Corrupt Government

See other Corrupt Government Articles

Title: Americans Who Opt Out of Medicare Must Forfeit Social Security Benefits

Source:

Breitbart

URL Source: http://www.breitbart.com/big-govern ... feit-social-security-benefits/

Published: May 31, 2016

Author: Dr. Susan Berry

Post Date: 2016-05-31 19:04:10 by cranky

Keywords: None

Views: 19787

Comments: 77

Most adults in the United States who turn 65 go onto the government-mandated health insurance program known as Medicare – the program liberal and socialist Democrats hope will universally cover all Americans some day soon. Seniors who choose to opt out of Medicare and continue to purchase their own private health insurance plans, however, are punished by the federal government for doing so by being forced to forfeit their Social Security benefits, even though they may have paid into the Social Security system for many years. Medicare and Social Security have been linked together since 1993 when unelected bureaucrats in the Clinton administration wrote a rule that states seniors cannot opt out of Medicare without giving up their Social Security benefits. In 2008, a group of seniors, who formed an organization called The Fund for Personal Liberty, filed a lawsuit – Hall v. Sebelius – in which they argued that the applications for Medicare and Social Security are voluntary and independent of each other. These Americans had all contributed to Medicare and Social Security throughout their employment histories, but wished to continue to purchase private health insurance once they reached age 65. They asserted that they should be able to opt out of Medicare – government-run healthcare – without forfeiting their Social Security benefits, and that forced participation in Medicare violates the right to privacy. The Fund wrote: The Medicare Lawsuit challenges the idea that unelected bureaucrats can create policies that act as law. Nowhere in the Medicare and Social Security statutes will you find a provision that a person who wishes to avoid Medicare shall be denied Social Security benefits. That is a penalty of approximately $250,000. The case proceeded for several years and hit its most alarming obstacle in March of 2011, when U.S. District Judge Rosemary Collyer – former general counsel of the National Labor Relations Board – who initially had sided with the plaintiffs, suddenly reversed herself, ruling in favor of the Obama administration instead. In an earlier ruling in the case, Collyer acknowledged that, “neither the statute nor the regulation specifies that Plaintiffs must withdraw from Social Security and repay retirement benefits in order to withdraw from Medicare.” In her stunning reversal decision, however, the judge ruled that “requiring a mechanism for plaintiffs and others in their situation to ‘dis-enroll’ would be contrary to congressional intent, which was to provide ‘mandatory’ benefits under Medicare Part A and for those receiving Social Security Retirement benefits.” Collyer also asserted in her decision that the Obama administration “extols the benefits of Medicare Part A and suggests that Plaintiffs would agree they are not truly injured if they were to learn more about Medicare, perhaps through discovery.” “Plaintiffs are trapped in a government program intended for their benefit,” she continued. “They disagree and wish to escape. The Court can find no loophole or requirement that the Secretary provide such a pathway.” Regarding the decision, Kent Masterson Brown, the lead attorney representing the seniors in the case, commented at the time: Anyone concerned with what will happen when the bureaucrats start writing the thousands of pages of rules that will govern the ‘Patient Protection and Affordable Care Act’ need only look at what has happened in Hall v. Sebelius. When they do, they will realize nothing will be optional and there will be no fair, affordable or swift manner to obtain recourse or appeal a decision made by the bureaucracy. After the ruling, which essentially decided that an entitlement program such as Medicare is “mandatory,” then-Sen. Jim DeMint (R-SC) introduced the Retirement Freedom Act. The bill would have allowed Medicare and Social Security to be “disconnected,” so that Americans would be free to opt out of government Medicare health insurance, but still retain their Social Security benefits. The bill, nevertheless, died in the Senate. Meanwhile, the members of the Fund appealed their case to the U.S. Supreme Court. In 2012, the Cato Institute and the American Civil Rights Union (ACRU) joined the case as well and submitted amicus briefs. However, in January of 2013, the Supreme Court denied the appeal, a decision the Fund stated was “the easy way out.” “The three branches of government all have the ability to reign in bureaucratic overreach, but none have the fortitude to do so,” wrote the Fund. “When unelected bureaucrats create mandates out of thin air, without any repercussions, we have opened Pandora’s Box.”

Unelected bureaucrats recently proposed the imposition of a new rule that would affect all Medicare Part B providers and nearly all Medicare drugs. Such bureaucrats, however, have been operating for years, forcing Americans onto government-run healthcare under pain of loss of Social Security benefits.

(1 image)

Post Comment Private Reply Ignore Thread

Top • Page Up • Full Thread • Page Down • Bottom/Latest

#1. To: cranky (#0)

That's a lie. I'm recently retired, covered under my wife's private health insurance, and getting full Social Security. And so is she. Many seniors are in similar positions. One spouse keeps working (or goes back to work) mainly for private health insurance. Yes, Medicare Part A (hospitalization) is free, but Part B (doctor's costs) and Part D (prescriptions) are not.

Must have been a frivolous lawsuit, then. Surprising it got that far in the legal system. There are three kinds of people in the world: those that can add and those that can't

You missed the entire scope of the article. The idea is to not apply for Medicare PERIOD, irrespective of any Medicare part alphabet soup BS. Some people don't want the nonsense of government intrusion and have the means to avoid Medicare altogether. There is ample reason to avoid Medicare: many private doctors don't take Medicare. The mandate of law is to sign up for Medicare Part A by the age of 65. There should be no linkage of Medicare with respect to Social Security and by opting out of one program, there should be no effect upon the other.

Yes, the article clearly states that the requirement/linkage pertains to Part A, not B or any other part of Medicare. Medicare A is free. A person may choose to supplement A with private insurance. In the case where a person is still working and has private insurance through his employer that insurance is primary and Medicare A is secondary. Upon retirement if the person can and does maintain the private insurance with his employer Medicare A becomes primary and the private insurance secondary. So what is the BFD? The private insurance covers what Medicare A does not cover. This seems like a win-win all the way around (except for those that are paying for whatever hospitalization costs Medicare A might cover for my wife and I through payroll deductions - just like we did before we were eligible for Medicare A). I have been enrolled in Medicare A since age 66. I also have been receiving SS payments since age 66. I have private insurance through my employer. I am now over 70 and just recently retired with my private insurance intact (I pay for it of course). Since age 66 while I was working my private insurance was primary and Medicare A secondary. My wife had major surgery for which my private insurance entirely paid for. Not one penny was paid by Medicare A. We haven't had to make a hospital claim since I retired but it is my understanding that if we did Medicare A would be the primary payor and my private insurance secondary. Though we have been eligible for it since we reach age 66 neither my wife or I have Medicare B and probably will not enroll for it now that I am retired as my private insurance and drug plan is more than adequate (it has picked up more than $250,000 in in post surgery cancer treatments and drugs for my wife). We recently had over $300,000 in medical expenses and counting, including brain surgery, and Medicare hasn't yet paid one penny of it. If we both stay out of the hospital Medicare never will pay out one penny on our behalf. So I ask again, what is the BFD in having Medicare A linked to SS payments when Medicare is totally free to the individual and does not diminish what a person's private insurance covers? "Collyer also asserted in her decision that the Obama administration “extols the benefits of Medicare Part A and suggests that Plaintiffs would agree they are not truly injured if they were to learn more about Medicare, perhaps through discovery.” It appears that the judge is correct except that Medicare A is not the invention of Obama but has been around for decades. потому что Бог хочет это тот путь

You make it sound so simple. I'm not there yet. Thanks!

I disagree because the two programs are not integrated within US law. The two programs are mutually exclusive and therefore independent of each other. To find one program dependent upon the other (and vice versa) is silly because the funding is separate. Congress needs to update the bureaucratic nightmare they have created by ensuring a seamless, consistent approach towards the various programs already designed and written into law. What we see (here) is the probable mandate of the forced US government medical blanket for all Americans whether considered "senior" or now the broad 0bama plan covering just about everyone including the wetback crossing the RioGrande.

You need to do more research. Bill Clinton signed the operative law. потому что Бог хочет это тот путь

Thanks, but it is not so simple. I have done some research and there appears to be good and valid reasons to enroll in Part B AND maintain your private health insurance. For example in addition to the 20% expenses not covered by Part B the private insurance may cover the copays and deductibles of Part B, as well as drugs which are not covered by Part B. Also most private insurance plans have a maximum annual out of pocket that once hit the plan covers 100% of expenses. So it really depends on how much medical expenses one incurs in any year. Trying to nail this all down is like trying to nail jello to the wall. потому что Бог хочет это тот путь

Why you can't get Social Security if you refuse Medicare "Posted on October 27, 2008 Say what? For all of America’s cherished belief in choice and freedom, it remains an astonishing fact that the U.S. government forces citizens over the age of 65 into a subpar health plan of its choosing. And so it is with some hope that we greet a new federal lawsuit that aims to allow senior citizens to flee Medicare. The suit comes courtesy of Kent Masterson Brown, a lawyer who has previously tangled with the government over Medicare benefits. Mr. Brown represents three plaintiffs who are suing the federal government to be allowed to opt out of Medicare without losing their Social Security benefits. Amazingly, this is not currently allowed. While the Social Security law does not require participants to accept Medicare, and the Medicare law does not require participants to accept Social Security, the Clinton Administration in 1993 tied the programs together. Under that policy, any senior who withdraws from Medicare also loses Social Security benefits. Mr. Brown’s plaintiffs are three men who do not want to be in Medicare, even though they paid Medicare taxes throughout their income-earning years and though they are not asking for that money back. The three instead saved privately to cover their health care expenses. They now prefer to contract with private doctors and health facilities that they believe are superior to those offered by Medicare. Read the whole thing – it’s short." потому что Бог хочет это тот путь

As long as you have private insurance, you don't have to enroll for Medicare Part A. You CAN, but you don't have to. If you're eligible for Medicare Part A and don't have private insurance, you MUST enroll. I have never heard of any link between Medicare and Social Security.

Sorry, the article is nonsense. The automatic entitlement is statutory. KAVANAUGH Appeal from the United States District Court for the District of Columbia (No. 1:08–cv–01715).Kent M. Brown argued the cause for appellants. With him on the briefs was Frank M. Northam. Samantha L. Chaifetz, Attorney, U.S. Department of Justice, argued the cause for appellees. With her on the brief were Tony West, Assistant Attorney General, Ronald C. Machen Jr., U.S. Attorney, Beth S. Brinkmann, Deputy Assistant Attorney General, and Mark B. Stern, Attorney. R. Craig Lawrence, Assistant U.S. Attorney, entered an appearance. Before: GINSBURG, HENDERSON, and KAVANAUGH, Circuit Judges. Opinion for the Court filed by Circuit Judge KAVANAUGH, with whom Circuit Judge GINSBURG joins. Dissenting opinion filed by Circuit Judge HENDERSON. KAVANAUGH, Circuit Judge: This is not your typical lawsuit against the Government. Plaintiffs here have sued because they don't want government benefits. They seek to disclaim their legal entitlement to Medicare Part A benefits for hospitalization costs. Plaintiffs want to disclaim their legal entitlement to Medicare Part A benefits because their private insurers limit coverage for patients who are entitled to Medicare Part A benefits. And plaintiffs would prefer to receive coverage from their private insurers rather than from the Government. Plaintiffs' lawsuit faces an insurmountable problem: Citizens who receive Social Security benefits and are 65 or older are automatically entitled under federal law to Medicare Part A benefits. To be sure, no one has to take the Medicare Part A benefits. But the benefits are available if you want them. There is no statutory avenue for those who are 65 or older and receiving Social Security benefits to disclaim their legal entitlement to Medicare Part A benefits. For that reason, the District Court granted summary judgment for the Government. We understand plaintiffs' frustration with their insurance situation and appreciate their desire for better private insurance coverage. But based on the law, we affirm the judgment of the District Court. I Most citizens who are 62 or older and file for Social Security benefits are legally entitled to receive Social Security benefits. See 42 U.S.C. § 402(a). Since Congress created Medicare in 1965, entitlement to Social Security benefits has led automatically to entitlement to Medicare Part A benefits for those who are 65 or older. See 42 U.S.C. § 426(a); see also Social Security Amendments of 1965, Pub.L. No. 89–97, § 101, 79 Stat. 286, 290. Plaintiffs Armey, Hall, and Kraus all receive Social Security benefits and are 65 or older. Therefore, they are automatically entitled to Medicare Part A benefits. But they want to disclaim their legal entitlement to Medicare Part A benefits. In other words, they want not only to reject the Medicare Part A benefits (which they are already free to do) but also to obtain a legal declaration that the Government cannot pay Medicare Part A benefits on their behalf. According to plaintiffs, if they could show their private insurers that they are not legally entitled to Medicare Part A benefits, they would receive additional benefits from their private insurers. Plaintiffs argue that the statute allows them to disclaim their legal entitlement to Medicare Part A benefits and that the agency has violated the statute by preventing them from doing so. II We first consider plaintiffs' standing. Plaintiffs claim that their private insurers have curtailed coverage as a result of plaintiffs' entitlement to Medicare Part A benefits. Plaintiff Armey declared that his legal entitlement to Medicare Part A benefits led his Blue Cross plan to reduce coverage without a matching reduction in premium. Plaintiff Hall declared that his Mail Handlers plan stopped acting as his primary payer because of his legal entitlement to Medicare Part A benefits. They claim they would receive enhanced coverage from their private insurers if they were not entitled to Medicare Part A benefits. For purposes of the standing inquiry, we must accept those declarations as true. We conclude that Armey and Hall have suffered injuries in fact from their reduced private insurance. They have shown causation because their private insurance has been curtailed as a direct result of their legal entitlement to Medicare Part A benefits. And as to redressability, plaintiffs claim that they could obtain additional coverage from their private insurance plans if allowed to disclaim their legal entitlement to Medicare Part A benefits. Because Armey and Hall have standing, we need not address standing for the other plaintiffs. We therefore proceed to the merits. III Because plaintiffs are 65 or older and are entitled to Social Security benefits, they are “entitled to hospital insurance benefits” through Medicare Part A. 42 U.S.C. § 426(a). But plaintiffs do not want to be legally entitled to Medicare Part A benefits. To be clear, plaintiffs already “may refuse to request Medicare payment” for services they receive and instead “agree to pay for the services out of their own funds or from other insurance.” Medicare Claims Processing Manual, ch. 1, § 50.1.5 (2011). So they can decline Medicare Part A benefits. But plaintiffs want something more than just the ability to decline Medicare payments. They seek a legal declaration that Medicare Part A benefits cannot be paid on their behalf—a declaration, in other words, that they are not legally entitled to Medicare Part A benefits. But the statute simply does not provide any mechanism to achieve that objective. If you are 65 or older and sign up for Social Security, you are automatically entitled to Medicare Part A benefits. You can decline those benefits. But you still remain entitled to them under the statute. What plaintiffs really seem to want is for the Government and, more importantly, their private insurers to treat plaintiffs' decision not to accept Medicare Part A benefits as meaning plaintiffs are also not legally entitled to Medicare Part A benefits. But the problem is that, under the law, plaintiffs remain legally entitled to the benefits regardless of whether they accept them. Consider an analogy. A poor citizen might be entitled under federal law to food stamps. The citizen does not have to take the food stamps. But even so, she nonetheless remains legally entitled to them. So it is here. Plaintiffs offer four arguments for why they must be allowed to disclaim their legal entitlement to Medicare Part A benefits. None is persuasive. First, plaintiffs say that the plain meaning of the statutory term “entitled” requires that the beneficiary be given a choice to accept or reject Medicare Part A. But plaintiffs' entitlement is to “hospital insurance benefits ” under Medicare Part A. 42 U.S.C. § 426(a) (emphasis added). As explained above, plaintiffs may refuse Medicare Part A benefits. See Medicare Claims Processing Manual, ch. 1, § 50.1.5. So they already have a choice to accept or reject those benefits. Second, plaintiffs claim that, by statute, Medicare Part A is a voluntary program. That's true in the sense that plaintiffs can always obtain private insurance and decline Medicare Part A benefits. But the fact that the program is voluntary does not mean there must be a statutory avenue for plaintiffs to disclaim their legal entitlement to Medicare Part A benefits. Third, plaintiffs acknowledge that they can escape their entitlement to Medicare Part A benefits by disenrolling from Social Security and forgoing Social Security benefits. From that, plaintiffs contend that entitlement to Medicare Part A benefits has thereby been made a prerequisite to receiving Social Security benefits, in contravention of the statute governing entitlement to Social Security benefits. But plaintiffs have it backwards. Signing up for Social Security is a prerequisite to Medicare Part A benefits, not the other way around. Fourth, plaintiffs note that entitlement to Social Security benefits is optional and argue that entitlement to Medicare Part A should likewise be optional. But Social Security participation is optional because filing an application for benefits is a statutory prerequisite to entitlement. See 42 U.S.C. § 402(a)(3). Congress could have made entitlement to Medicare Part A benefits depend on an application. But Congress instead opted to make entitlement to Medicare Part A benefits automatic for those who receive Social Security benefits and are 65 or older. In sum, plaintiffs' position is inconsistent with the statutory text. Because plaintiffs are entitled to Social Security benefits and are 65 or older, they are automatically entitled to Medicare Part A benefits. The statute offers no path to disclaim their legal entitlement to Medicare Part A benefits. Therefore, the agency was not required to offer plaintiffs a mechanism for disclaiming their legal entitlement, and its refusal to do so was lawful. We have considered plaintiffs' other arguments and find them without merit. I agree with my colleagues that plaintiffs Hall and Armey have the requisite standing to pursue this suit. Majority Op. at 1295. We affirm the judgment of the District Court. So ordered. See also: https://www.medicare.gov/Pubs/pdf/11036.pdf At 10-11: What if I’m already getting benefits from Social Security or the Railroad Retirement Board (RRB)? If you are, in most cases, you’ll automatically get Part A and Part B starting the first day of the month you turn 65. If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month. You’ll get the “Initial Enrollment Package” that welcomes you to the program. This package is mailed about 3 months before your 65th birthday. In this package, you’ll get your Medicare card. If you don’t want Part B, follow the instructions that come with the card. Read this package carefully since you’ll have to decide the following: 1. If you want to keep Part B 2. If you keep Part B, how do you want to get your Medicare coverage 3. If you want or need Medicare prescription drug coverage 4. If you want to buy a Medicare Supplement Insurance (Medigap policy) https://www.law.cornell.edu/uscode/text/42/426 42 U.S. Code § 426 - Entitlement to hospital insurance benefits Every individual who— (1) has attained age 65, and (2) (B) is a qualified railroad retirement beneficiary, or (C) shall be entitled to hospital insurance benefits under part A of subchapter XVIII of this chapter for each month for which he meets the condition specified in paragraph (2), beginning with the first month after June 1966 for which he meets the conditions specified in paragraphs (1) and (2). https://www.law.cornell.edu/cfr/text/42/406.6 (a) Basic provision. In most cases, eligibility for Medicare Part A is a result of entitlement to monthly social security or railroad retirement cash benefits or eligibility for monthly social security cash benefits. This section specifies the individuals who need not file an application to become entitled to hospital insurance, those who must file an application, and those who must enroll. (b) Individuals who need not file an application for hospital insurance. An individual who meets any of the following conditions need not file an application for hospital insurance: (2) At the time of attainment of age 65, is entitled to monthly social security or railroad retirement benefits. (3) Establishes entitlement to monthly social security or railroad retirement benefits at any time after attaining age 65. (c) Individuals who must file an application for hospital insurance. An individual must file an application for hospital insurance if he or she seeks entitlement to hospital insurance on the basis of— (2) Deemed entitlement to disabled widow's or widower's benefit under certain circumstances as provided in § 406.12; (3) A diagnosis of end-stage renal disease, as specified in § 406.13; (4) Effective January 1, 1981, eligibility for social security cash benefits, as specified in § 406.10(a)(3), if the individual has attained age 65 without applying for those benefits; or (5) The special provisions applicable to government employment as set forth in § 406.15. (d) When application is deemed to be filed. (2) An application for deemed entitlement to disabled widow's or widower's benefits, that is filed before the first month in which the individual meets all conditions of entitlement for this benefit, will be deemed a valid application if those conditions are met before an initial determination, reconsideration, or hearing decision is made on the application. If the conditions are met after the date of any hearing decision, a new application will have to be filed. An application validly filed within 12 months after the first month of eligibility is retroactive to that first month. If filed more than 12 months after that first month, it is retroactive to the 12th month before the month of filing. (3) Effective June 8, 1980, an application based on eligibility for social security benefits at or after age 65, that is filed before the first month in which the individual meets all eligibility conditions for this benefit, will be deemed a valid application if those conditions are met before an initial determination, reconsideration, or hearing decision is made on the application. If the conditions are met after the date of any hearing decision, a new application will have to be filed. (4) Effective March 1, 1981, an application under § 406.10 that is validly filed within 6 months after the first month of eligibility is retroactive to that first month. If filed more than 6 months after that first month, it is retroactive to the 6th month before the month of filing. (e) Individuals who must enroll for hospital insurance. An individual who must pay a monthly premium for hospital insurance must enroll in accordance with the procedures set forth in § 406.21. [48 FR 12536, Mar. 25, 1983, as amended at 50 FR 33033, Aug. 16, 1985; 53 FR 47202, Nov. 22, 1988; 61 FR 40345, Aug. 2, 1996]

But it seems to be there between SS and Medicare A. потому что Бог хочет это тот путь

We conclude that Armey and Hall have suffered injuries in fact from their reduced private insurance. IMO this is the more significant and meaningful part of the thread - namely, that the Federal government imposes reduced medical care insurance coverage on people that are eligible for Medicare whether a person takes Medicare or not. WTF? потому что Бог хочет это тот путь

IMO this is the more significant and meaningful part of the thread - namely, that the Federal government imposes reduced medical care insurance coverage on people that are eligible for Medicare whether a person takes Medicare or not. The snippet quote leaves out the important qualifying statement that precedes it. We conclude that Armey and Hall have suffered injuries in fact from their reduced private insurance. They have shown causation because their private insurance has been curtailed as a direct result of their legal entitlement to Medicare Part A benefits. And as to redressability, plaintiffs claim that they could obtain additional coverage from their private insurance plans if allowed to disclaim their legal entitlement to Medicare Part A benefits. Because Armey and Hall have standing, we need not address standing for the other plaintiffs. We therefore proceed to the merits. It is only for purposes of standing inquiry that the court must accept the allegations as true. The Court proceeded to find the claims meritless. That is the most significant part of the opinion. BCBS imposes reduced medical care insurance coverage on people who are eligible to have the government pay for that same care as the primary payer.

The need arose to change primary care physician. It was early in the month and the office of the replacement doctor accepts a maximum of one (1) new Medicare patient per month. That meant a seven (7) week wait for an initial appointment. Couldn't even pay cash. You can have the doctor of your choice, but it may be a long wait. Medicare Part A diminishes what all the insurance combined can pay by setting the maximum allowable payment by law. Doctors can choose not to accept Medicare patients or limit their number.

Total BS. Courts have the duty to determine what allegations have merit and what do not. Otherwise again BS allegation must be accepts for the purpose of standing. The court is not bound to accept every allegation for the purposes of standing. At the minimum the court could have asked for some sort of proof that the allegation is true. In this case all the plantiff would have to do is provide a statement or rejection of an expense by his insurance company that corroborates the plantiff's allegation. "The Court proceeded to find the claims meritless. That is the most significant part of the opinion." So what injuries did the court find the plantiff suffered? "We conclude that Armey and Hall have suffered injuries in fact from their reduced private insurance." The court determined that the plantiffs were injured because "BCBS imposes reduced medical care insurance coverage on people who are eligible to have the government pay for that same care as the primary payer". Then the court makes this statement: "In sum, plaintiffs' position is inconsistent with the statutory text. Because plaintiffs are entitled to Social Security benefits and are 65 or older, they are automatically entitled to Medicare Part A benefits. The statute offers no path to disclaim their legal entitlement to Medicare Part A benefits. Therefore, the agency was not required to offer plaintiffs a mechanism for disclaiming their legal entitlement, and its refusal to do so was lawful." In so doing the court said it was perfectly legal and OK for the government to injure the plantiff AND give the plantiff no way to address or undo the injury. That is totally f*cked up and demonstrates just how tyrannical the government is. Do you honestly believe that this is what the Founding fathers had in mind for We The People? потому что Бог хочет это тот путь

Total BS. Courts have the duty to determine what allegations have merit and what do not. Otherwise again BS allegation must be accepts for the purpose of standing. The court is not bound to accept every allegation for the purposes of standing. "The question of standing is whether the litigant is entitled to have the court decide the merits of the dispute or of particular issues." Before the court has jurisdiction to consider the merits of a case, it MUST determine standing. The standard applied in determining standing is not the same standard used to decide the case on the merits. Allen v. Wright, 468 U.S. 737 (1984) Article III of the Constitution confines the federal courts to adjudicating actual "cases" and "controversies." As the Court explained in Valley Forge Christian College v. Americans United for Separation of Church and State, Inc., 454 U.S. 464, 471-476 (1982), the "case or controversy" requirement defines with respect to the Judicial Branch the idea of separation of powers on which the Federal Government is founded. The several doctrines that have grown up to elaborate that requirement are "founded in concern about the proper — and properly limited — role of the courts in a democratic society." Warth v. Seldin, 422 U.S. 490, 498 (1975). "All of the doctrines that cluster about Article III — not only standing but mootness, ripeness, political question, and the like — relate in part, and in different though overlapping ways, to an idea, which is more than an intuition but less than a rigorous and explicit theory, about the constitutional and prudential limits to the powers of an unelected, unrepresentative judiciary in our kind of government." Vander Jagt v. O'Neill, 226 U.S.App.D.C. 14, 26-27, 699 F.2d 1166, 1178-1179 (1983) (Bork, J., concurring). The case-or-controversy doctrines state fundamental limits on federal judicial power in our system of government. The Art. III doctrine that requires a litigant to have "standing" to invoke the power of a federal court is perhaps the most important of these doctrines. "In essence the question of standing is whether the litigant is entitled to have the court decide the merits of the dispute or of particular issues." Warth v. Seldin, supra, at 498.

The case was decided not on the merit that the plantiffs were injured but because "the agency was not required to offer plaintiffs a mechanism for disclaiming their legal entitlement, and its refusal to do so was lawful." The court found that the plantiffs were injured. The court said that that was not relevant to the court's finding because the government could legally injure the plantiffs and did not have to provide a means to prevent the injury that the law caused. Do you think that this is what our FFs intended? потому что Бог хочет это тот путь

Medicare Part A is free. Why would there be a link between the two? Why would there even be a problem? They want me to sign up, fine. I'll sign up and bill the government for my hospitalization instead of the private insurance I currently have. F**k 'em.

Medicare Part A is free. Why would there be a link between the two? Why would there even be a problem? Have you read the article and some of the relevant posts on this thread? The answers are right there. HINT: It's so because the courts say it is so because that is the intent of Congress that made the law and Clinton who signed it. At least read post #17. потому что Бог хочет это тот путь

Do you think that this is what our FFs intended? Yes, the FFs intended for the courts to follow the law, including contract law. The case was explicitly decided on the merits — the Court found there were none. The Court stated, "plaintiffs have it backwards. Signing up for Social Security is a prerequisite to Medicare Part A benefits, not the other way around." You seem fixated on the pre-trial proceedings regarding standing and a pre-trial motion for summary judgment which could have denied the right to a trial altogether. The Court found standing to exist -- that there was a right to proceed to trial. Simply showing a right to proceed to trial does not connote a showing that the party will win at trial where the merits are judged. They only showed sufficient evidence that there had been some particularized injury. The appellate court found that the pre-trial question of standing had successfully been overcome. The appellate court then announced they would proceed to address the merits of the case. What plaintiffs sought was a judicial declaration that they were not entitled to Medicare Part A benefits, binding upon their private insurers. Because plaintiffs are 65 or older and are entitled to Social Security benefits, they are “entitled to hospital insurance benefits” through Medicare Part A. 42 U.S.C. § 426(a). But plaintiffs do not want to be legally entitled to Medicare Part A benefits. To be clear, plaintiffs already “may refuse to request Medicare payment” for services they receive and instead “agree to pay for the services out of their own funds or from other insurance.” Medicare Claims Processing Manual, ch. 1, § 50.1.5 (2011). So they can decline Medicare Part A benefits. But plaintiffs want something more than just the ability to decline Medicare payments. They seek a legal declaration that Medicare Part A benefits cannot be paid on their behalf—a declaration, in other words, that they are not legally entitled to Medicare Part A benefits. But the statute simply does not provide any mechanism to achieve that objective. If you are 65 or older and sign up for Social Security, you are automatically entitled to Medicare Part A benefits. You can decline those benefits. But you still remain entitled to them under the statute. What plaintiffs really seem to want is for the Government and, more importantly, their private insurers to treat plaintiffs' decision not to accept Medicare Part A benefits as meaning plaintiffs are also not legally entitled to Medicare Part A benefits. Plaintiffs sought a judicial declaration that they were not entitled to Medicare Part A benefits. The Court found, properly, that they were entitled to such benefits by statute. The requested redress is beyond the legal autority of the Court. Paintiff Armey is former Congressman Dick Armey. He apparently chose the gold standard BCBS plan. Plaintiff is apparently a USPS worker, a mail handler, who apparently chose the NPMHU plan sponsored by the National Postal Mail Handlers Union. This is all part of the FEHBP, Federal Employees Health Benefits Plan. [...] Third, plaintiffs acknowledge that they can escape their entitlement to Medicare Part A benefits by disenrolling from Social Security and forgoing Social Security benefits. From that, plaintiffs contend that entitlement to Medicare Part A benefits has thereby been made a prerequisite to receiving Social Security benefits, in contravention of the statute governing entitlement to Social Security benefits. But plaintiffs have it backwards. Signing up for Social Security is a prerequisite to Medicare Part A benefits, not the other way around. Fourth, plaintiffs note that entitlement to Social Security benefits is optional and argue that entitlement to Medicare Part A should likewise be optional. But Social Security participation is optional because filing an application for benefits is a statutory prerequisite to entitlement. See 42 U.S.C. § 402(a)(3). Congress could have made entitlement to Medicare Part A benefits depend on an application. But Congress instead opted to make entitlement to Medicare Part A benefits automatic for those who receive Social Security benefits and are 65 or older. In sum, plaintiffs' position is inconsistent with the statutory text. Because plaintiffs are entitled to Social Security benefits and are 65 or older, they are automatically entitled to Medicare Part A benefits. The statute offers no path to disclaim their legal entitlement to Medicare Part A benefits. Therefore, the agency was not required to offer plaintiffs a mechanism for disclaiming their legal entitlement, and its refusal to do so was lawful. What the plaintiffs requested was impossible under prevailing law. They are over 65 and entitled to Social Security benefits. They are, therefore, automatically eligible for Medicare Part A. Therefore, the requested redress for the claimed injury is impossible under law, and the plaintiffs have no right to receive it. What the plaintiffs actually seek is to have their private insurer pay more. They are eligible for Medicare Part A, and are not entitled to a court declaration saying they are not eligible. I should think they are better off, payment-wise, with Medicare Part A and private insurance secondary. Medicare would pay the lion's share of what is deemed to be the allowable amount. Federal BCBS would pick up almost the entirety of the remainder. For the mail handler, he is a retired civil service employee and his retirement check is the responsibility of, and comes from, the Officer of Personnel Management, not the USPS. Uncle Sugar pays about 80% of the insurance premium. The better policies, such as Federal BCBS (and I believe NPMHU), include prescription payment, making Medicare Part B unnecessary. In the case of the brain surgery that ran about 300,000, using fictional made up figures, Medicare may have capped its maximum authorized payment at about $200,000. Depending on how the doctor/providers associated with Medicare, he/they may be able to claim slightly more than the normal authorization, but that is it for complete claimable compensation. The personal payout is minimal. In any case, you cannot say you are ineligible for Medicare and cost BCBS additional hundreds of thousands of dollars they are not liable to pay. BCBS is not eligible for paying that which Medicare will pay. Just because a patient does not want to claim payment by Medicare does not make BCBS responsible. If BCBS were the primary and sole insurer, the providers can charge what they want and the BCBS payout may exceed the Medicare allowed maximum. The BCBS policy is a contract you enter into and you accept that they will not pay what you are eligible to have Medicare pay. This was a failed attempt to make an end run around the private insurance contract that the individual entered into, in order to make the private insurer liable in a manner contrary to Federal law. It did not work and was rejected on the merits.

BULLSHIT.

I do the same thing, I paid medicare for a year or so then I canceled because of my wife's new job. There's a penalty for not paying for Plan B but it's waived if your go off spouses insurance and sign up for Plan B. It all works out.

At least read the actual Federal law and not some dingbat's misguided nonsense about it. The entitlement has been automatic since 1965. It is from 1965 and that means it was signed by LBJ. http://uscode.house.gov/statviewer.htm?volume=79&page=290 79 Statutes at Large, 290, Public Law 89-97, H.R. 6675, Social Security Amendments of 1965, (TITLE I-HEALTH INSURANCE FOR THE AGED AND MEDICAL ASSISTANCE) Approved July 30, 1965, 5 :19 p .m . SHORT TITLE SEC. 100. This title may be cited as the "Health Insurance for the Aged Act". PART 1-HEALTH INSURANCE BENEFITS FOR THE AGED ENTITLEMENT TO HOSPITAL INSURANCE BENEFITS 53 Stat . 1362. SEC. 101 . Title II of the Social Security Act is amended by adding 42 USC 401-425 . at the, nd thereof the following new section "ENTITLEMENT TO HOSPITAL INSURANCE BENEFITS [79 STAT. "SEC. 226. (a) Every individual who- "(1) has attained the age of 65, and "(2) is entitled to monthly insurance benefits under section 202 or is a qualified railroad retirement beneficiary, shall be entitled to hospital insurance benefits under part A of title XVIII for each month for which he meets the condition specified in paragraph (2), beginning with the first month after June 1966 for which he meets the conditions specified in paragraphs (1) and (2) . "(b) For purposes of subsection (a)- "(1) entitlement of an individual to hospital insurance benefits for a month shall consist of entitlement to have payment made under, and subject to the limitations in, part A of title XVIII on his behalf for inpatient hospital services, post-hospital extended care services, post-hospital home health services, and outpatient hospital diagnostic services (as such terms are defined in part C of title XVIII) furnished him in the United States (or outside the United States in the case of inpatient hospital services furnished under the conditions described in section 1814(f) ) during such month ; except that (A) no such payment may be made for post-hospital extended care services furnished before January 1967, and (B) no such payment may be made for posthospital extended care services or post-hospital home health services unless the discharge from the hospital required to qualify such services for payment under part A of title XVIII occurred after June 30, 1966, or on or after the first day of the month in which he attains age 65, whichever is later ; and "(2) an individual shall be deemed entitled to monthly insurance benefits under section 202, or to be a qualified railroad retirement beneficiary, for the month in which he died if he would have been entitled to such benefits, or would have been a qualified railroad retirement beneficiary, for such month had he died in the next month.

BULLSHIT. Become an appellate lawyer, take it to court, and make yourself famous persuading the court that you are right and they are wrong.

BULLSHIT. 'Zactly. SS was around decades before Medicare came into existence. потому что Бог хочет это тот путь

There is a reasonable chance that you will be less covered by Medicare than your private insurance or that you will have to change medical providers because they do not accept Medicare. that is the injury that the judge in this case acknowledged for the plantiffs. потому что Бог хочет это тот путь

Why waste the tyme? The facts are the facts.

And the Court decided what the facts were.

Now there is a grand irrelevant point. SS could have been around since 1789, and in 1965 the CONGRESS decided to bestow Medicare eligibility to all who were receiving SS benefits. How long SS was around does not matter.

The judge was opining in a light most favorable to the non-moving party on a pre-trial matter involving standing. On the merits, the Court opined that the plaintiffs argument had no merit. Automatic eligibility for Medicare for the plaintiffs had been a matter of statute law since 1965.

Now there is a total irrelevant and off the mark response by you. The fact is Congress tied SS to Medicare when it made the law that one could not refuse Medicare A and maintain their SS. For example, what happened to those that were receiving SS prior to 1965? They had Medicare trusted upon them with the consequence that some, perhaps most, lost some insurance coverage from their private insurance provider. In essence the government told We The People that they can't win, they can't break even and more importantly they can't quit. потому что Бог хочет это тот путь

Why are you being so dense? Yes, the merit to which the judge was referring was the fact that the plantiffs could not renounce their eligibility for Medicare - EVEN IN LIGHT OF THE FACT THAT THE PLANTIFFS WERE INJURED BY THAT ELIGIBILITY. It is as if the government deliberately set out to reduce the amount of medical benefits seniors can receive by tying Medicare to SS. And the judge said that it was irrelevant that the government injured people in that way. F*ck him and the government for that. потому что Бог хочет это тот путь

No, you know that is bass ackwards as the Court stated. SS is in no way tied to obtainment, signing up for, or eligibility for Medicare. Cite the law or regulation that says it is. SOSO #7: "You need to do more research. Bill Clinton signed the operative law. " SOSO #9: [Quoting a blogger] "While the Social Security law does not require participants to accept Medicare, and the Medicare law does not require participants to accept Social Security, the Clinton Administration in 1993 tied the programs together. Under that policy, any senior who withdraws from Medicare also loses Social Security benefits." SOSO #12: "But it [a link] seems to be there between SS and Medicare A." SOSO #17: "HINT: It's so because the courts say it is so because that is the intent of Congress that made the law and Clinton who signed it." SOSO #32: "The fact is Congress tied SS to Medicare when it made the law that one could not refuse Medicare A and maintain their SS. You have repeatedly talked about this unidentified law alleged signed by Bill Clinton. Put up or shut up. Identify the law. I have linked and posted actual law. Where's yours??? xx U.S.C. xxxx

They sought to have the Court declare they were ineligible for Medicare Part A. Pursuant to Federal statute law, they were, in fact, eligible for Medicare Part A. Therefore their lawsuit has no merit. The law did not reduce their personal insurance benefits. Their insurance company did that. As a secondary insurer, their private insurer will not pay what the primary insurer is required to pay. The government made people age 65 on Social Security automatically eligible for no-cost health insurance. Medicare puts limits on what they will pay for each procedure. Providers who accept Medicare payments cannot accept more than the Medicare established maximum limit. Providers can refuse to particpate in Medicare. Private secondary insurers will not pay what the primary insurer is required, by law, to pay. Health care providers must bill the primary insurer first. The judge said that what they asked for, a declaration that they were ineligible for Medicare Part A, was directly contrary to law and could not be granted. You tell a good fairy tale about an unidentified law supposedly signed by Bill Clinton, but the court case is clear and simple. The case had no legal merit. They were eligible for Medicare pursuant to U.S. statute law. The Court could not hold otherwise. The Article 3 case or controversy requirement mandates that the injury will be "redressed" by the remedy being sought. In the lost case, Hall v. Sebelius, the remedy sought was directly contrary to law. The requested remedy was impossible for the court to grant. You do not have a valid case or controversy when the requested remedy is directly contrary to statute law. [SOSO #16] [SOSO] Total BS. Courts have the duty to determine what allegations have merit and what do not. Otherwise again BS allegation must be accepts for the purpose of standing. The court is not bound to accept every allegation for the purposes of standing. Quoting the Opinion of the U.S. Supreme Court in Warth v. Seldin. Warth v. Seldin, 422 U.S. 490, 500-02 (1975) One further preliminary matter requires discussion. For purposes of ruling on a motion to dismiss for want of standing, both the trial and reviewing courts must accept as true all material allegations of the complaint, and must construe the complaint in favor of the complaining party. E.g., Jenkins v. McKeithen, 395 U. S. 411, 395 U. S. 421-422 (1969). At the same time, it is within the trial court's power to allow or to require the plaintiff to supply, by amendment to the complaint or by affidavits, further particularized allegations of fact deemed supportive of plaintiff's standing. If, after this opportunity, the plaintiff's standing does not adequately appear from all materials of record, the complaint must be dismissed. Steel Co. v. Citizens For Better Environment, 523 U.S. 83, 102-03 (1998) First and foremost, there must be alleged (and ultimately proved) an "injury in fact" — a harm suffered by the plaintiff that is "concrete" and "actual or imminent, not 'conjectural' or 'hypothetical.'" Whitmore v. Arkansas, supra, at 149, 155 (quoting Los Angeles v. Lyons, 461 U.S. 95, 101-102 (1983)). Second, there must be causation — a fairly traceable connection between the plaintiff's injury and the complained-of conduct of the defendant. Simon v. Eastern Ky. Welfare Rights Organization, 426 U.S. 26, 41-42 (1976). And third, there must be redressability — a likelihood that the requested relief will redress the alleged injury. Id., at 45-46; see also Warth v. Seldin, 422 U.S. 490, 505 (1975). This triad of injury in fact, causation, and redressability constitutes the core of Article III's case-or-controversy requirement, and the party invoking federal jurisdiction bears the burden of establishing its existence. See FW/PBS, Inc. v. Dallas, 493 U.S. 215, 231 (1990).

The law did not reduce their personal insurance benefits. Their insurance company did that. Excellent sophistry. Yes, your honor, my client did aim and pull the trigger, but it was the bullet that actually killed that cop. потому что Бог хочет это тот путь

Then why are you arguing with me as this is exactly my point. The plantiffs suffered injury exactly because they could not escape the limits imposed by Medicare. The judge acknowledged that. The fact is that most providers that accept Medicare limit their coverage to what Medicare covers and to the amount established by Medicare for a particular service or treatment. That fact is that for many Medicare provides inferior coverage to the private insurance that they have. By forcing Medicare A upon people by taking away their SS benefits the government de facto mandates inferior insurance coverage for those people. The fact is that when a person becomes eligible for Medicare and Medicare becomes the primary insurer almost all private insurers adjust their coverage to match that of Medicare. In most cases this means that the private insurer reduces the amount it covers whether or not a provider accepts Medicare. For example, I am over 65, have Medicare A, have private insurance, and have the option to enroll in Medicare B. If I do enroll in Medicare B the coverage my private insurance will be limited to what is provided under Medicare B which is less than the coverage I currently have with the insurance company. Further, this is true if I choose a provider that doesn't accept Medicare. In other words, Medicare puts a cap on what my insurance company will cover whether I have it or not. I believe that this is true for almost everyone that has private insurance. I will ask you one more time, what do you believe our Founding Fathers would think of this government action? "At the same time, it is within the trial court's power to allow or to require the plaintiff to supply, by amendment to the complaint or by affidavits, further particularized allegations of fact deemed supportive of plaintiff's standing. If, after this opportunity, the plaintiff's standing does not adequately appear from all materials of record, the complaint must be dismissed." Lastly, as for standing, for all the BS you posted it comes down to the question of whether or not the plantiffs suffered some injury. The fact that the judge didn't even ask the plantiffs for any proof or evidence that they did speaks loudly to the wide spread common knowledge that Medicare provides inferior coverage for many people with private insurance - in other words it was a slam dunk that the plantiffs were injured. потому что Бог хочет это тот путь

The limits were on what the doctors could charge. The plaintiff's, by law, could only be charged LESS, and Uncle Sugar picked up most of the bill. The Secondary Insurer picked up all, or virtually all, the rest. Medicare eliminates the deductible for a doctor's visit. Please quit the obscene bullshit. I have explained it to you nine ways to Sunday. See #14: We conclude that Armey and Hall have suffered injuries in fact from their reduced private insurance. See SOSO #16, in which you are caught pulling your response out of your ass. [SOSO #16] [SOSO] Total BS. Courts have the duty to determine what allegations have merit and what do not. Otherwise again BS allegation must be accepts for the purpose of standing. The court is not bound to accept every allegation for the purposes of standing. [nolu chan #35] "For purposes of ruling on a motion to dismiss for want of standing, both the trial and reviewing courts must accept as true all material allegations of the complaint, and must construe the complaint in favor of the complaining party." E.g., Jenkins v. McKeithen, 395 U. S. 411, 395 U. S. 421-422 (1969). You continually misrepresent what was said as a holding of the court. It was a review of an inquiry on standing where the court must accept the allegations as true, in order to determine whether the complainant has alleged facts, which if true, would justify proceeding to trial on the merits. In the proceedings on the merits, those allegations still need to be proven. On the merits, the case failed. The case was lost. Deal with it.

Exactly. That is why some of the better docs decide not to accept medicare. And that is why only the wealthy get care from those better docs. I guess you do not think that a person is injured when they no longer can get treatment from a better doctor because the government forced them to have to pay more because their existing private insurer no longer covered what that doctor was charging. NB - The private insurance company very likely negotiated a payment arrangement with that specific provider which undoubtedly was lower than the doctor's posted rated to the uber cash paying rich, such as the Kennedys. Now I agree that the billing practices of doctors and hospitals are a sham. The face value of the services provided to my wife (i.e. - what was billed to the insurance company) for treatment of her brain cancer, from surgery through the present clinical trial, is well in excess of $400,000. After the "discounts" negotiated by my private insurer, the actual payment was less than 30 cents on the dollar and my annual out of pocket cash expense was capped at well less than $8,000. Even though we had Medicare A it was not in the picture because is was still worker and my private insurance was primary at the time of her hospitalization. I just retired and Medicare A is now my primary for hospitalization and our private insurance secondary. I have not enrolled in Medicare B so my private insurance is still primary for these service. We are hoping that my wife will not need another surgery but if she does I am not at all sure that the combination of Medicare A as primary and my private insurance now as secondary will cover all of the cost ex. my stated annual out of pocket expense. I am trying to figure out what would happen if we did enroll in Medicare B. It is not at all clear that I would be at least as well covered as when I was not retired. Somehow I feel that we would be screwed. потому что Бог хочет это тот путь

No, you know that is bass ackwards as the Court stated. plaintiffs contend that entitlement to Medicare Part A benefits has thereby been made a prerequisite to receiving Social Security benefits, in contravention of the statute governing entitlement to Social Security benefits. But plaintiffs have it backwards. Signing up for Social Security is a prerequisite to Medicare Part A benefits, not the other way around. SS is in no way tied to obtainment, signing up for, or eligibility for Medicare. Cite the law or regulation that says it is. SOSO #7: "You need to do more research. Bill Clinton signed the operative law. " SOSO #9: [Quoting a blogger] "While the Social Security law does not require participants to accept Medicare, and the Medicare law does not require participants to accept Social Security, the Clinton Administration in 1993 tied the programs together. Under that policy, any senior who withdraws from Medicare also loses Social Security benefits." SOSO #12: "But it [a link] seems to be there between SS and Medicare A." SOSO #17: "HINT: It's so because the courts say it is so because that is the intent of Congress that made the law and Clinton who signed it." SOSO #32: "The fact is Congress tied SS to Medicare when it made the law that one could not refuse Medicare A and maintain their SS. You have repeatedly talked about this unidentified law alleged signed by Bill Clinton. Put up or shut up. Identify the law. I have linked and posted actual law. Where's yours??? What is your phantom law? What is it? What does it say? xx U.S.C. xxxx

I have not enrolled in Part B as my private insurance pays for it. The cost of my private insurance would not be reduced by my paying to have the government cover the cost. I believe BCBS is better and the govt won't screw with that because all the congressmen use it. As for the lawsuit, you can construe it any which way you want, but the requested remedy was contrary to statute law and the Court was legally barred from providing it. The statement that they were harmed was made assuming their allegations were true, and construing all doubts in favor of the plaintiff. There is no viable claim against Medicare as the law is clear and specific. Any remedy would have to come from Congress, not the Court. As for docs who do not participate in Medicare (not a penny acceptance of Medicare funds) you should be able to use your private insurer or money. In general, those providers would be expensive.

You missed the whole point of this thread. Upon retirement you automatically become eligible for Medicare A. As a result your private insurance only covers the amount that is determined by Medicare A, even though the day before it was covering a higher amount for you when you were not eligible for Medicare A. You lose coverage. You have to pay more out of pocket. The same is true for what your private insurance will pay to providers that do not accept Medicare. i.e. - it is my understanding that when Medicare is primary by law the insurance company can only pay the Medicare determined amount for a particular service (which may very well be lower than what it was paying the same provider when Medicare was not primary). If you were already collecting Social Security retirement benefits when you turned 65, you will automatically be enrolled Medicare Part A irrespective of whether or not you have private insurance. Prior to retirement your private insurance is primary and Medicare A secondary. The amount paid to providers is almost always negotiated between the provider and the insurance company - and it is usually above what Medicare A will pay. When you retire Medicare becomes primary. At that time if your private insurance reduces what it pays for a service to what is allowed by Medicare A you are injured just by the fact that Medicare A is considered primary. This judge ruled that the law is that one cannot reject Medicare eligibility. I am not quibbling with that finding but am outraged with the law. As for Medicare B vs. BCBS when you retire, I have no idea if you would be better off with just BCBS, with just Medicare B or paying for both. As you noted, most private insurance will cover the deductibles and copays under Medicare. This could be more than the premium paid for the BCBS coverage. To the extent that BCBS pays for services not covered by Medicare B you easily could be ahead of the game by have both coverages. This is what I am trying to determine with respect to my private insurance now that I am retired. When all is said and done tying Medicare to SS and not allowing a person to be free of Medicare eligibility just screws most retirees by providing a lower level of service or by forcing them to pay more for the same level of coverage. On last time, do you think this is what the Founding fathers intended? потому что Бог хочет это тот путь

No, Medicare becomes your primary insurer and pays most of the cost and yor private insurer become secondary and pays the remainder. You pay little to nothing out of pocket.

Thank you for posting this case, nolo chan. As always, I enjoy reading your posts even if we disagree. I love conversing with intelligent people like yourself.

Only up to the amount established by Medicare which I believe is less than what the private insurers pay when they are primary. The net result is that your out of pocket expense increases. потому что Бог хочет это тот путь

The only duty the Courts have is to determine three things: 1)personal jurisdiction over you, jurisdiction to hear your case, and finally standing to sue not just based on the merits of your case alone. There could be substantive laws of procedure that would compel such a panel of judges to grant review of your case. This may be referred to as Judicial Review possibly by a panel of judges at an en banc hearing.

As this case reads standing was determined on the basis of whether the plantiffs were injured. RE: post #14: "They claim they would receive enhanced coverage from their private insurers if they were not entitled to Medicare Part A benefits. For purposes of the standing inquiry, we must accept those declarations as true. We conclude that Armey and Hall have suffered injuries in fact from their reduced private insurance. They have shown causation because their private insurance has been curtailed as a direct result of their legal entitlement to Medicare Part A benefits. And as to redressability, plaintiffs claim that they could obtain additional coverage from their private insurance plans if allowed to disclaim their legal entitlement to Medicare Part A benefits. Because Armey and Hall have standing, we need not address standing for the other plaintiffs. We therefore proceed to the merits." Is there any way to read those paragraphs that leads to the conclusion that the judge found that the plantiffs were in fact injured, that the basis for establishing plantiifs standing was that injury, and, that the merits of the case were something other than that injury? потому что Бог хочет это тот путь

Is there any way to read those paragraphs that leads to the conclusion that the judge found that the plantiffs were in fact injured, That would have to be determined by the causation leading to the injury. ... that the basis for establishing plantiifs [sic] standing was that injury, Again, that would be determined by the causation stated in Plaintiff's Complaint concerning that injury. You might want to re-read post 11. Cause this is what I got from it. II We first consider plaintiffs' standing. Plaintiffs claim that their private insurers have curtailed coverage as a result of plaintiffs' entitlement to Medicare Part A benefits. Plaintiff Armey declared that his legal entitlement to Medicare Part A benefits led his Blue Cross plan to reduce coverage without a matching reduction in premium. Plaintiff Hall declared that his Mail Handlers plan stopped acting as his primary payer because of his legal entitlement to Medicare Part A benefits. They claim they would receive enhanced coverage from their private insurers if they were not entitled to Medicare Part A benefits. For purposes of the standing inquiry, we must accept those declarations as true. [Emphasis added here]

That doesn't square with your post #46. потому что Бог хочет это тот путь

Actually it does. The reason why is that the judges in this matter relied on the Plaintiff's sworn Declarations that were attached to the Verified Complaints. Not excluding the federal statutes on rules of civil procedures on merits of cases, Declarations are used as part of the Complaint and although they are not incorporated into each paragraph, the Declaration (or sworn Affidavit) as separate from the Complaint, is just as important as the Complaint and stated causes of actions incorporated into each paragraph itself.

Negative. The amount the provider can charge decreases to what Medicare allows. I will provide my personal info from April. The figures come straight off my BCBS paperwork. An MRI had charges submitted by the imaging center for $2,214.00. The Medicare Plan Allowance was $245.51. Medicare paid $148.77. BCBS paid the remainder $96.74. I paid nothing. Absent Medicare, the bill would have been $2,214.00. Had a private insurer paid 90% (no deductible), that would have left a bill of $221.40. When the provider participates in Medicare, they agree to accept the plan allowance as full payment, in this case $245.51. If I had no secondary insurer, I could have been billed not more than $96.74 out of pocket. Because Medicare lowballs the plan allowance so much, the providers increase what they charge others so they can remain profitable. It is not the Medicare patient whose out of pocket expenses increase, it is the non-Medicare expenses that increase.

Where did you get an MRI billed for only $2,214? потому что Бог хочет это тот путь

So you are claiming that the plantiffs lied about having to pay more when Medicare became primary? потому что Бог хочет это тот путь

Were they required to do that as they stated that they must or did they just accept the plantiffs declarations without further inquiry? потому что Бог хочет это тот путь

And that's exactly the catch. If my provider of choice does not accept Medicare but had a separate agreement with the insurance company the insurance company would in almost all cases pay more for that provider's service than the Medicare amount. When I then become locked into mandated Medicare the insurance company automatically reduces what it will pay my provider of choice for a particular service. So when I now again go to my provider of choice I will have to pay more out of pocket if I want treatment by that provider. My alternative is to find another provider that accepts Medicare. It's Obama's lie again, "if you want to keep your provider you can......but it may very well cost you." No matter how you cut it Big Brother is forcing us to take Medicare whether we like it or not. Only the wealthy (including the lawmakers) will be able to afford the provider of their choice and there will only be room for a few them. Again I ask you, is this what you believe that the Founding Fathers intended? потому что Бог хочет это тот путь

OK, your provider accepts Medicare. When my wife was diagnosed with brain cancer we chose our providers on the basis of skill, reputation, recommendations from people in the medical community, etc. AND if they were covered by our private insurance which at the time was primary (though we had Medicare A no Medicare was involved as I still was working). Medicare did not come into our thinking at the time we chose our providers. Frankly I have no idea if our providers accept Medicare or not. If they do our experience going forward with her treatments may likely follow yours. If not we will likely have to pay significantly more out of pocket OR change providers in mid-stream of long-term treatment. If the latter we will certainly feel that we lost something as we chose our providers very carefully from among of several alternatives - obviously we felt we chose the best providers available to us at the time. Medicare did not enter into the picture. Enter Medicare and we may now have to choose what we view as lesser skilled providers and/or facilities. And the picture is even more uncertain as we are almost certain to have to find another clinical trial in the not too distant future with Medicare A now our primary insurance. We have been in contact with a few of the most notable doctors in the country to establish a relationship with them when the time comes for us to move on. I have no idea if these most prominent neuro- oncologists and neuro-surgeons accept Medicare. If they don't I don't know if we will be able to afford the treatment. I do know for a fact that Ted Kennedy had no money problems with being able to engage one or more of these doctors to treat his brain cancer. Dealing with incurable cancer is scary enough not to have to worry about losing some insurance coverage because of a government mandate. потому что Бог хочет это тот путь

Baptist.

No, I am saying you are mistaken about what plaintiffs claimed.

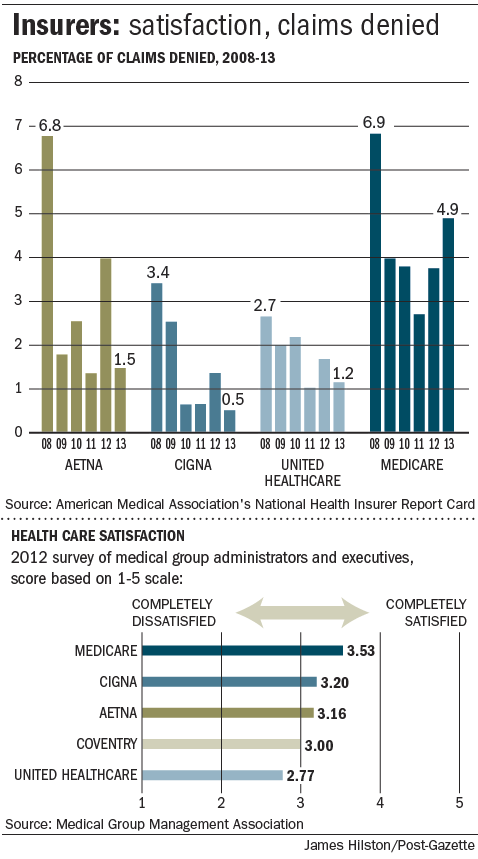

With its higher denial rate please tell me again why mandated Medicare does not represent a lowering of medical care for patients. "In its most recent report from 2013, the association found Medicare most frequently denied claims, at 4.92 percent of the time; followed by Aetna, with a denial rate of 1.5 percent; United Healthcare, 1.18 percent; and Cigna, 0.54 percent.' When Medicare is primary and private insurance secondary, what do the private insurers cover when Medicare denies a claim? потому что Бог хочет это тот путь

OK, please tell me what injury did they claim? потому что Бог хочет это тот путь

When you are 65 and eligible for Social Security, you automatically become entitled to Medicare Part A. The vast majority of people over 65 are eligible for Social Security and have Medicare Part A bestowed upon them. If you choose not to accept Medicare Part A benefits, that's your choice. It will cost you a small fortune to use an opt-out provider. You should find out for absolute certain what your private insurer would pay. A mistake could be very, very expensive. In general, if you see an opt-out provider, you must enter into a contract for his services and you are responsible for the full payment. In general, when you become entitled to Medicare Part A, the private insurer diminishes their responsibility to pay. They do not volunteer to pick up a $2K tab for a procedure for which 99% of providers will accept about $250. Entitlement has been automatic since Lyndon Johnson signed it into law. Obama hadn't turned 4 years old yet. About 99% of providers accept Medicare. You are not forced to take Medicare benefits, but you are automatically entitled to the benefits. Your for-profit insurance company acts accordingly. It depends. Some wanted a monarchy. Some immediately went about the business of interpreting and transforming the Constitution. Within a few years, America had the Alien and Sedition Acts. The transformation did not happen by accident.