL. After about 15 minutes, while they didn't understand the underlying theory that makes the systems work, they had enough knowledge to go back to the vendor, ask some key questions... And decide we'd reuse the old systems, because they are more cost-effective. Point of all of this is, I end up being an ad-hoc instructor/teacher for a lot of people, and have been told I should be a professor at the local university (still kicking that around- I haven't decided). To sum it up... I must make the assumption that you have the ability to think rationally, logically. I make comments and point out information to you, in the same way that I do everyone else... Nobody EVER tells me it's too complicated, or that I'm full of crap, because I back up everything I say with plenty of documentation or first-hand evidence. Again: If the answer is too adult for you, that's not my problem, but yours. Your refusal to learn, or admit when you've been bested, again, is an indication of immaturity, which is also not my problem. You've got a LOT to learn... and not much time to learn it. The situation is going to spiral rapidly out of hand, and you'd best be prepared for it... Those that aren't prepared, are in for some very harsh life-lessons. I truly wish you well, in spite of your behavior. May you come through the storm intact. Regards,

Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

You remind me of a guy here at work. He's always at the forefront of introducing what we do and how we do it to the new people or customers. He goes on and on captivating people with his knowledge and dazzling style. People are grateful for him telling them how things work in a method that they understand. I usually go up to them about halfway through and quietly tell them that when he's done I'll fill them in on how things really work. Eventually people see the guy is full of shit, that he just likes to babble and impress people. They appreciate me giving them the real info and then regret the time they wasted listening to him. Ya, you remind me of that guy, lol

"Were you ever in the music or song writing business?" ... e_type_jagoff to Mudboy lol ..... AND ....... "But his decent into vile absurdity is still actually kind of sad and pitiful really" .... mad doggie

Ya, you remind me of that guy, lol Best lines you've written on LF. Eric is full of shit.

Being a Democratic shill means you check your humanity at the door.

Eric is full of shit. LOL. Two "like minds," eh? MUNCH, MUNCH, MUNCH... LOLZ.

Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

I usually go up to them about halfway through and quietly tell them that when he's done I'll fill them in on how things really work. Eventually people see the guy is full of shit, that he just likes to babble and impress people. They appreciate me giving them the real info and then regret the time they wasted listening to him. Ya, you remind me of that guy, lol Since you don't know shit about what I do, and you have no idea who I am, your opinion doesn't mean diddley-shit. I'm the guy who comes up with solutions, when your 50 engineers- who know "how things really work"- have fucked up the job, and it's gotta be fixed... People like you never appreciate or care about people like me... Until you NEED me. But I doubt you'll ever be high enough on the food chain to run across me. I'm sure that makes us both happy, since I already have enough idiots to clean up after.

Democrats vs Republicans: The false paradigm of American politics People continue to believe in fallacies like the left-right paradigm because they are inclined for some reason- to make decisions based on their feelings, rather than objective logic or rational thought unfortunately.

Well, why not tell us what you do do?

Being a Democratic shill means you check your humanity at the door.

Finally, deflationary credit contraction is, necessarily, severely limited. Whereas credit can expand … virtually to infinity, circulating credit can contract only as far down as the total amount of specie in circulation. In short, its maximum possible limit is the eradication of all previous credit expansion.

#2. To: Nebuchadnezzar (#1)

I agree with this assessment. Deflation is needed to re-set prices to their free-market level.

#3. To: Capitalist Eric (#2)

Sure. But deflation robs power from the elitists. They'll NEVER stand for that...

#4. To: Nebuchadnezzar (#3)

Hey, at any time you care to stop being a dick-head that would be fine with me.

You and I agree with the Austrian's on this problem we have here. I despise Keynesians and the bullshit they spew.

So drop the sanctimonious bullshit, okay?

Psychologists call that "projection." Something else for you to research...

#5. To: Nebuchadnezzar (#3)

Here is where we disagree: You see hyper-inflation coming and I see a continuance of deflation.

--Ben S. Bernanke--

Before the National Economists Club, Washington, D.C.

November 21, 2002

#6. To: Capitalist Eric (#4)

You don't seem to understand where I'm coming from, so I'll spell it out... I'm trying to put the information out there, TELL people what's coming, so they can be aware, or (better yet) research it for themselves. I don't give a shit if you prefer I be sweet and nice... the TRUTH is not sweet, it's not nice, and if people don't get their collective heads out of the asses, we're gonna' go Cro-Magnon as we fight the Socialist/Fascist government and their thugs, or on each other, while we're fighting for crumbs of bread, and a few drops of water...

#7. To: Nebuchadnezzar (#6)

#8. To: Capitalist Eric (#5)

#9. To: Nebuchadnezzar (#8)

#10. To: Capitalist Eric (#9)

Where are the prices of imported goods going?

#11. To: Nebuchadnezzar (#10)

#12. To: Capitalist Eric (#11)

he "peak oil" scam was manipulation to capture excessive profits.

#13. To: Nebuchadnezzar (#12)

I destroy your hypothesis and you fail to counter the oil claim.

#14. To: Capitalist Eric (#9)

#15. To: Capitalist Eric (#0)

The Paul Reveres of the economics profession are riding their horses, warning Americans, "Deflation is coming! Deflation is coming!"

#16. To: war (#15)

Deflation is already here...

#17. To: Nebuchadnezzar (#16)

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#18. To: Capitalist Eric (#17)

#19. To: Nebuchadnezzar (#18)

Note the emphsis on the work "CAN". The Fed has been trying it's best to creat inflation, but has failed in a breathtaking fashion.

Deflation Vs Hyperinflation

It is no accident that many of the worst periods of hyperinflation are preceded by deflation. In fiat currencies with high levels of government debt, severe cases of deflation cause a loss of confidence in the nation's currency by shrinking the economy and making the government's debt appear increasingly unsustainable. The loss of confidence then causes the flow of money to speed up as individuals become desperate to exchange cash for real goods as fast as possible, producing hyperinflation.

How deflation creates hyperinflation

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#20. To: Capitalist Eric (#19)

Not surprised, that you would look for a single sentence, to cherry-pick out of the article, and then twisted to match your ignorance. I have a lot of engineers do that, and they always end up looking the fool, with such petty tactics.

#21. To: Nebuchadnezzar (#20)

#22. To: Capitalist Eric (#19)

Deflation slows the speed of money to crawl due to fears about the deteriorating economy.

#23. To: war (#21)

He won't answer...in his usually circular fashion he'll tell you to read the article and then you'll know. But when you actually read the article and point out how it's long on bullshit and short on anything remotely empirical, he'll claim that you didn't read it and declare victory.

#24. To: Nebuchadnezzar (#23)

#25. To: Nebuchadnezzar (#23)

Agreed. You and I disagree on about 90% of the issues, but at least you give a fair and interesting fight.

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#26. To: Capitalist Eric (#25)

That you disagree with war 90% of the time, indicates you have some scintilla of intellect.

#27. To: Nebuchadnezzar (#26)

(Edited)

#28. To: war (#27)

Notice he responded exactly as I predicted and he didn't even have the balls to PING me.

#29. To: war (#22)

Nope. Deflation causes prices to fall. An economy in which spending slows, is one in which VELOCITY or the speed of money, i.e, how many times a dollar changes hands, slows.

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#30. To: Nebuchadnezzar (#26)

At least War can answer a direct question.

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#31. To: Capitalist Eric (#29)

Like a good liar, you take a grain of truth, and manipulate it around, so that it seems reasonable, to those who don't know better... You are the B.S. artist of the forum...

#32. To: Capitalist Eric (#30)

I've answered your question.

#33. To: Capitalist Eric (#30)

I've answered your question.

#34. To: Nebuchadnezzar, Capitalist Eric, war (#33)

#35. To: Nebuchadnezzar (#33)

Apparently you're incapable of articulating your opinions and have them make sense.

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#36. To: Capitalist Eric (#35)

#37. To: Abu el Banat (#36)

Eventually people see the guy is full of shit, that he just likes to babble and impress people. They appreciate me giving them the real info and then regret the time they wasted listening to him.

#38. To: Nebuchadnezzar, Abu el Banat (#37)

Best lines you've written on LF.

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#39. To: Abu el Banat (#36)

You remind me of a guy here at work. He's always at the forefront of introducing what we do and how we do it to the new people or customers. He goes on and on captivating people with his knowledge and dazzling style. People are grateful for him telling them how things work in a method that they understand.

What paradigm? That is the type of response one would receive from the average voter in the United States today. It reflects the clandestine ignorance of the majority of the populace today. So the question becomes, why does the population continue to believe in the so called, left-right paradigm?

#40. To: Capitalist Eric (#39)

Since you don't know shit about what I do, and you have no idea who I am, your opinion doesn't mean diddley-shit.

Top • Page Up • Full Thread • Page Down • Bottom/Latest

[Home] [Headlines] [Latest Articles] [Latest Comments] [Post] [Mail] [Sign-in] [Setup] [Help] [Register]